Volatile SPACs: Welcome

As low-cap stocks, SPACs have built-in volatility. That’s a good thing.

During the past year, special purpose acquisition companies (SPACs) have grown in popularity, not only because they finance companies but also because they offer opportunities for options traders. For the former, SPACs reduce regulatory hassle and speed up the availability of new products and ideas to investors. For the latter, SPACs offer volatility, and volatility creates opportunity by raising the prices of options.

Traders are gravitating toward SPACs for specific reasons. Higher options prices mean higher potential profits for traders who short them, and options on SPACs tend to have higher prices given SPACs’ higher volatility, even when volatility is lower across the broader market. And SPACs’ volatility is built into them as very low-cap stocks.

Take SPACs like Virgin Galactic (SPCE), whose options have a 109% implied volatility (IV), Nikola (NKLA), with a 108% IV, Foley Trasimene (BFT), with a 110% IV, or XL Fleet (XL), with a 134% IV. On their faces, those SPACs are technology companies to one degree or another, and technology stocks tend to have higher volatility. At the same time, though, other tech stocks like Apple (AAPL) had a 34% IV, Microsoft (MSFT) had a 27% IV, Amazon (AMZN) had a 29% IV and Alphabet (GOOGL) had a 28% IV.

But tech stocks aren’t equal. The mega-cap stocks, like Apple, Microsoft, Amazon and Alphabet, have more reliable cash flows and business models. They’ve been around a long time. The market is more confident in their prospects than it is of a SPAC launched less than a year ago. That uncertainty of their future cash flows is part of why SPACs’ volatilities are much higher.

An old theory in finance promulgated by Eugene Fama and Ken French that helps explain what we see with SPAC IV is that the riskier an asset is, the cheaper it is. A stock has a low market cap because the market considers it riskier than a stock with a higher market cap. And when a stock with a low capitalization has options, those options tend to have higher IV to reflect the market’s perception of risk.

Sure enough, the market capitalizations of these SPACs are relatively small. Virgin Galactic’s market cap is $7.7 billion, Nikola’s is $6.4 billion, Foley Trasimene’s is $2.9 billion and XL Feet’s is $1.5 billion. Apple’s market cap is $2.06 trillion, Microsoft’s is $1.78 trillion, Amazon’s is $1.56 trillion and Alphabet’s is $1.37 trillion. They’re 1,000x larger than the SPACs, but their options have lower IVs and thus present less opportunity than options on SPACs.

In trading, volatility’s job is to tell investors the potential magnitude of a stock’s future price changes. The higher the volatility, the larger the potential price changes. For example, there’s a higher probability of a 5% price change up or down in a stock with higher volatility than in a stock with lower volatility. The lower-volatility stock could have a 5% price change, but it’s just less likely. What SPACs’ high IV is telling traders is that the market expects these stocks to have large price changes and potentially wide trading ranges. That, in turn, increases the options prices of further out-of-the-money strikes.

If stock price changes are randomly distributed over a normal distribution curve, higher volatility makes that normal curve wider and flatter. That means a data point—a stock price change in this case—on the far right-hand side or far left-hand side of the curve has a higher probability of occurring.

Options’ strike prices are above or below the current stock price. Place the strikes on the normal distribution curve with the current stock price at the mean, and it’s easy to see there’s a lower probability of the stock price reaching the strikes that are farther away from the stock price. The farther away the strike price, the less likely it is that the stock price will have a price change large enough to reach it.

But with higher volatility, the probability of the stock reaching those far out-of-the-money strikes is higher, and thus their option prices are higher, too. Take a stock like Virgin Galactic with a volatility of 105%. At the time this article was written, it was trading for $32, and the 25 put with 64 days to expiration was trading at $2.20. If the IV of that put were closer to the 30% IV of the options on mega-cap tech stocks, that 25 put’s value would be closer to $0.03. That’s 1/73rd of the Virgin Galactic put’s actual value. An options seller willing to take the risk of trading options on Virgin Galactic would be rewarded with a max profit of $220 versus $3.

The benefits of shorting options at higher prices are that their potential profits are higher, their breakeven points are farther away from the stock price, they have a higher probability of making 50% of their max profit and they have higher positive theta.

Further, even though clearing firms can set higher margin requiements for SPAC options with their higher IVs, their max profit versus their margin requirement is higher than for options with lower IVs. That short 25 put in Virgin Galactic had a margin requirement of about $1,700. Divide the $220 credit for shorting the put by the margin and get about 12.9% maximum return on capital. Do that for a stock with 30% IV and standard margin requirement and one would get about 1.2% maximum return on capital.

That’s why even though SPACs with higher volatility can be riskier, they are welcomed in the marketplace.

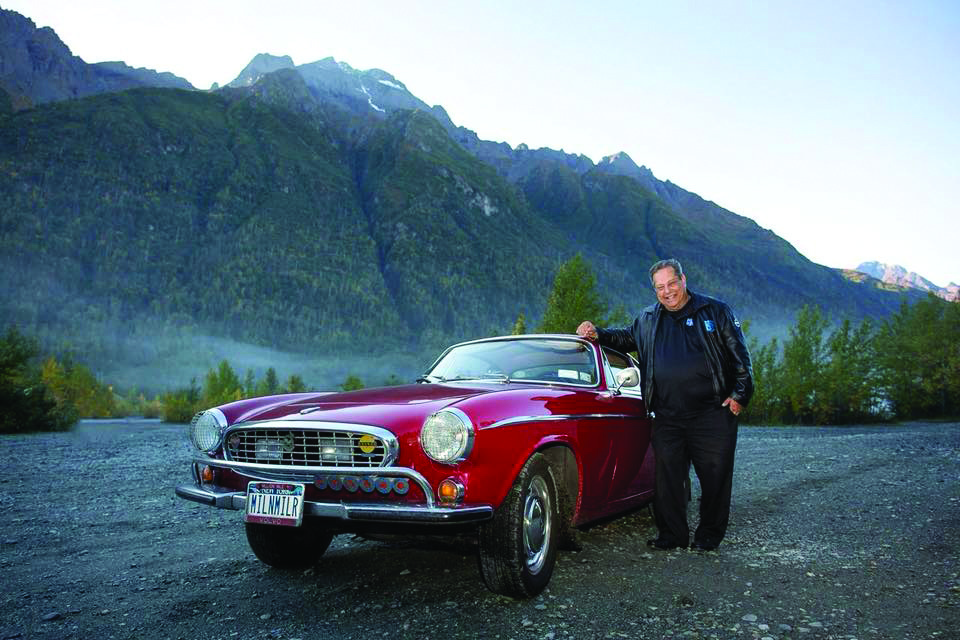

Tom Preston, Luckbox features editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate. @fittypercent