Seven Smart Stocks

Is Luckbox focuses on the measure of intelligence, let’s turn our attention toward the sector of the equity markets dedicated to education companies.

Most well-known institutions of higher learning, such as Harvard, Stanford and MIT, are multi-billion-dollar entities but aren’t publicly held. In recent years, however—particularly with the surge in online learning—dozens of corporations focused on education have been coming to the public markets.

These seven charts of the stock performance of publicly traded educational firms are loosely ranked, with the weakest and most vulnerable first, followed by the strongest and most promising.

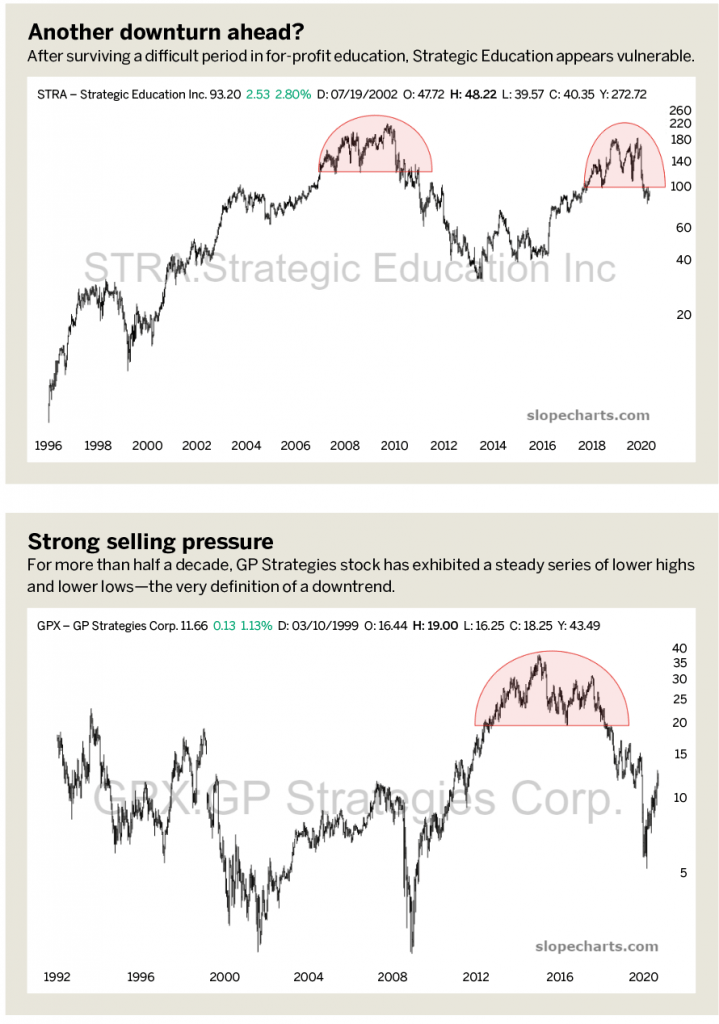

Strategic Education

Herndon, Virginia-based Strategic Education (STRA) owns a variety of for-profit educational firms, some with traditional campuses and others that concentrate on online learning. Besides operating Capella University and Strayer University, it has coding schools that include DevMountain, Generation Code, Hackbright Academy and The New York Code + Design Academy.

Back in 2014, equity analysts tended to take a grim view of prospects for stocks in for-profit education companies.

The company has been around nearly 30 years, starting in 1991 as Capella Education Co. From its IPO in 1996 until 2010, the stock did phenomenally well, rising from about $5 to above $220, an increase of more than 4,000%. In the next four years, however, the stock sank nearly 85%, partly because of the bad publicity that plagued for-profit education companies, especially ITT Technical Institute.

After surviving that era, the stock began climbing once more, although not to its former highs. It managed to rise as high as about $175 before losing around half its value in the span of just months. Even after that substantial loss, the chart continues to look vulnerable because the topping pattern recently completed resembles a similar pattern from 2007-2011, which preceded a severe decline in share prices.

GP Strategies

One of the oldest education companies on any public market, GP Strategies (GPX), began as a technology-focused venture capital firm in 1959 and had its public offering the very next year. Since then, GP Strategies has focused on products for sales and technical training. In recent years, it has emphasized e-learning and virtual reality.

The stock’s performance over many years was unimpressive, and it bottomed out in March 2009 at a low of $2.36. Then, however, its price and trading volume grew steadily, and its share price went up over 10-fold. A topping pattern was hammered out from about October 2012 to June 2018 in the shape of a large, inverted saucer. Once the pattern was completed, the stock once again tumbled down into the single digits, steadying itself at about $5 per share.

Although the stock has recovered somewhat from those levels, the chart has been creating a steady series of lower highs and lower lows, demonstrating an unmistakable downtrend for more than half a decade. It seems likely that any buying will be overmatched by owners at higher prices liquidating their positions, creating strong selling pressure from all the overhead supply created over the years that the stock was trading in the $20s and $30s.

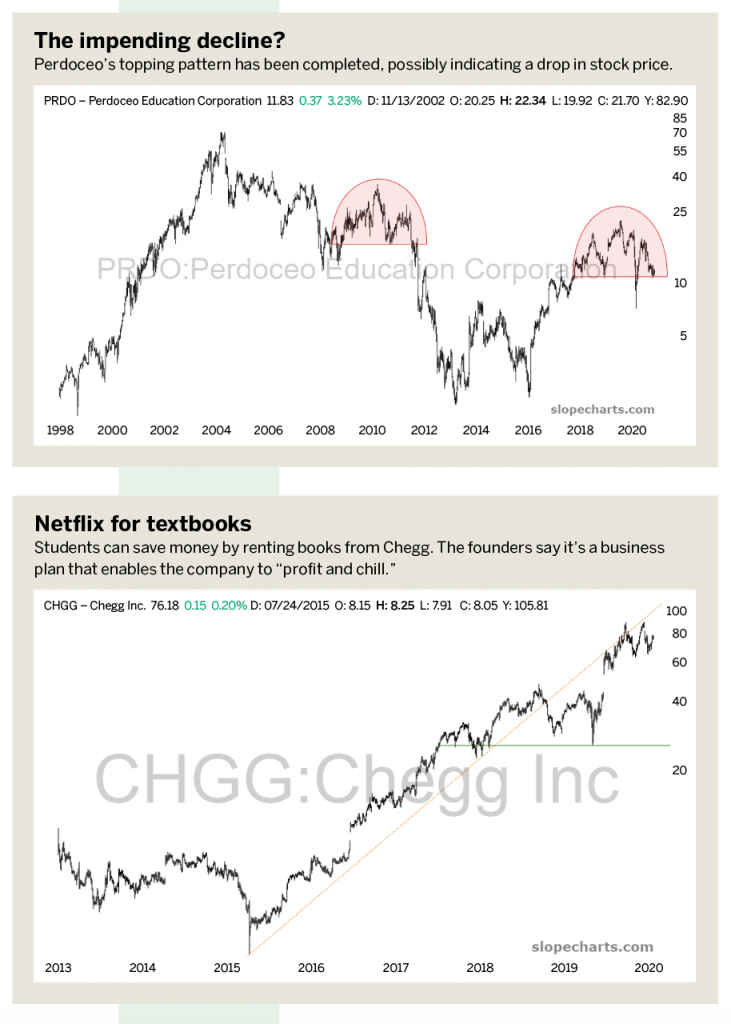

Perdoceo

Until this year, Schaumburg, Illinois-based Perdoceo (PRDO) was known as Career Education Corp. and used the ticker symbol CEC. The company, a for-profit postsecondary education provider, offers campus-based and online instruction from the associate level all the way up to doctoral levels, while also awarding certificates in career-focused disciplines.

Like other for-profit education companies, the company suffered quite a bit of bad publicity in the early 2010s, and its stock peaked at about $66 in 2004 before falling to $2 in 2013. In 2011, more than 95% of the company’s revenue came from enrolling students whose tuition was paid by the federal government, with about $67 million per year coming from the U.S. Department of Defense and the Veterans Administration.

That situation came to an end with the passage of a law known as the “90-10 Rule,” which states for-profit colleges can get no more than 90% of their revenue from the government or face losing federal funding.

The company closed quite a few of its brick-and-mortar campuses, although it still retains some to this day. In the chart, two tinted areas represent topping patterns. One of those areas, spanning 2008-2011, preceded an enormous drop in equity value. The present topping pattern, which was completed only recently, may presage a similar decrease in price. Suffice it to say that the stock chart looks vulnerable.

Chegg Inc.

Instead of providing educational services directly to students, Chegg Inc. (CHGG) earns most of its revenue by renting out textbooks. The company was founded in 2000 by students at Iowa State University, and they coined the name by combining “chicken” and “egg.” It was inspired by the fact that recent grads can’t land a job without experience and can’t get experience without a job.

Chegg operates like a Netflix (NFLX) for textbooks. College textbooks often cost hundreds of dollars, and a quarter’s or semester’s reading can push a book budget into quadruple digits. Chegg spreads the cost over many users, allowing clients to rent a book only for the period they require it. The company has acquired about three million “subscribers,” and revenue is approaching a third of a billion dollars a year.

Ever since early 2016, the company’s stock has been doing remarkably well, climbing about 20-fold. Even in 2020, the stock tripled from March to August, and the uptrend has been impressive. The only concern is that the trendline was broken in August 2019, and what had been support has now become resistance. That doesn’t mean the stock has to go down in price. On the contrary, it has climbed robustly. But note that the reliable trendline has changed its purpose, and the cleanness of the uptrend has ended.

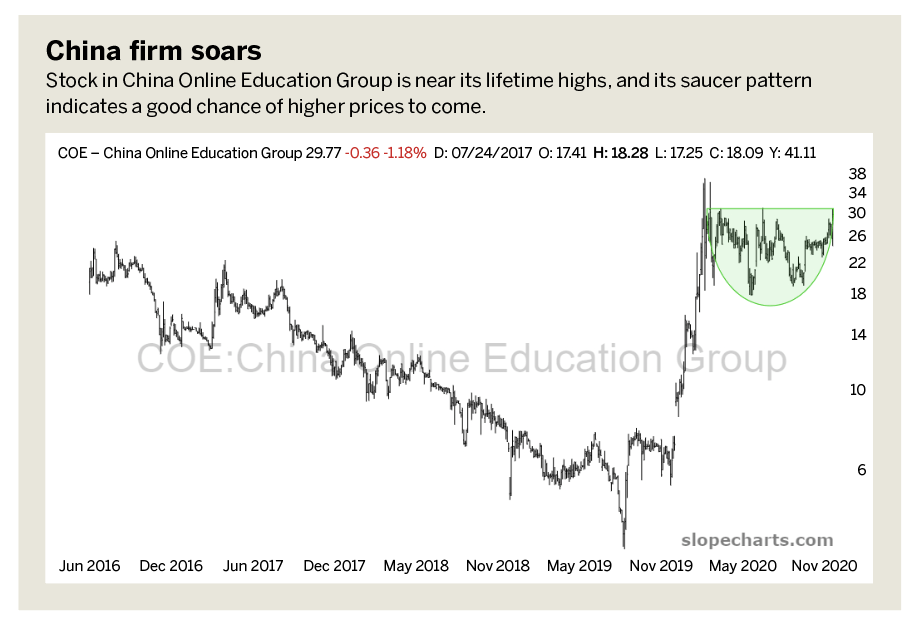

China Online Education Group

As one might suppose, China Online Education Group (COE) is based in China, and it provides English language education services online. It also provides tutoring through the internet, analyzes teacher aptitude, solicits ratings and feedback about teachers from students, and matches students with teachers based on learning objectives. In short, the company is focused on the development of English communication skills.

The company doesn’t have as long a history as a publicly traded entity, but its recent saucer pattern is relatively well-formed and features good growth in trading volume. The stock is presently near its lifetime highs, and a clean break above this saucer would suggest higher prices ahead.

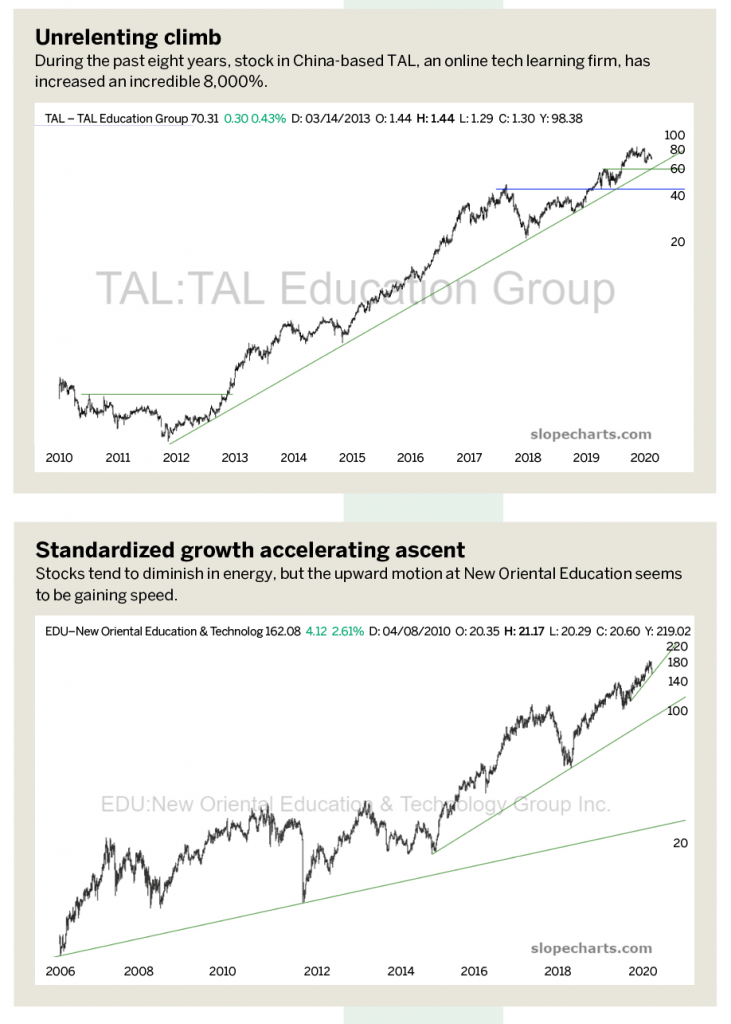

TAL Education Group

The acronym for TAL Education Group (TAL) stands for Tomorrow Advancing Life, another Chinese firm focused on online education by way of high tech. Its performance as a stock has been superb.

During the past eight years, the stock has increased an incredible 8,000%. What’s even more remarkable is the steady, unrelenting pace of the climb. Similar to stocks like Walmart and The Home Depot, TAL has simply pushed higher month after month, year after year, with no meaningful downturn.

The strongest general bear markets don’t break the uptrend but can cause a temporary softness to the stock’s price. The company’s strategy, revenues and profits are lined up well.

New Oriental Education

Another Chinese company, New Oriental Education (EDU), resides at the “top of the heap.” It’s the largest educational company in China, based on enrollment, number of programs and broad geographic presence. Unlike other companies that focus strictly on higher education, New Oriental works with children beginning in pre-school. The company became public in 2006 as the first Chinese educational IPO, and it now has 30 million students.

The main company prepares clients for standardized tests, such as the TOEFL, SAT, ACT, GRE, GMAT, IELTS and LSAT. It will be interesting to see in the years ahead if revenue from test preparation starts to soften, given the reduced “push” of Chinese nationals to attend United States colleges and universities.

Although New Oriental’s stock price is not as calm and steady as TAL stock, the overall trend is obviously up, and the sharpness of the uptrend keeps increasing. There are three trendlines on this chart, each more recent than the other, and each more sharply ascending than the prior one. Normally, stocks tend to diminish in energy, but the company seems to be accelerating its ascent.

Commencement

Back in 2014, equity analysts tended to view prospects for stocks in for-profit education companies as grim. But the apex of public rancor against the sector was actually the nadir of those stock prices. One general conclusion to draw from the seven stocks examined here is that the public markets seem to show the most enthusiasm for China-based companies. The trend appears likely to continue in 2021.

Tim Knight has been using technical analysis to trade the markets for 30 years. He hosts Trading the Close daily on the tastytrade network and offers free access to his charting platform at slopecharts.com.