Title Fight

Only a handful of companies dominate the real estate title insurance industry. They will need to evolve quickly to retain their reign in front of a fast-moving blockchain.

Almost everyone has insurance of one kind or another. Depending on circumstances, someone might have life, fire, flood, earthquake, homeowner’s, renter’s or dental insurance—or any one of many other financial products designed to share risk.

Virtually all forms of insurance are designed to protect against an uncertain future: Someone steals a laptop, a devasting illness strikes or the kitchen catches fire. But title insurance does the opposite. It’s designed to insure against unexpected circumstances that have already happened but haven’t become apparent.

Anyone who has ever bought or sold property has some experience with title insurance. It can involve showing up at the title company’s office to sign a gargantuan stack of legal papers that no one in human history has ever read except for the people who composed them in the first place.

Once the process reaches “the close,” an even bigger stack of papers awaits signatures. Some of the papers list financial calculations about the transaction, including the thousands of dollars paid to the title insurance company.

The history of insurance

Insurance, in some form or another, has been around almost as long as the written word. The 4,000-year-old Code of Hammurabi included laws pertaining to insurance that don’t seem out of place in the modern world. It’s remarkable how sophisticated people were about risk and financial costs that long ago.

Title insurance, on the other hand, is a relatively recent creation that’s rare outside North America. The general idea is to guarantee that when people buy a piece of property they actually own it free of encumbrances or errors.

No one wants to spend millions on a house, only to be sued a few months later by someone else who also claims to own it or be pursued by a government entity that’s owed tens of thousands of dollars in property taxes. Title insurance makes sure the purchase is “clean.”

In the rest of the world—and even North America until about 150 years ago—the government keeps track of who owns what and protects new owners from legal or financial snags.

These days, county governments in the United States and census geographic units in Canada keep track of ownership simply as a matter of public record, and they offer no legal protection to buyers and sellers.

Instead, a $17 billion industry has been built around that function to make sure real estate purchases are free from, to use the industry term, “defects.”

Blockchain opportunity

Besides its backward-looking nature, title insurance differs from almost every other kind of insurance because of the small amount it pays in claims.

In the case of “normal” insurance, about 80% of the amount taken in as premiums is paid back to policyholders to cover claims. With title insurance, the amount paid out is a single-digit percentage of the amount taken in because it’s unusual for a legitimate financial surprise to crop up with property ownership.

So, the main expense for these companies is research. When a property changes

hands, the title search has to cover just about every entity that might come after the new property owner. That could include a contractor who wasn’t paid, a county seeking uncollected taxes, a former spouse disputing ownership or a disgruntled investor demanding restitution.

The title searches are time-consuming and, except for the modern office equipment the companies use, they resemble the kinds of research performed in the late 1800s.

The very heart of this entire industry comes down to several key elements:

– Keeping transaction-by-transaction records

– Having a means to update information as ownership changes

– Knowing with certainty that the information about a property is accurate and complete

This seems to be a made-to-order use case for the blockchain. In fact, enthusiastic cryptocurrency fans might conclude that the blockchain will relegate this old-fashioned, time-consuming, low-tech industry to oblivion.

Title insurance companies could soon face the same sort of obsolescence that doomed buggy whip manufacturers in the early 20th century. Well, not so fast. Let’s ponder the financial health of the market leaders.

The big guys

The title insurance industry is extremely concentrated. Just four companies account for nearly 90% of the entire business, and the top two, Fidelity National Financial (FNF) and First American Corp. (FAF), account for about 60% of the entire sector.

Their success depends upon geographic reach, accuracy and reputation. Most of

all, they need to be excellent record-keepers and researchers.

Although local governments do track records of title, the title insurance companies themselves have their own parallel systems for doing so. That paid off as far back as 1906 when an earthquake and the resulting fires nearly destroyed San Francisco and reduced the local government’s records to ashes.

The citizenry managed to solve the riddle of who owned what because title insurance companies located far from the flames had records of ownership. Respect for duplicated data goes way back.

These days, the enduring value of such practices has helped the sector rebound nicely from recent setbacks.

First American Financial

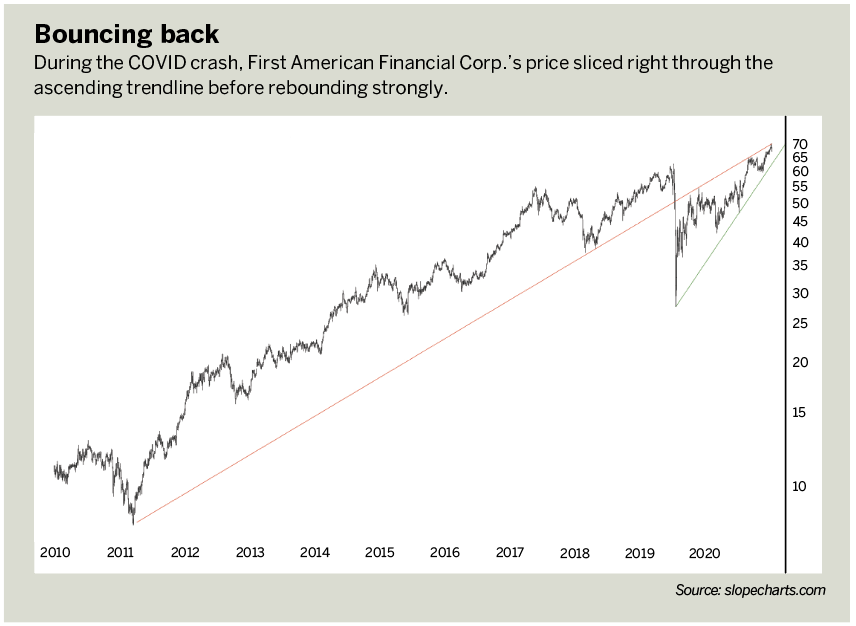

First American Corp. has a 27% market share of the title insurance business. In general, the strength of the real estate market correlates directly with the company’s prosperity because more transactions mean more premiums.

During the past decade, given the combination of easy money and low interest rates, the stock has been ascending steadily. But a fascinating pattern has occurred recently because of the trendlines shown. During

the COVID crash, the price sliced right through the ascending trendline before rebounding strongly.

Closer look at FAF

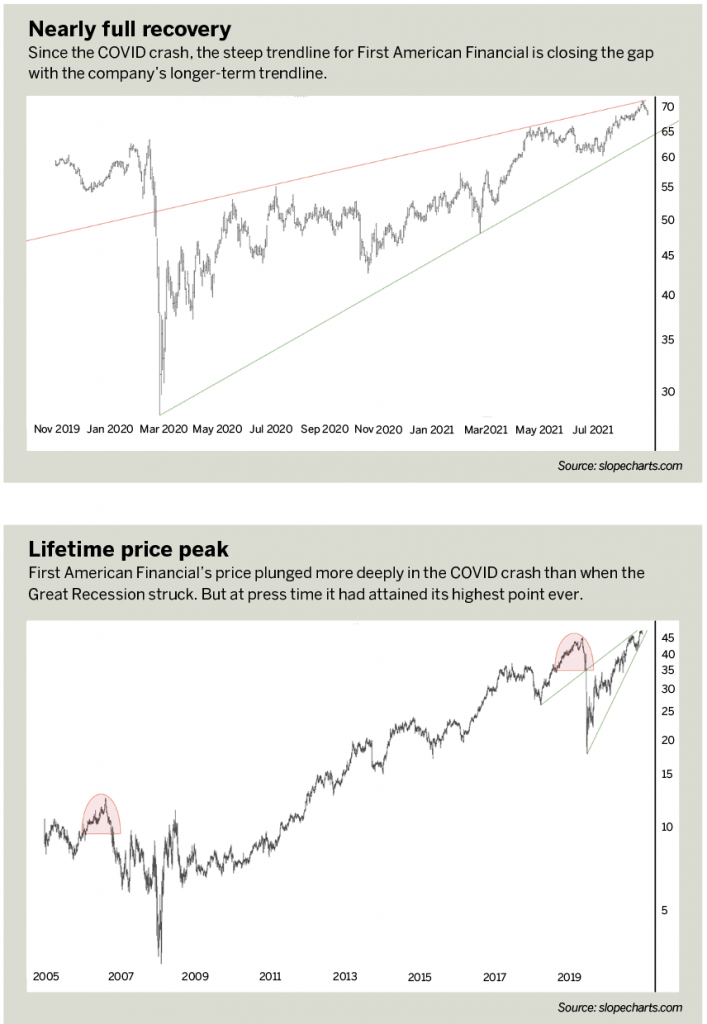

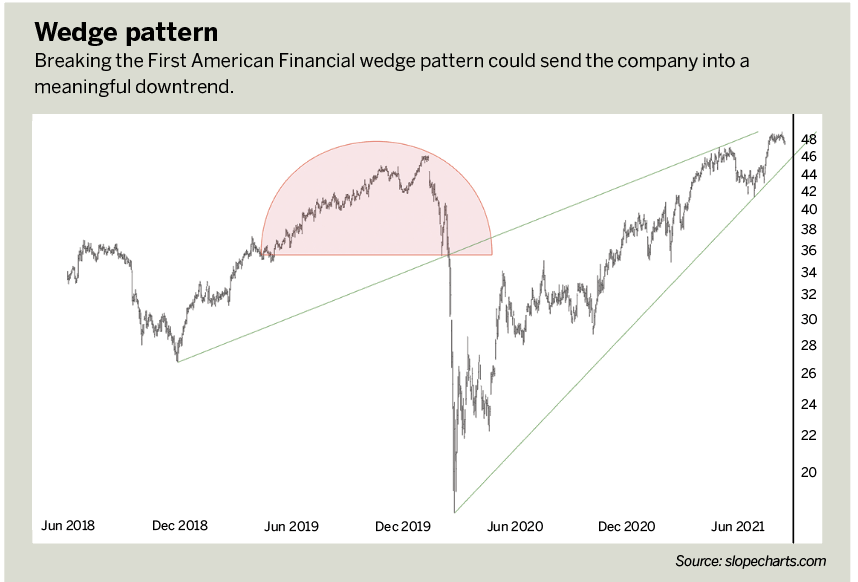

Looking at a more detailed view of recent history, the plunge and subsequent recovery for First American Financial in 2020 and 2021 has generated a very clean pattern in the form of a wedge.

Should that wedge be broken—in other words, if the green supporting trendline is fractured to the downside—it would likely put the company into a meaningful downtrend.

Fidelity National Financial

The largest firm in this sector, Fidelity National Financial (this is not an industry that aspires to overly creative names), has about one-third of the market.

The company’s history as a public entity goes back to the days before the 2008 financial crisis, and the battering that the bear market of that time inflicted on the stock is clear.

Since then, as with most stocks, the company’s share price has been ascending, and it reached its lifetime price peak just before press time.

Closer look at FNF

Fidelity National Financial’s stock chart is sporting precisely the same wedge pattern as its competitor. Should the price slip below the green supporting trendline, it would portend bad fortune for FNF’s value. Both stocks are at the mercy of the money flow in the real estate industry in general, but the failure of the wedge patterns would be akin to the proverbial canary in the coal mine, suggesting that a general downturn is underway.

Innovate or die

Although the blockchain would seem to represent an utterly disruptive technology for the title insurance industry, a few factors seem likely to save these firms from being snuffed out swiftly.

The real estate sector remains relatively conservative and slow-moving. When dealing with the largest transactions of their lives, people don’t want to experiment with new approaches just to save a relatively small amount of money. They want peace of mind, and it will take time to convince them they will be just as safe with something novel as they have been with the old-fashioned approach.

Title insurance research isn’t simple. It isn’t just a matter of declaring that “A used to own it, and now B owns it.” As described above, a whole host of entities might lay claim to some kind of title defect. And there’s no single, unified database of entities that might have a lien on the property. The data required to declare a title is clean can seem highly disjointed and discontiguous.

The transfer of information from existing databases to a title-focused blockchain would be a Herculean task. It will almost certainly happen, but it’s a big project involving tens of thousands of “silos” of information. But the project has begun, and an interesting startup called Ubitquity is working on it.

All of that aside, the title insurance giants aren’t about to remain stuck in their ways and let blockchain take over. The First American and Fidelity National home pages carry prominent statements and images about e-signatures, electronic closings, technological transformation, going digital and how they intend to lead the way.

The march of technology is providing an opportunity for the market leaders to transform the way they do business, as opposed to allowing breakthroughs to render them obsolete overnight.

However, it appears that the premiums the title insurance companies charge will shrink dramatically as the industry proceeds from the 19th century to the 21st. These companies are, after all, rooted more firmly in the information business than in the insurance business. As such, they recognize the need to stay ahead of the technological curve.

Meanwhile, the charts reflect the industry’s vulnerability to how many real estate transactions are completed. If home buying dries up, these stocks are going to be hit hard.

These large firms will adapt to new technology, but they’ll also face a host of scrappy, small organizations that run more cheaply while providing the same service.

That could result in a new landscape where just two companies don’t control 60% of an entire industry.

Tim Knight has been using technical analysis to trade the markets for 30 years. He’s the host of Trading the Close on the tastytrade network and offers free access to his charting platform at slopecharts.com.

@slopeofhope