Failure to Launch

It’s no secret that equity investors are always on the lookout for the “next big thing.” In years past, they’ve become fascinated with cannabis stocks, 3-D printing and the gig economy. Lately, thanks to the repeated pronouncements of a few astro-fixated billionaires, space exploration has been attracting a lot of attention, even though the sector offers precious few places to invest.

It wasn’t always this way with “fad” sectors. Investors could find dozens of ticker symbols in categories like precious metals miners or pot stocks. The stocks may not have been traded in the United States, and they might not have been large—as measured by market cap—but at least investors had something to trade.

The space-exploration category, however, is nearly as empty as space itself. Just about the only “pure” space play is Virgin Galactic (SPCE), which managed to seize a very appropriate ticker symbol. Founded by the world-famous billionaire entrepreneur Richard Branson, Virgin Galactic is in the business of space tourism. At this point, its principal occupation is losing money (having recorded $138 million in losses on just above $3 million in revenue in the first nine months of 2020), but that’s to be expected. The only revenue stream flows from taking customer deposits for space flights scheduled to take place in the future.

What (expensive) fun!

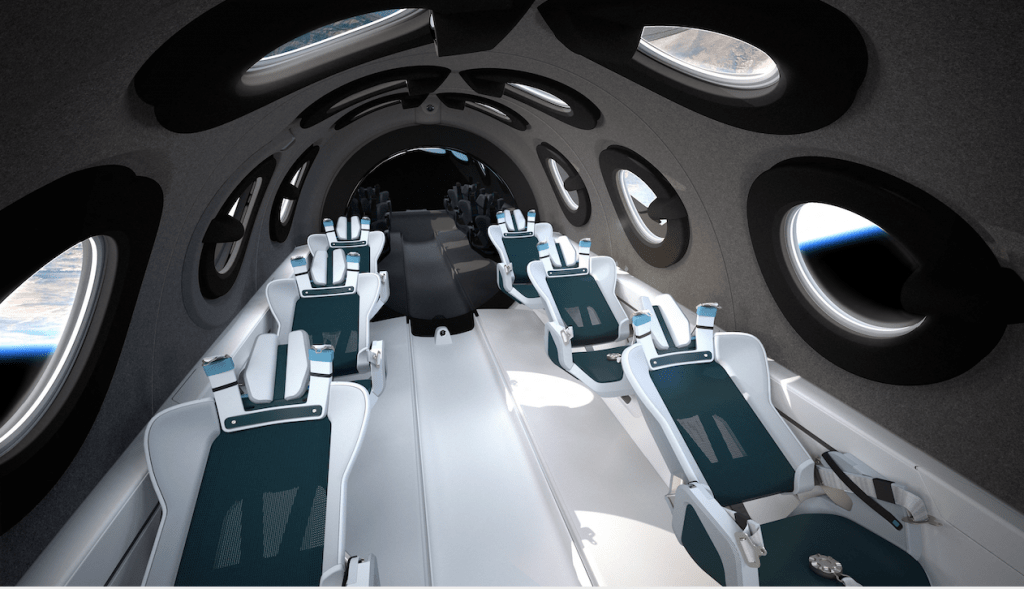

No one is pretending this is anything but a fun adventure for the very rich. A deposit on a future flight costs $250,000 per seat, and the website cheerfully invites customers to book up to six seats—the spacecraft’s entire passenger capacity.

Journalists have mistakenly reported that a seat costs $250,000, but that’s merely a deposit, with the full price to be established later. The company asks website visitors how much they would be willing to pay and estimates the maximum price as “more than $1 million.”

Indeed, reserving a seat seems a bit like filling out a (simple) college application. It isn’t merely about handing Branson a bunch of cash. Visitors to the site are asked what aspects of space flight appeal to them. The choices include:

• The zero-g experience

• The view

• Fulfilling a dream

• Following my heroes

• Following a higher purpose

(whatever that might mean)

Irrespective of the reasons for space travel—be they a higher purpose or bragging rights—Virgin Galactic hasn’t had trouble finding takers. The reservations sold out quickly, and the stock price has been doing sensationally well.

The company’s market cap has reached about $8 billion—no mean feat for a corporation that has scraped together only a few million dollars in revenue and will obviously be losing money for many years to come. Clearly, this is an extroardinarily speculative instrument, based on the notion that space tourism will become a thriving, rapidly growing business.

The lessons of history

As a historical footnote, dirigibles were a thriving, wildly successful industry until the Hindenburg exploded in the 1930s. It took only one disaster to snuff out the world’s love affair with that mode of transportation.

So, it will be crucial to the success of Virgin Galactic that no accident ever befalls it. A regretable event would warrant instantaneous worldwide news coverage. Hopefully, such a thing will never occur, and space tourists can climb aboard without (much) fear.

For those who do, their experience as astronauts will be relatively brief. First, they’ll board SpaceShipTwo, a reusable spacecraft tethered to WhiteKnightTwo, a large aircraft. Then the plane will ferry the spacecraft to an altitude of 45,000 feet. Next, the spacecraft’s booster rockets will fire to propel it into the darkness of space.

For about 90 minutes, the six passengers can gaze upon the wonder of the cosmos and absorb the spectacular views of Earth below. They’ll have the experience of a lifetime before returning to Earth and landing in much the same way any jet aircraft would.

Morgan Stanley predicts space-based tourism could be worth $800 billion a couple of decades from now. Maybe so, maybe not.

If it is—and “first mover advantage” applies—Virgin Galactic has a crucial toehold at the earliest stage of this new industry.

Long, long distance calls

Artificial satellites have been zipping around Earth since before anyone had ever heard of The Beatles. Recent orbital ventures have focused on worldwide communications, such as Elon Musk’s Starlink project, which is placing more than 40,000 tiny satellites in orbit to provide global broadband internet access.

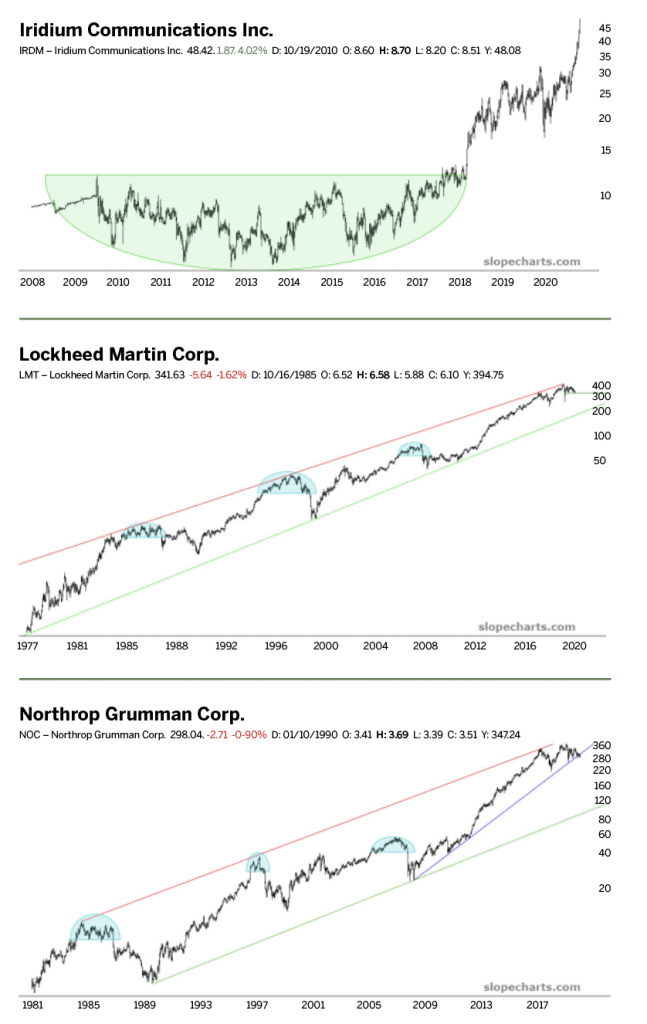

Like Musk’s other space venture, SpaceX, his Starlink project is a privately held enterprise. There is, however, one major publicly traded firm focused on space-based communications: Iridium (IRDM). It provides voice, data and IoT (Internet of Things) capabilities, principally to governments and corporations. For example, cellular technology is useless to ships at sea except with the help of satellites.

Iridium has been fantastically successful and has a market cap approaching $7 billion. The company spent a decade building an enormous saucer base, but after pushing beyond that phase it has blasted to new highs almost without interruption.

Nominally celestial

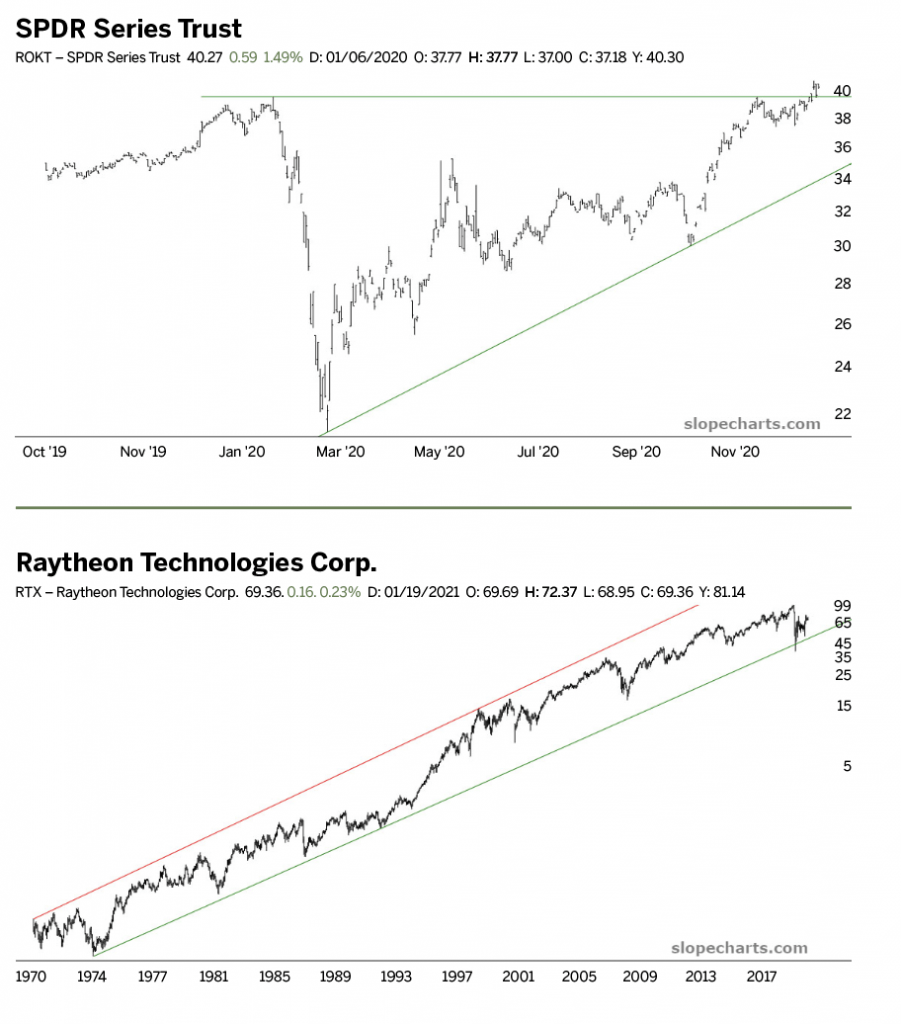

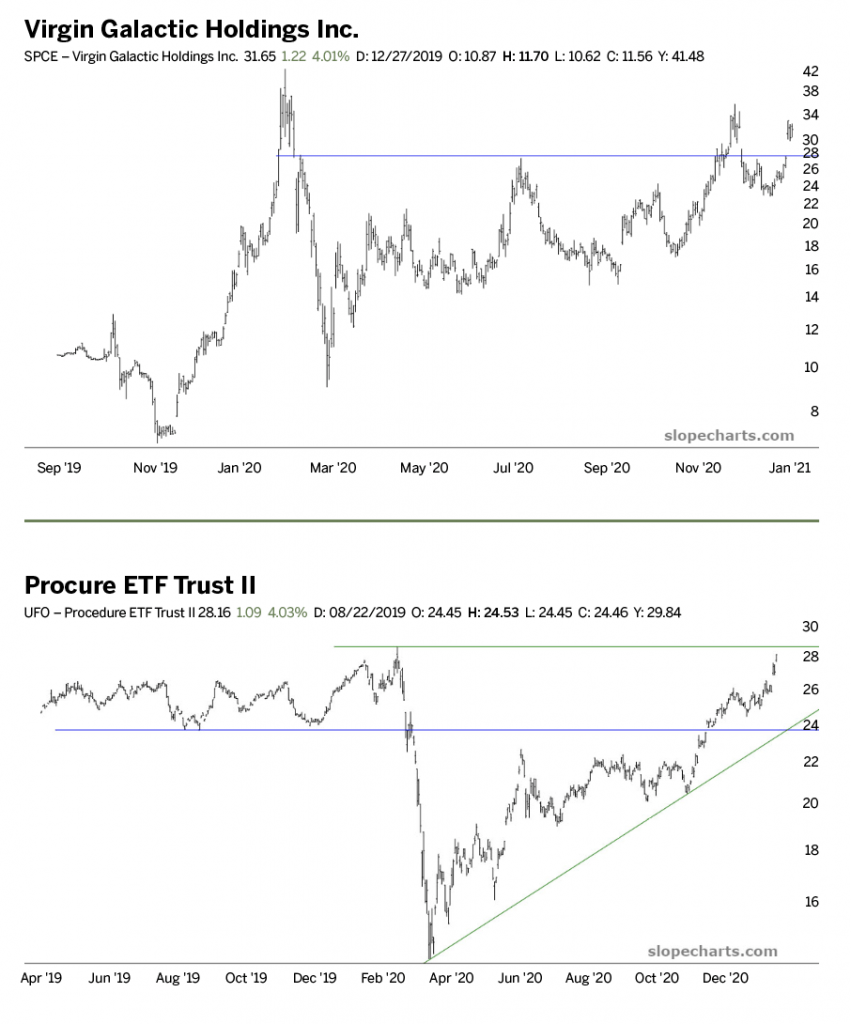

The public is infatuated with the potential profits of space-based businesses, a fact that’s not lost on the financial services world. Two of the funds created to focus on space “plays” are Kensho Final Frontiers (ROKT) and Procure Space ETF (UFO). If nothing else, space ventures deserve credit for some very creative ticker symbols.

The issue with funds like these is that not many space businesses are publicly traded. Most of these tiny funds focus on big aerospace and defense companies—Boeing, Lockheed and Honeywell—and other public firms somehow related to space exploration.

But at a giant firm like Boeing, the portion of revenues directly related to space is minuscule. What’s more, supposedly space-related funds sometimes decide to purchase a stake in companies such as ExxonMobil (XOM) because rockets need fuel to get into space. But having a product with some oblique relationship to space exploration doesn’t exactly make a company a space play.

These two funds have, however, been prospering. Still, that’s mostly because the stock market in general has been making lifetime highs virtually every day. If companies like Martin Marietta (MLM) and Raytheon (RTX) are pushing persistently higher, funds like Procure Space ETF will, too.

If, over time, more “pure” space plays have public offerings, it seems likely that the funds that purport to invest in space will likewise take positions there. Until then, the pickings remain slim for fund managers trying to craft a strategy around this sector.

Past as prologue?

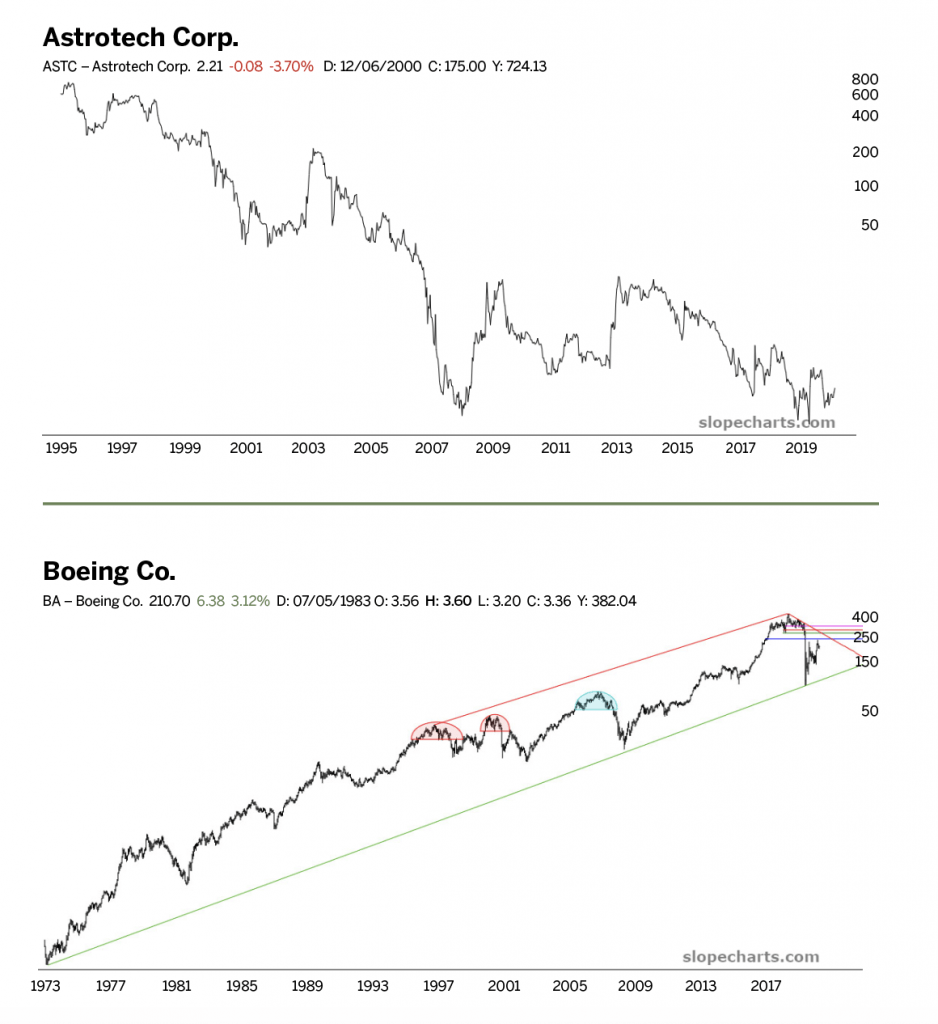

This isn’t the first time in financial history that space exploration has become a hot sector. Orbital Sciences (ORB) merged with

Alliant Techsystems (ATK) back in 2014. Astrotech (ASTC) was founded way back in 1984 to provide NASA with space shuttle equipment.

The space shuttle has long since been mothballed, and Astrotech has virtually no revenue to report these days. Its stock is still publicly traded, but the company is worth only

$20 million, and it has lost virtually its entire value, falling from a split-adjusted $800 to $2.

These grim results for earlier “pure space” equities don’t necessarily spell bad news for the present day because technology has advanced and opportunity has expanded. On the other hand, it’s important not to get caught up in the hype and fantasy of a sector where imagination can run wild.

Humanity has gazed skyward since time immemorial and contemplated what life could be like if only we could conquer space. For the numbers-based world of space equities, however, it’s useful to keep at least one foot planted on terra firma, even while monitoring some exciting ventures.

Tim Knight has been using technical analysis to trade the markets for 30 years. He hosts Trading the Close daily on the tastytrade network and offers free access to his charting platform at slopecharts.com.