Risk Mechanics

By Mike Hart

Knowing how and when to evaluate and control risk

Trading is commerce, and commerce is the relationship between the markets’ vast number of buyers and sellers—all aiming to end the day with a profit. Some will win, and others will not.

As in all of the many manifestations of commerce, trading has rules for success. They’re the mechanics that drive the outcome. While these guidelines differ depending on the business, success does not happen by accident.

One aspect of the “mechanics of success” is knowing how and when to evaluate and control options trading risk.

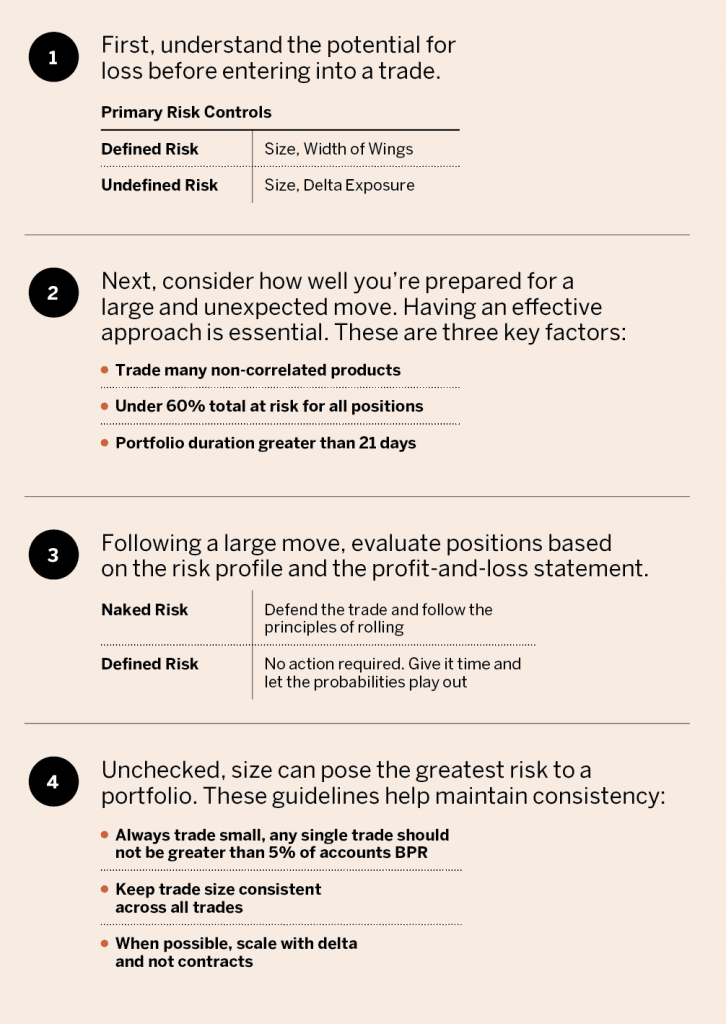

This cheat sheet can serve as a guide on how to approach risk in the options market. The goal is to set realistic expectations through repeatable mechanics, that are rooted in mathematics and statistics.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79

Cheat Sheet

-

Cheat Sheet No. 31

|Hockey Sticks Visualize the possible gain or loss from any options trade Simple graphical representations called hockey sticks show the potential profit and loss of any options trade. The name… -

How to Choose an ETF

|Exchange-traded funds reduce risk by diversifying portfolios Retail investors had their choice among 3,145 exchange-traded funds (ETFs) as of the beginning of this year, according to Morningstar. But how do… -

Your Pre-market Checklist

|These five best practices can keep traders well informed before the bell rings Everyone’s morning routine differs—some start with coffee, some walk the dog. A daily trading routine is no… -

The Short Naked Put

|Collect income while waiting for the price of a stock to go down Ever wanted to own a stock for less than its current price? Or would you like to… -

Covered Strangle

|A bullish bet with some added protection Investors often hear they should “buy low and sell high.” But when the opportunity arises, they can feel reluctant to commit capital. The… -

Covered Call Basics

|Neutral to bullish on a stock? Investors can use a covered call without continually checking their portfolios. Work smarter, not harder. That’s sound advice on the job or at home,… -

Costless Collar

|A costless collar is formed from a combination of strategies to create a “free” position protecting 100 shares of stock. Here they are: A covered call, which is a two-part… -

Dollar-cost Averaging

|DCA, the strategy of investing an equal amount of money at regular intervals regardless of the price of the underlying stock, removes emotion from the equation -

Long Call Speculation

|Paying a fee to lock in a price Buying a long call option is like saving a coupon for a rainy day. Let’s say a clothing store sells rain jackets.… -

Maximum Dividends

|The guru of wealth building uses a simple strategy any investor can mimic Traders can make the most of their portfolios by taking a cue from investment guru Warren Buffett.One… -

Stay Logical

By Mike Hart

|Traders should always bear in mind that markets are random and that the future remains unknown. Predicting prices presents a challenge, but traders can improve their chances by creating and… -

Looking for Liquidity?

By Mike Hart

|Liquidity is essential to successful trading Traders think of price discovery—an essential characteristic of any market—as the process that sets spot prices. It’s a matter of buyers and sellers making… -

It’s Your Move

By Mike Hart

|Trading platforms offer built-in tools that point toward expected stock prices The market is defined from moment to moment by every single decision made by each trader—combined with all of… -

Cyber Scrutiny

By Mike Hart

|Finding the best cyber companies to trade doesn’t have to be hard. Here’s the secret formula. Cyber security companies are big and growing bigger. The industry generated $120 billion in… -

Cryptocurrencies

By Mike Hart

|This cheat sheet shows the results of studies testing for average volatility and correlations Cryptocurrencies have become a trading realm onto themselves. Investors have hundreds of coins to choose from,… -

The Trading Game

By Mike Hart

|Be ready to revise your game plan. New products and new types of trades are making investing feel more like a game. But don’t look to reinvent an approach to… -

Four Pillars of Options

By Mike Hart

|These four elements can provide the key to successful investing. In statistics, the law of large numbers says that as the sample size grows, outcomes will more closely resemble the… -

Outsmarting the Machines

By Mike Hart

|Be prepared when the algorithms switch from BUY to SELL In his cutting-edge 1950s I, Robot science-fiction stories, Isaac Asimov created a world where robots gained more than a bit… -

Metrics & Mechanics

By Mike Hart

|Alleviate the guesswork and reduce the risk of trade decision-making The market reacts to the decisions of millions of traders and even expresses their emotions. It does both by establishing… -

Market Awareness

By Mike Hart

|Getting in touch with your inner guru The phrase “market awareness” isn’t commonly used in finance, but it’s essential in the trading world. It’s broad but not specific. It’s not…