Cyber Scrutiny

Finding the best cyber companies to trade doesn’t have to be hard. Here’s the secret formula.

Cyber security companies are big and growing bigger. The industry generated $120 billion in 2020 and projections call for volume to increase substantially.

Therefore, trading possibilities abound. But choosing the right strategies requires the fundamental skill of knowing how to evaluate a company.

Thankfully, a step-by-step process helps traders choose options trades in this or any other industry, and this Cheat Sheet lays out the basics.

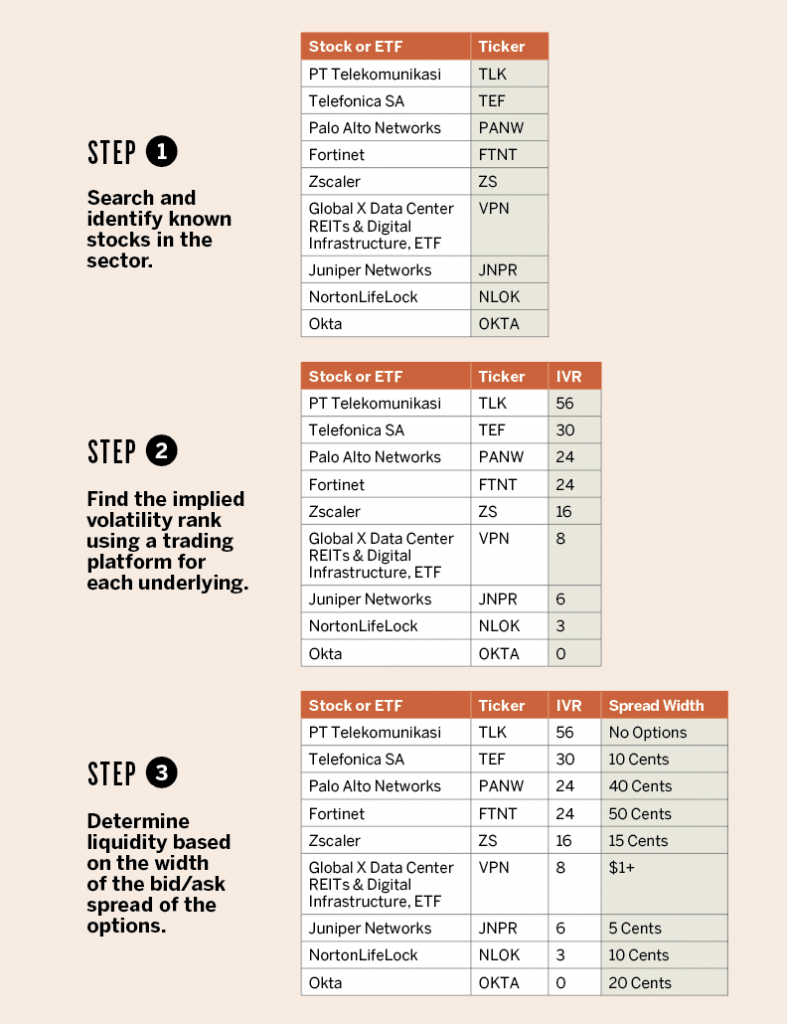

First, use a quick internet search to identify stocks that trade in the industry. Keep an eye out for exchange-traded funds (ETFs). For those, do a little investigating and run a search for their holdings. Create a possibility list of companies and ETFs.

For the next step, look at each company on a trading platform and record the current level of implied volatility rank (IVR). Higher premiums for higher IVRs (greater than 20) mean the company may qualify as an excellent candidate for selling options. If a company has an IVR lower than 20, consider long volatility strategies.

Next, confirm liquidity. Ideally, the spread between the bid and ask is a couple of cents wide. If it’s more than 20 cents, exercise caution with trading and make sure to work entry orders carefully.

With those data points, evaluate options opportunities for each company and ETF. This process not only reveals opportunities but also identifies stocks and ETFs to exclude.

Mike Hart, a former floor trader at the Chicago Stock Exchange and proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79