Crude Over Crypto

Cryptocurrency may seem less attractive these days as the invasion of Ukraine increases the volatility of crude oil

As war rages in Ukraine, crude oil is impersonating a cryptocurrency. The price for West Texas Intermediate contracts (WTI) jumped nearly 7% in one day—the commodity’s biggest rise since record keeping began.

The relationship between bitcoin and traditional assets, such as gold and crude oil, is part of the debate over whether the dominant cryptocurrency is a currency or a commodity.

In traditional financial markets, times of extreme volatility and uncertainty usually drive investors toward “safe-haven” assets with lower risk and lower returns. Examples of such assets include gold and low-yield bonds, such as U.S. Treasuries.

Gold is accepted as a global store of value, and U.S. Treasuries are backed by the government and should never go bust. But over the past month, the definition of a safe-haven asset has been brought into question.

So, where does bitcoin come into this? Normally, a safe-haven asset is uncorrelated with the stock market, which people believed was the case with bitcoin. Yet, recently its price fell in sync with equities, which calls this assumption into question.

That spawned debate over whether the cryptocurrency—or digital assets in general—can be classified as safe when its price is unpredictable. After all, bitcoin has posted a weekly loss of 10%.

Between early January and February, the implied volatility of West Texas Intermediate rose from 38% to more than 100%, whereas bitcoin’s implied volatility fell from over 90% to under 40%.

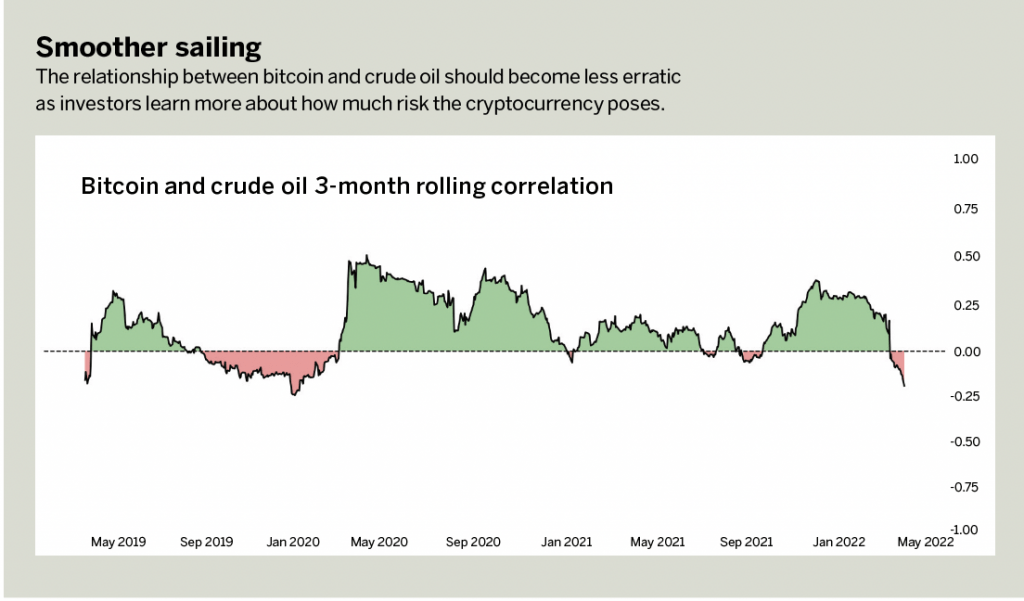

The graph shows the correlation between bitcoin and crude oil. When the line moves above zero, a positive correlation exists between the two assets, and when it moves below, the correlation is negative.

Although the line appears to fluctuate greatly, the scale on the right indicates that the correlation between the two assets is not significant enough to make any real conclusions about the relationship between the two assets.

Note, however, that as bitcoin matures, this graph should become less choppy as investors learn where the cryptocurrency sits on the spectrum of safe to unsafe.

It’s too early to judge how bitcoin may be positioned in the future. On the one hand, it could remain a purely speculative asset that increases in volatility as whales accumulate coins and cyclically buy from or sell them to novice traders. On the other hand, it could become an easy-to-hold asset compared with commodities like crude oil, which would appeal to investors in countries with high inflation or political instability.

With regard to trading opportunity, bitcoin may sit on the sidelines in this period of lower volatility. More opportunity might be found in crude oil’s large intraday swings, as the Ukraine war continues. Bitcoin’s historical volatility fell below crude oil’s in March as oil started moving faster than the cryptocurrency.

Bitcoin traders may want to consider crude oil. Attractive factors include product variety, leverage and two-sided tradable markets. Unlike bitcoin, crude oil futures and futures options enable traders to place leveraged trades in either direction.

For example, traders can buy or sell a micro crude oil future (/MCL) for just $1,800. The contract controls 100 barrels of oil, $10,000 with crude at $100 per barrel. That’s an amazing opportunity to harness leverage if traders keep their risk management in check.

Cryptocurrencies brought many new traders to the dance floor, but learning to use capital-efficient, liquid products in currently compelling assets may keep their party going.

Pete Mulmat, tastytrade chief futures strategist, hosts Splash Into Futures on the tastytrade network. @traderpetem