Trading the Strong Rebound in the Global Travel Sector

After a sharp slowdown during the COVID-19 pandemic, global tourism rebounded during 2022, which has provided a strong boost for many stocks operating in the travel sector.

Recent data indicates that global travel has strongly rebounded in the wake of the COVID-19 pandemic.

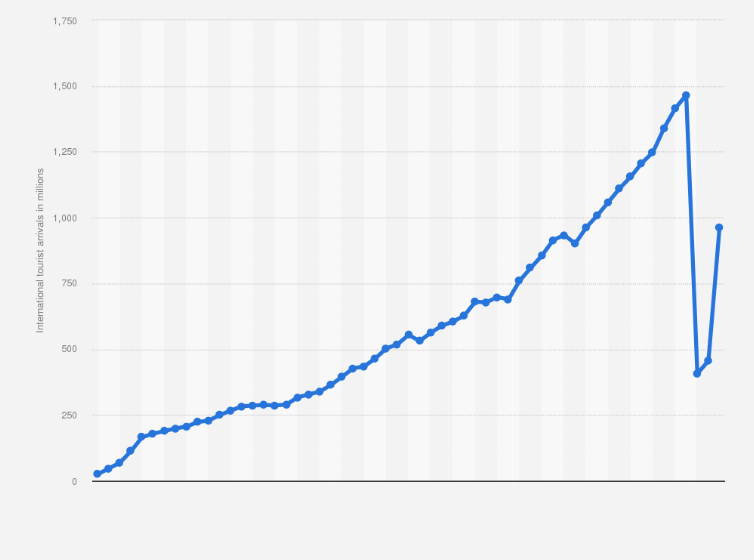

According to the United Nations World Tourism Organization (UNWTO), more than 900 million people traveled internationally in 2022. That’s double the figure from 2021.

However, 900 million was still well below the number of international travelers observed in the year immediately before the pandemic. In 2019, there were closer to 1.45 billion international travelers.

International tourist arrivals (1950-2022)

In the United States, however, domestic travel has arguably rebounded to a stronger degree. In 2023, Transportation Security Administration (TSA) checkpoint figures indicate that the volume of U.S. travelers is mostly back on par with those observed in 2019.

For example, on May 17, 2023, approximately 2,305,668 travelers passed through TSA checkpoints, as compared to 2,472,123 travelers on the same day in 2019. In comparison, the same day in 2020 saw only 230,367 travelers.

The hotel occupancy rate also reflects a strong rebound in domestic travel. Prior to the pandemic, the hotel occupancy rate in the U.S. hovered right around 64%-65% during the five-year period leading up to the pandemic. In 2020, that figure dropped to about 44%.

Last year, hotel occupancy rallied back above 60% and ended the year at nearly 63%, which is within shouting distance of pre-pandemic levels.

Rebounding revenue and stock prices

Much like TSA checkpoint and hotel occupancy data, sales data from the travel industry reflects a strong rebound in domestic and international travel.

United Airlines (UAL), for example, reported quarterly revenues of $11.43 billion in the first quarter of 2023. That’s actually 19% higher than the quarterly revenue reported by United in the first quarter of 2019, which was $9.59 billion.

Those figures dwarf United’s low point during the pandemic, when the airline reported $1.45 billion in quarterly revenue during Q2 2020. The strong rebound in United’s sales figures helps illustrate how far the travel sector has come since the depths of the pandemic.

Shares in United have also rebounded sharply since the stock bottomed at under $20/share in May 2020. The stock currently trades for about $47/share, which represents a 135% trough-to-peak return since 2020.

Interestingly, shares in United are still well below the levels observed leading up to the pandemic. At the start of 2020, United stock was trading about $88/share, which means the stock is still down roughly 47% from pre-pandemic levels.

One reason the shares have underperformed likely ties back to United’s effort to regain operational efficiency in the wake of the pandemic. Despite the large surge in revenues in Q1 2023, earnings at United haven’t rebounded to the same degree.

United reported a net loss of roughly $200 million in Q1 2023, as compared to a net profit of nearly $300 million during Q1 2019. At this time, the ongoing threat of recession in the United States, and the elevated interest rate environment (higher financing costs), are likely harming the earnings potential at United, and likewise weighing on the share price.

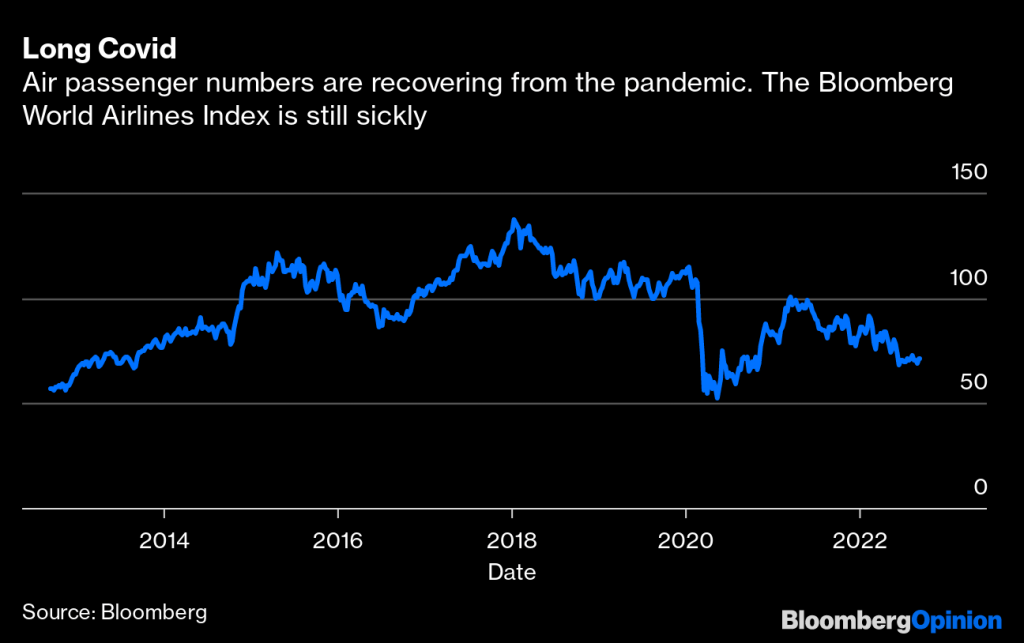

Looking at the broader airline sector, performance in United closely mirrors that of the overall airline industry. The U.S. Global Jets ETF (JETS) has rallied by about 55% since bottoming in May of 2020, and is currently trading at nearly $18.50/share.

However, U.S. Global Jets is still down roughly 40% from pre-pandemic levels. Similarly, the Bloomberg World Airlines Index is also still trading well below where it was in 2019, as shown below.

In comparison, the broader travel industry (including hotels, travel websites, etc.) appears to have fared slightly better than the airline sector since bottoming in 2020.

For example, the well-diversified Invesco Dynamic Leisure and Entertainment ETF (PEJ) is trading on par with the levels observed immediately ahead of the pandemic. At the start of 2020, Invesco Dynamic Leisure and Entertainment was trading roughly $42.50/share. Today, it trades only 3.5% below that level, at $41.00/share.

Much like the airlines, Invesco Dynamic Leisure and Entertainment bottomed in the first half of 2020 at roughly $24/share. It has since rallied by 73%.

Shares in Expedia (EXPE)—another well-known, diversified player in the travel industry—have also performed in-line with the broader travel industry (i.e. better than the airlines). Expedia is currently trading at about $98/share, which is only 11% lower than where it was trading at the start of 2020.

Expedia bottomed out at about $48/share in April 2020, and has rallied by about 104% since that time.

Slowdown in business travel and increased experiential travel

Looking beyond the strong rebound in global travel, there’s been a few notable shifts within the sector.

One of the key stories as of late has been a slowdown in business travel. Recent data has shown that the business niche of the broader travel industry hasn’t rebounded as strongly as tourist-related travel in the wake of the pandemic.

Deloitte released a research report in April that focused specifically on business-related travel, and the data was fairly grim. For example, during the first half of 2023, business-related travel is expected to clock in at roughly 57% of the level observed in H1 2019.

Under the best-case scenarios, business travel could climb to roughly 66% of the H2 2019 level during the second half of this year.

One of the main headwinds for business travel has been the slowdown in the economy, which has caused many businesses to tighten their budgets. Additionally, in the wake of the pandemic, more workers are attending events virtually, as opposed to in person. The in-person events most likely to get axed include company retreats, trade shows and incentive travel.

According to Deloitte’s report, one of the biggest deterrents to business travel—beyond the slowdown in the global economy—is the increased cost of airfare and hotels. Along those lines, the U.S. Bureau of Labor Statistics reported that the average airfare in the United States rose 28.5% in 2022 over the previous year.

The Deloitte report did indicate that business travel could climb back to 2019 levels by 2024 or 25, but that “corporate travel will likely be smaller than it was prior to the pandemic.”

Another interesting development in 2023 is that tourists have been increasingly focused on big cities as opposed to beaches, suggesting that tourists are now serving as an important replacement for business travelers in some of the world’s key metropolitan areas.

Peter Kern, CEO of Expedia, commented on this emerging trend during his company’s Q1 earnings call, “Throughout the [first] quarter, we saw strong consumer demand with acceleration in international and big city travel [along with] more of Asia reopening.”

Another trend observed with leisure-focused tourists has been increased interest in experiential travel.

A research study conducted by Booking.com revealed that 73% of travelers are now looking forward to experiencing the type of “out of comfort zone travel, that pushes them to the limits,” illustrating a new interest in immersive and culturally rich experiences.

This shifting dynamic may help explain why large, metropolitan areas have experienced a surge in interest, with travelers soaking up the diversity, food and entertainment that are the hallmarks of cosmopolitan cities.

This year’s best- and worst-performing travel stocks

Trends are one thing, but performance in the market is quite another. The lists below highlight some of the best- and worst-performing stocks in the travel sector so far in 2023.

Top-performing stocks (year-to-date)

- SkyWest, SKYW +73%

- Carnival Corp, CCL +41%

- Ryanair Holdings, RYAAY +34%

- Booking Holdings, BKNG +33%

- Airbnb, ABNB +29%

- MGM Resorts, MGM +27%

- United Airlines, UAL +27%

- Wynn Resorts, WYNN +26%

- Hyatt Hotels Corporation, H +25%

- Marriott International, MAR +18%

Worst-performing stocks (year-to-date)

- Frontier Group, ULCC -22%

- Spirit Airlines, SAVE -21%

- PENN Entertainment, PENN -14%

- Tripadvisor, TRIP -12%

- Monarch Casino & Resort, MCRI -11%

- Southwest Airlines, LUV -10%

- Marriott Vacations, VAC -6%

- Wyndham Hotels & Resorts, WH -6%

- Trip.com Group, TCOM -5%

In addition to the individual stocks listed above, investors and traders can also access exposure to the travel industry via the following ETFs, which are listed with their associated year-to-date performance:

- PowerShares Dynamic Leisure and Entertainment ETF, PEJ +13%

- ALPS Global Travel Beneficiaries ETF JRNY, +12%

- U.S. Global Jets ETF, JETS, +9%

- AdvisorShares Hotel ETF, BEDZ +8%

- MG Travel Tech ETF, AWAY +2%

To review the best-performing stocks and ETFs in the market so far in 2023—beyond just the travel sector—check out this recent Luckbox article.

To follow everything moving the markets in 2023, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.