Stay Logical

Traders should always bear in mind that markets are random and that the future remains unknown. Predicting prices presents a challenge, but traders can improve their chances by creating and following an approach that’s systematic and logical.

They can accomplish that by using facts to create a logical structure. At the same time, they should avoid

emotional trading by disregarding biased opinions and questioning baseless market hype.

This Cheat Sheet offers five simple metrics that traders can use to control their emotions and start following the facts to make rational decisions. Statistical analysis provides a wealth of information, and calculating probabilities provides insight into market dynamics. Let’s consider how it might work in the five examples on this page.

- Market Expectations

There’s a 68% probability that an underlying will remain within the range of its expected move. That gives a rough estimation of potential future price action. The tastyworks platform calculates and displays that in a couple of ways. The trade page shows the expected move both visually and numerically.

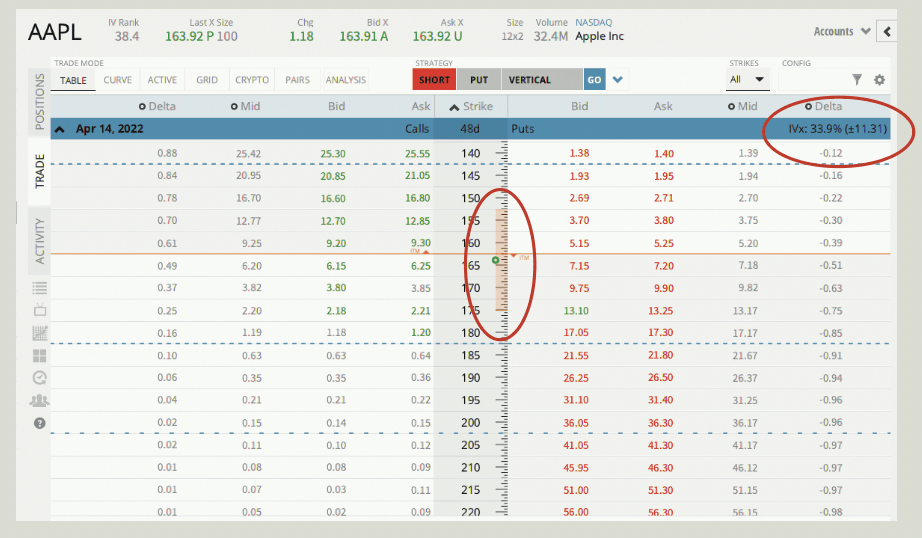

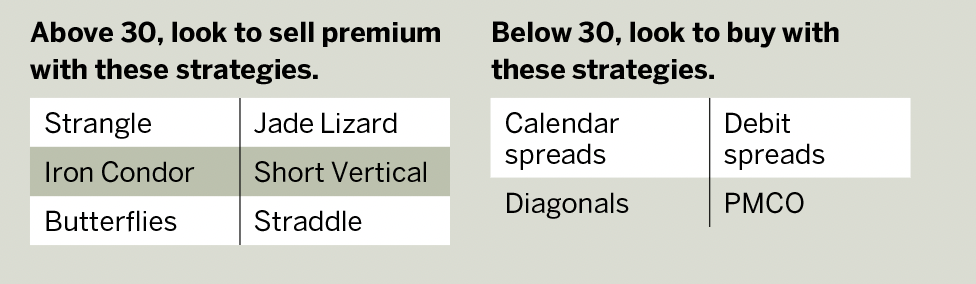

2. IV Rank

Ranging between 0 and 100, IV Rank (IVR) helps evaluate the current level of volatility. Using 30 as a cutoff between

high and low, it’s especially useful for strategy selection.

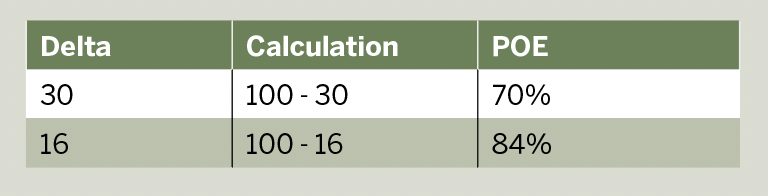

3. Expiration Probability

Probability of expiring out-of-the-money (OTM) measures an option’s chance of expiring worthless. The metric is calculated by subtracting the option’s delta from 100.

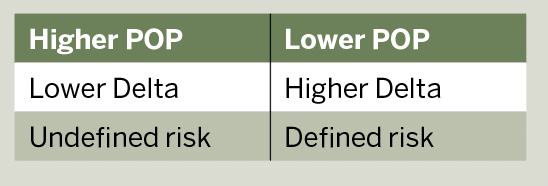

4. Probability of Profit

Probability of Profit (POP) is calculated to help evaluate risk and reward by using probabilities to quantify a trade’s potential outcome.

5. Touch

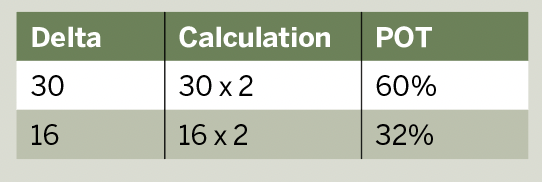

The Probability of Touch (POT) is the likelihood that at some point before expiration the price of a stock will reach a strike. That gives context to the trade’s expectations. To calculate, multiply the delta of the option by two.

Mike Hart, a former floor trader at the Chicago Stock Exchange and proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79