Market Awareness

Getting in touch with your inner guru

The phrase “market awareness” isn’t commonly used in finance, but it’s essential in the trading world. It’s broad but not specific. It’s not a one-size-fits-all. Think of it as the sum of a trader’s market exposure plus knowledge of current market conditions—everything that sets the stage for assumptions. It also magnifies what traders value as essential and non-essential for any given trade.

Ultimately, market awareness differs for every trader. However, certain ways of thinking enhance market awareness.

It begins with reflecting on the big picture: Where does the market stand from a macro-economic perspective and what drives it right now? What’s the state of interest rates or where the futures market is trading? Are binary events,

such as a presidential election, on the radar? Could other uncertainties play a role? The market and its focus are always changing, and each day presents a different picture.

Next, use the VIX index to determine what the market’s volatility is indicating. Is it high or low relative to its historic 30-year mean of 15.5%?

Using knowledge of equity indexes is the next step. Compare recent price movement for, say, the S&P 500 or the Nasdaq. This step will include interpreting the level of IV Rank for each.

Finally, get specific by gauging what stocks are in play and choosing the best opportunity, based on current market awareness assumptions.

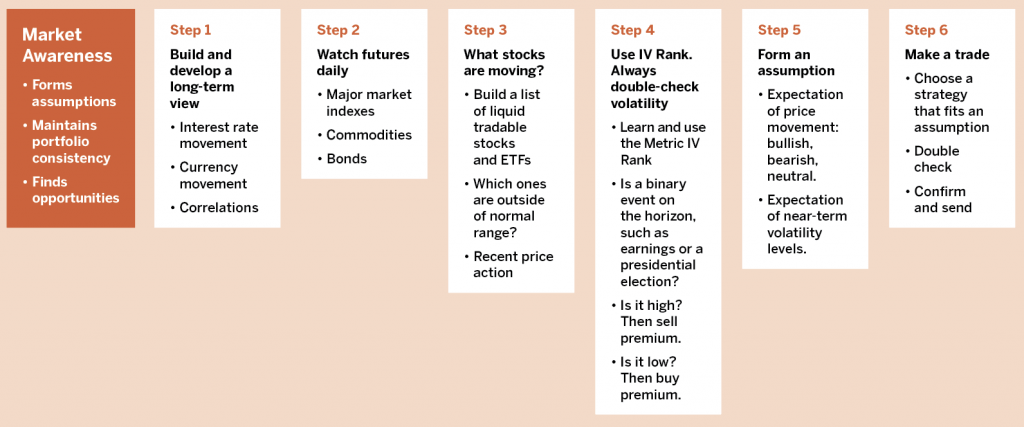

This cheat sheet can serve as a guide to the elusive market awareness assumption process.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79