After 40% Surge: Is There More Upside for Deutsche Bank?

From Frankfurt to Wall Street, this German bank is turning heads in 2025

- Shares in Deutsche Bank have surged 40% year-to-date, driven by strong earnings despite a challenging economy.

- The bank’s diversified operations, particularly in investment banking and asset management, are positioned for continued growth.

- Its valuation remains attractive, with favorable metrics providing a strong foundation for further upside.

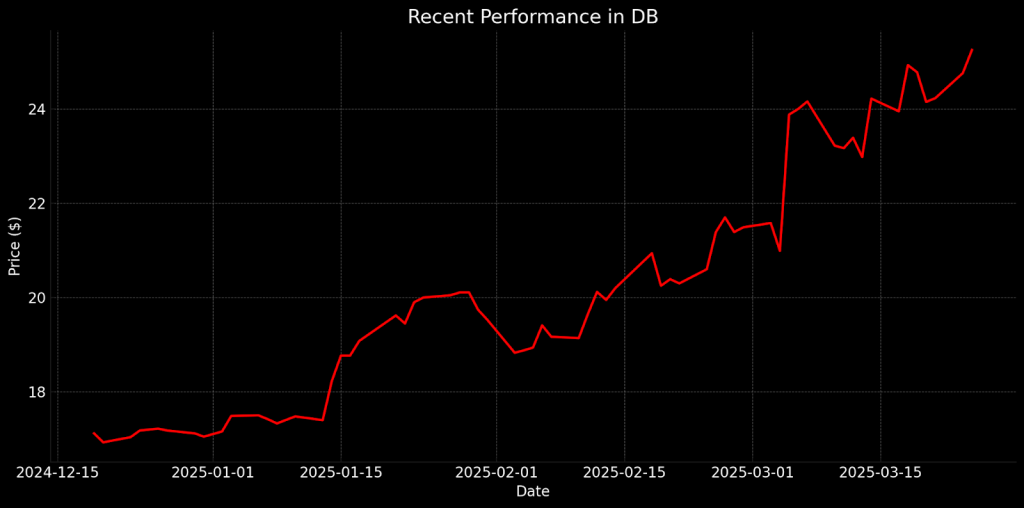

In a year when AI and tech stocks are getting all of the attention, it’s easy to forget other sectors are quietly delivering standout performances. While the financial sector may not have the same buzz or futuristic “juice” as Silicon Valley’s AI giants, some financial stocks are having a major moment in early 2025. A prime example? Deutsche Bank (DB), whose shares have soared by 40% year-to-date, proving that even in the world of banking, growth is very much alive.

After such a strong run, the question is where does Deutsche Bank stock stand right now? Is this surge just a one-time event or does the stock still offer long-term potential? Today, we dive into the bank’s recent performance and its valuation while considering whether its stock remains an attractive buy—or if it’s already priced for perfection.

Deutsche Bank’s global reach and financial strength

Frankfurt, Germany-based Deutsche Bank is one of the world’s most prominent global financial institutions and has a rich history dating back to its founding in 1870. As Germany’s largest bank and a significant force in European finance, it offers a wide range of financial services, including investment banking, asset management and retail banking. It’s a key provider of services to corporations, institutional investors and governments, helping to facilitate financial transactions, manage assets and navigate the complexities of global markets.

Deutsche Bank’s operations are organized into several divisions: Corporate and Investment Bank (CIB), Private and Commercial Bank (PCB) and Asset Management (DWS). The backbone of its business is the Corporate and Investment Bank (CIB) Division, which includes trading, lending and advisory services. CIB offers services across equities, fixed income and derivatives, making it the biggest contributor to the bank’s revenue and overall performance.

Besides CIB, Deutsche Bank’s asset management business—DWS—provides investment services to individuals and institutions, while the Private and Commercial Bank Division focuses on retail banking services, including savings accounts, loans and credit cards, catering mainly to customers in Germany and other markets.

Deutsche Bank’s operations and influence extend well beyond Europe. The bank plays serves as a primary dealer in the massive government debt market, as well as the global derivatives and foreign exchange markets. In recent years, the bank has worked to strengthen its capital base, streamline its operations and focus on core business areas, such as investment banking and asset management, while divesting itself from non-core businesses. This strategy has supported its broader global expansion, with Deutsche Bank now maintaining a presence in more than 70 countries.

Deutsche Bank’s latest earnings report sparked optimism among investors, revealing a modest but surprising profit that showed the bank’s resilience in a challenging economy. The report, along with a series of strategic initiatives, has boosted confidence among investors, pushing the stock up about 40% so far in 2025. The latest financial results not only demonstrate the bank’s ability to navigate turbulent conditions but also set the stage for sustained growth.

Q4 earnings increase investors’ optimism

Deutsche Bank’s recent earnings report boosted investor sentiment, despite an uncertain economic landscape. The bank’s robust performance, particularly in its investment banking and asset management segments, helped it beat expectations and sustain recent positive momentum. In the fourth quarter of 2024, Deutsche Bank reported net profits of €1.3 billion, far surpassing analysts’ expectations of €785 million. While this represented a 30% decline from the previous year, it still demonstrated the resilience of the bank’s underlying operations, particularly as it capitalized on growth in its fixed income, currency and private banking segments.

Quarterly net revenue rose to €6.7 billion, marking a 5% year-on-year increase, and helping Deutsche Bank achieve €30 billion in total revenue for fiscal year 2024. This solid performance in top-line revenue was complemented by substantial shareholder returns—€1.6 billion in buybacks and dividends, highlighting the bank’s commitment to rewarding investors. In addition, Deutsche Bank’s core capital strength remains robust, with a strong CET1 ratio—a critical industry metric that evaluates a financial institution’s ability to weather financial shocks. While higher litigation costs and a slight uptick in credit loss provisions raised concern, they didn’t detract from an otherwise impressive quarter.

Moving forward, Deutsche Bank’s outlook remains optimistic. The bank is projecting 10% year-over-year growth in its investment banking operations and expects to continue seeing strong demand in origination and advisory services. Additionally, its asset management division surpassed €1 trillion in assets under management for the first time, solidifying its competitive edge. Despite challenges, such as its Private Bank’s return on equity, the bank remains well-positioned for growth in 2025, with a clear focus on improving cost efficiency and achieving long-term profitability. This positive momentum has helped fuel a 40% year-to-date surge in the bank’s stock, signaling it’s on solid footing, even amid the headwinds in the Eurozone economy.

Valuation metrics suggest shares are still attractiv

Deutsche Bank’s valuation offers an interesting proposition for investors, particularly given its performance in 2025 and the bank’s recent earnings momentum. When looking at several key valuation metrics—price-to-earning (P/E), price-to-book (P/B) and price-to-sales (P/S) ratios—Deutsche the bank represents a compelling investment proposition, especially in comparison to its peers.

Starting with the P/E ratio, Deutsche Bank is trading closely in line with the sector median at around 13x, suggesting the bank’s stock is priced fairly in relation to its earnings. This makes the bank a reasonably priced option when compared to the broader sector, particularly considering its robust earnings growth and ongoing operational improvements. A P/E ratio of 13x suggests the market is valuing Deutsche Bank’s ability to generate sustainable profits, even in a challenging macroeconomic environment.

Perhaps more notably, Deutsche Bank’s P/B ratio stands at 0.60, which is below the sector median of around 1.25. The P/B ratio is particularly important for banks, as it reflects how much investors are willing to pay for each dollar of net assets. A ratio below 1.0 indicates that the stock is trading at a discount to its book value, indicating the bank is undervalued relative to the value of its underlying assets. A discounted P/B ratio makes Deutsche Bank an attractive prospect for investors, especially considering the Q4 earnings report and the bank’s continuing focus on improving efficiency and profitability.

Looking at the P/S ratio, Deutsche Bank’s figure of 1.60 is also below the sector median of around 3, further reinforcing the notion that the stock is reasonably valued relative to its revenue base. A low P/S ratio suggests the market is not overvaluing Deutsche Bank’s revenue, despite its solid performance across various business units.

Despite these favorable valuation metrics, analyst sentiment on the stock is neutral. Of the 18 analysts covering Deutsche Bank, only 10 rate the stock a “buy” or “overweight,” while four rate it as “sell” or “underweight.” The average price target of $23 per share is slightly below the current market price of around $24. But considering the positive momentum from the most recent earnings report, as well as the bank’s potential for continued growth in 2025, the stock doesn’t appear overextended on a valuation basis. With a P/B ratio that’s well below its sector peers and a stable P/E ratio, the bank looks ready for a favorable revaluation in the near term, particularly if it continues to execute on its vision.

Takeaways

Deutsche Bank’s stellar performance in 2025 has captured the market’s attention, with the stock surging about 40% year-to-date. Despite the challenging economic backdrop, the bank’s ability to execute on its strategic initiatives and deliver impressive results signals it’s not just weathering the storm—it’s positioning itself for sustained growth. With a low P/B ratio and favorable valuation metrics, it stands out as a potential diamond in the rough, ready for revaluation as it continues to execute its vision.

For forward-looking investors, Deutsche Bank offers a compelling opportunity. It’s a solid “hold” at the very least, with upside potential if the global economy rebounds. For those willing to take on a bit more risk, the bank presents a well-priced entry point for growth, with an attractive mix of value and opportunity. Whether it’s a “buy” or “hold” will likely depend on an investor’s outlook for the global economy.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.