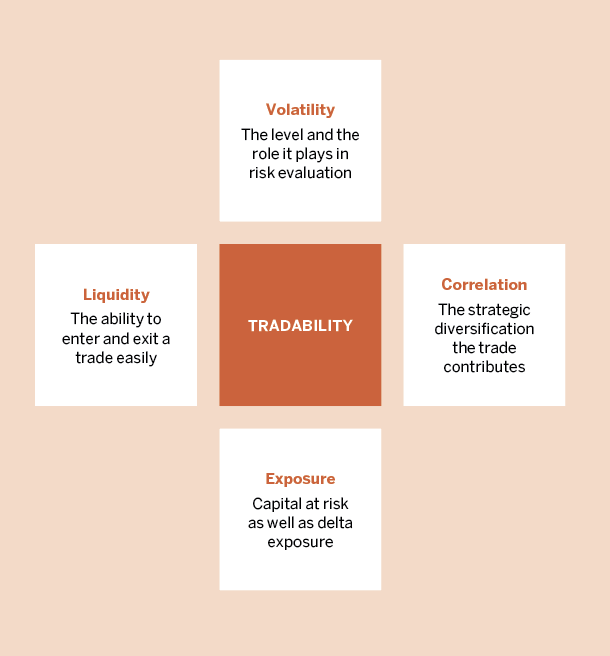

Calculating Tradability

Before placing a trade, confirm liquidity, implied volatility rank and risk exposure. Then make sure it fits the portfolio.

Before executing a trade, confirm a product’s tradability. Do it by checking liquidity, implied volatility rank and risk exposure, and by ensuring its size fits the portfolio. Strive for consistency through a more conscious and precise approach.

So with a particular trade in mind, it’s time to run the tests.

Liquidity is an absolute necessity. Think of it as the ability to enter and exit a trade easily. To determine liquidity, look to the bid/ask spread; the closer they are in price, the better. Also, look for high volume and open interest because they indicate lots of participation in the market and hence more liquidity.

IV rank determines whether an investor is applying the correct strategy. Don’t place a trade without properly identifying whether it fits the volatility environment. Typically, if it’s above 30%, look to sell premium. If it’s below 30%, look to buy premium.

The last step is ensuring size and risk fit the portfolio. First, consider notional size. Is it a $10 stock or a $1,000 stock? The higher the price, the greater the buying power needed and, without proper strategy adjustments, the greater the risk. If risk is too high (a trade should not represent more than 5% of total portfolio value) consider a smaller size or change the level of risk through the strategy approach.

These steps (right) represent the fundamental building blocks of a successful trade approach with the ultimate goal of creating a functioning and profitable portfolio.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79