Acquiring Short Delta

Delta can be either static or dynamic. Here’s how to get either one.

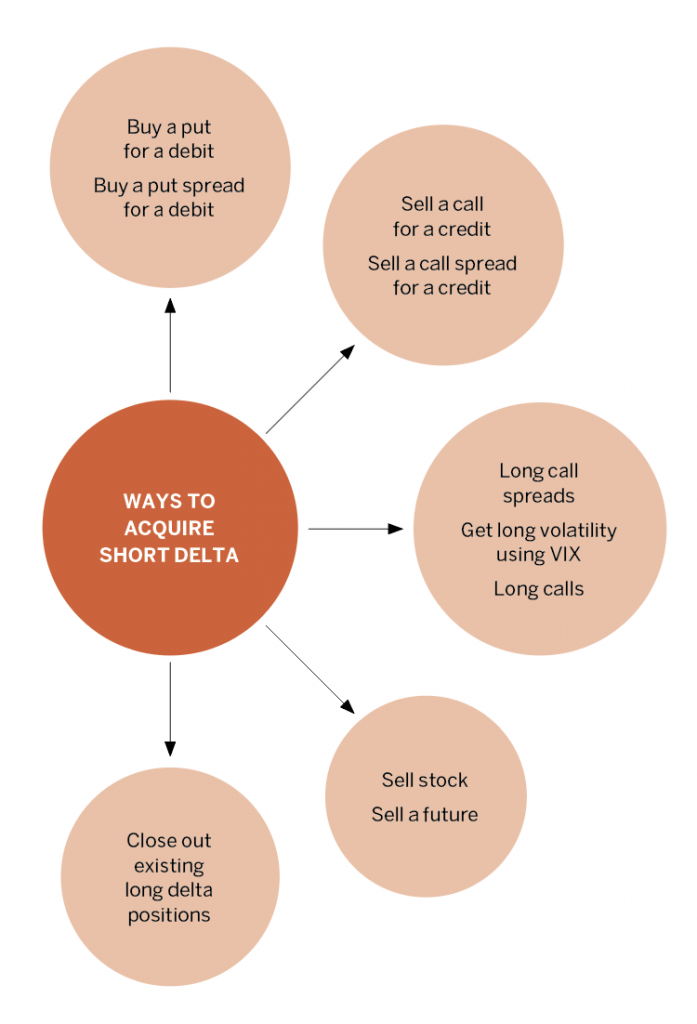

Acquiring short delta means adding positions that benefit from a move to the downside. Keep this cheat sheet as a reference for strategies.

Delta can be either static or dynamic. To generate static short delta, sell stock or sell a future. Regardless of the price movement that follows, the short delta remains constant.

Dynamic short delta is subject to change based on the underlying’s movement. It occurs in the options world. Next to closing out long delta positions, the naked options strategies are the most straightforward. Traders have two main choices: Buy a put or sell a call at an out-of-the-money strike to generate the desired short delta level.

Adding spreads to a portfolio provides a level of defined risk to a dynamic short delta trade. Either sell a call spread or buy a debit put spread. Typically, sell a call spread when the premium is rich and volatility is high. Opt for the put spread when volatility is low.

A final way to add dynamic short delta is by getting long inversely related products. Volatility is chief among these, carrying about a -.98 negative correlation. To do that, use options on the VIX to get long.

Whatever strategy a trader uses to get short, it will likely be one of the approaches laid out on this cheat sheet.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79