Covered Call Basics

Neutral to bullish on a stock? Investors can use a covered call without continually checking their portfolios.

Work smarter, not harder. That’s sound advice on the job or at home, but it also applies to the markets. Investors who buy a stock and hold it until retirement can sell covered calls to improve performance without working any harder.

Think of a covered call as a two-part strategy consisting of long shares of stock and short calls equivalent to the number of shares held. When determining the number of calls to sell, remember that each represents 100 shares of the underlying stock, and the seller assumes the obligation to sell 100 shares at the strike price anytime before expiration. So, investors with 300 shares can sell three calls against those shares of stock.

Covered calls offer three main benefits:

- Generating income via the premium received for selling the calls. This is a popular reason for selling covered calls, and many investors sell them on a regular basis to generate consistent income. It can boost annual returns by several percentage points.

2. Creating a target price for the potential sale of a stock position. Timing the market is incredibly difficult, especially when it comes time to sell a stock position. Selling covered calls can take the guesswork out of setting target prices for stocks because if the strike on the short call is breached, the equivalent shares will be sold at that price.

3. Lowering the purchase price of a long stock position. If an investor purchased a long stock position for $100 per share and sells a call with a strike price of $110 for $1 per share, then the theoretical purchase price or “cost basis” is lowered to $99 per share. Covered calls can mitigate the downside risks associated with holding long stock. Over time, the premium adds up and can reduce the cost basis even further.

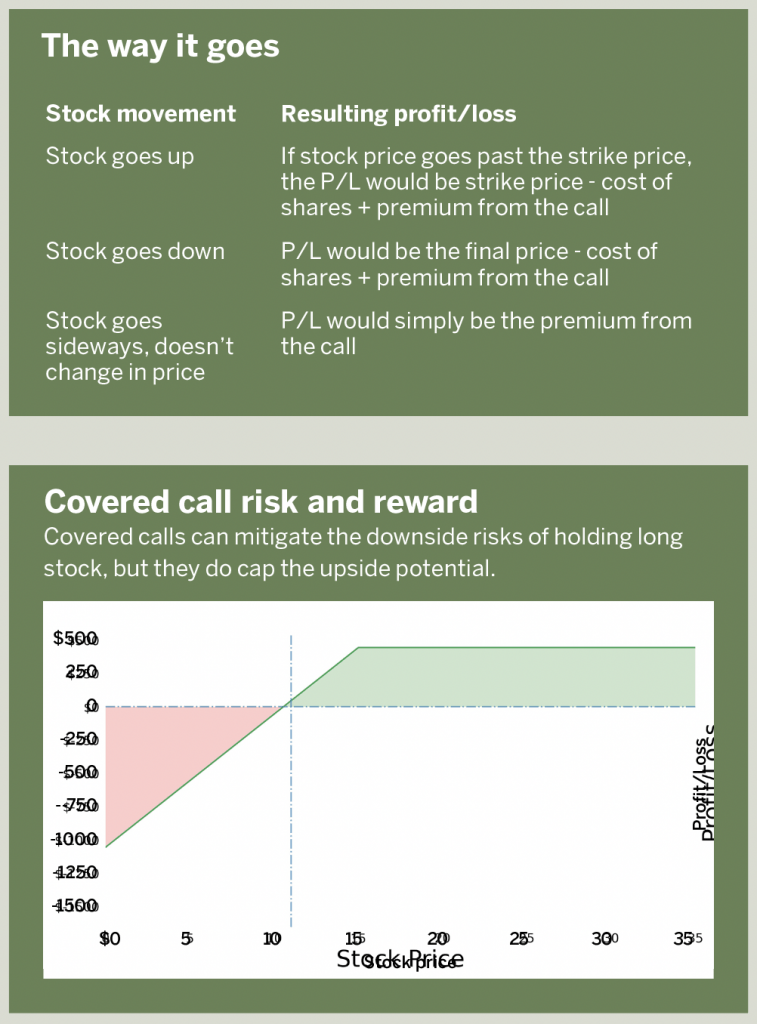

Let’s walk through an example of a covered call using a popular education stock, Udemy (UDMY). Assuming it has a share price of $11, it would cost $1,100 to buy 100 shares, and an investor could sell a call with a strike price of $15 for approximately $0.45 per share. That would make the cost basis $10.55 per share. What would happen to this position if the stock price moved? The answer is below.

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11