Your Pre-market Checklist

These five best practices can keep traders well informed before the bell rings

Everyone’s morning routine differs—some start with coffee, some walk the dog. A daily trading routine is no different. But following these five best practices before the market opens will help you prepare for your trading day.

Check the headlines. While many investors place trades without regard for what’s in the news, global headline macro economic events can set the tone for any given trading day.

Huge drops in Chinese gross domestic product, for example, have ripple effects throughout the global economy and often influence the stock markets.

Reports of slower consumer spending typically hurt retail stocks. Keeping tabs on global financial news makes for a more informed trader and may spark ideas for potential opportunity.

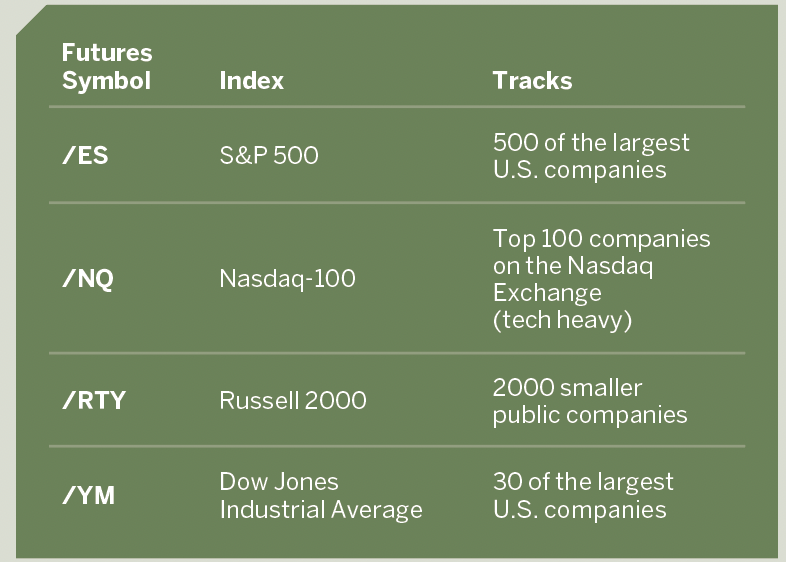

Check the futures market. While many traders are adding futures products to their trading arsenal, others use them as a barometer for how the market is moving overnight and how it will open that morning.

While there are futures for everything from metals to bonds, equity-focused traders can follow four key futures that track the major indices.

Check portfolio movers. It’s important to anticipate how a portfolio is likely to move on any given day. The overall movement in the Nasdaq-100 often shows traders how their portfolios will move if they’re long shares in technology companies.

However, traders with a wider mix of positions or those who trade options on stocks or funds will want to check their specific movements to gauge what positions need closer attention at the market open. Check the bid-ask prices compared to the prior day’s close to see how a stock is projected to move on the open.

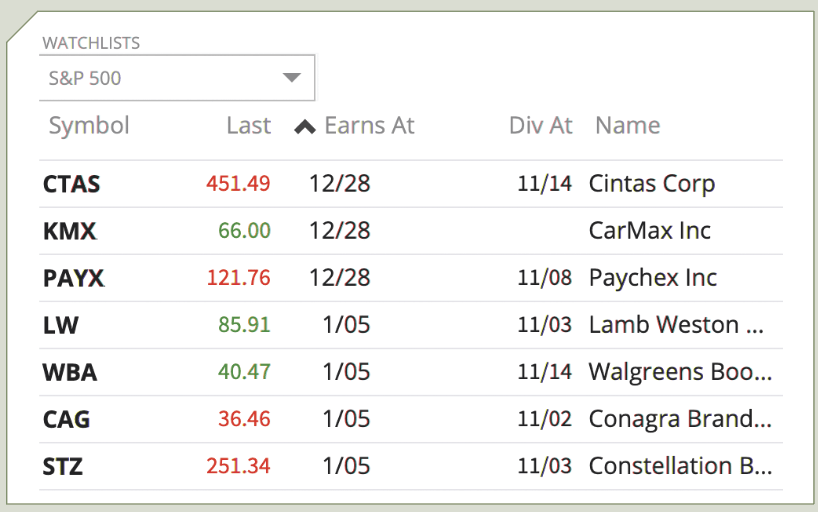

Check earnings, dividends and events. A company’s events can trigger large movements for its stock and underlying options, but can also create opportunity. Setting up an online watchlist to include information about earnings, dividends and other scheduled company releases can keep traders informed.

Check for other portfolio and corporate actions. The impact of other corporate actions and possible portfolio actions varies for different types of traders. Consider dividends, for example, which pay cash and can trigger a share purchase, depending upon how shareholders have set up their dividend reinvestment. However, for options traders with short calls, dividends can lead to early assignment, resulting in a delivery of short shares. As expiration draws near, traders who want to hold the same options position should roll them to the next cycle, so checking positions with only a few days to expiration is key.