Dollar-cost Averaging

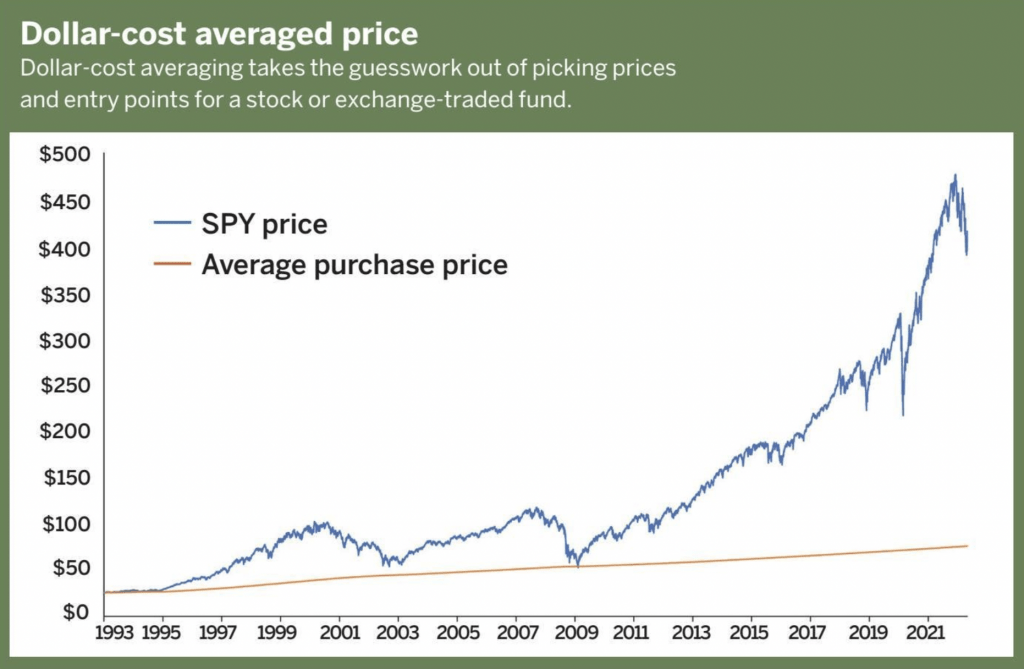

DCA, the strategy of investing an equal amount of money at regular intervals regardless of the price of the underlying stock, removes emotion from the equation

Don’t expect to time the market consistently. Just ask investors who foolishly insist on attempting to buy at the bottom and sell at the top. The likelihood of that actually happening is slim to none.

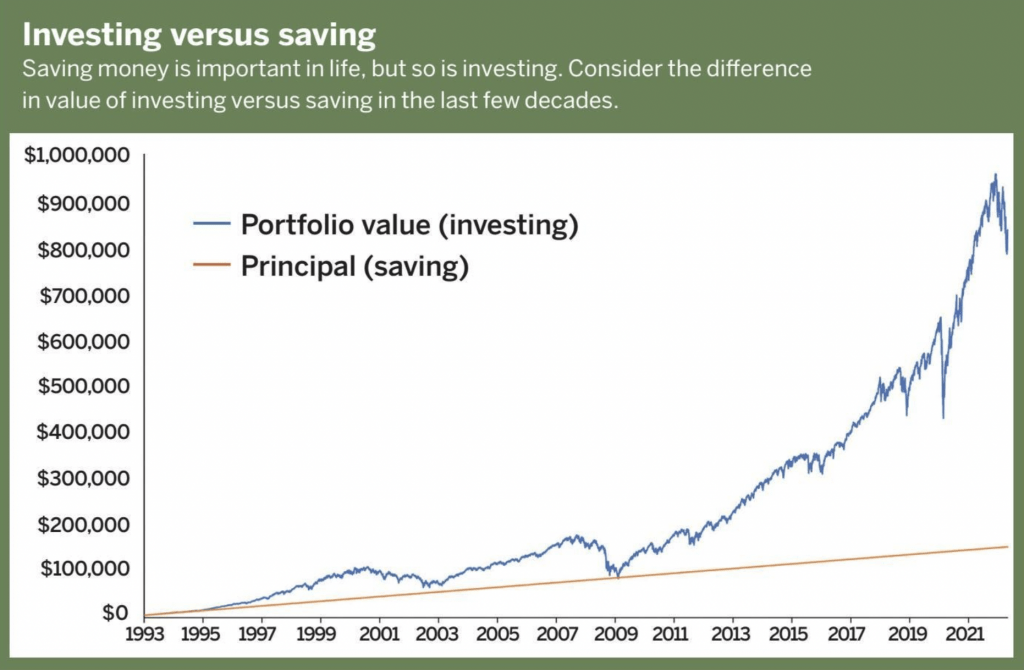

So, instead of aiming for perfect timing, why not aim for consistent investing?

Enter dollar-cost averaging (DCA), one of the simplest investment strategies for anyone who doesn’t have the time or the interest to monitor a portfolio.

DCA consists of systematically investing an equal portion of money at regular intervals, regardless of the price of the underlying stock. That helps remove the emotion that may keep investors from buying when stocks are low or over-investing when stocks are high.

DCA also helps prevent procrastination. Most people know the importance of investing but can’t seem to get themselves to start.

Another benefit is that it eliminates the temptation to try to time the market, which may cost thousands in the long run if investors wait to invest because they believe “this isn’t the bottom.”

Most brokerages provide a relatively simple way to start DCA.

Let’s say an investor sets this up to take $100 a week from a bank account and put it into an investment account. From there, all the investor would need to do is log into the account each time the deposit clears, purchase whichever stock, exchange-traded fund or other fund they are DCA in, and they are good to go.

Ultimately, DCA is a risk mitigation strategy that reduces the chance of poor timing or, more importantly, not investing at all. DCA takes the guesswork out of investing and removes the emotion associated with money management.

Eddie Rajcevic a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts programs. @erajcevic11