Here Are Some ETFs to Avoid

Many commodity ETFs represent bad long-term investments

Investors often want part of the action when commodities start to move around, especially when prices decline. It’s logical then that they often head to exchange-traded funds (ETFs).

What’s not to love? They’re easy trading vehicles that don’t require special trading permissions, and the prices are affordable for most accounts.

But many commodity ETFs represent bad long-term investments. Traders sink money into them each month expecting to make a profit on a rebound in the underlying commodity, only to have it underperform consistently.

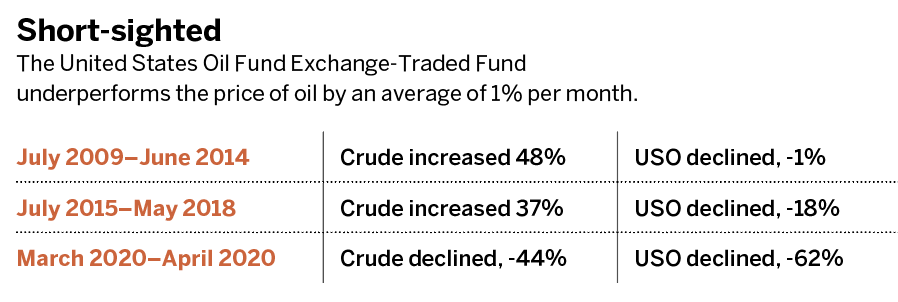

Don’t believe it? Take a look at the table of only a few timespans in “Short sighted,” (below).

The United States Oil Fund ETF (USO) underperforms the price of oil by an average of 1% per month. So, the longer the commodity stays flat, the greater the position is that’s working against the trader.

It isn’t a scam. No one is bilking investors. It’s simply the method the ETF’s creators used to build USO to make it trade in ways similar to the price of crude oil.

The logistics of oil prevent storing it easily. Thus, the creators of the ETF use futures contracts to purchase the commodity on behalf of the ETF product. But the futures contracts disrupt the ETF.

The Natural Gas ETF (UNG) is equally bad for longer-term investors. Perhaps worse. Don’t jump into the natural gas ETF thinking a summer decline can easily lead to a massive spike and that the increase in demand during the winter drives prices up. The Natural Gas ETF tends to underperform the price of the commodity by 2%.

The math—and therefore the probabilities—line up against anyone losing an average of 2% a month on a long position.

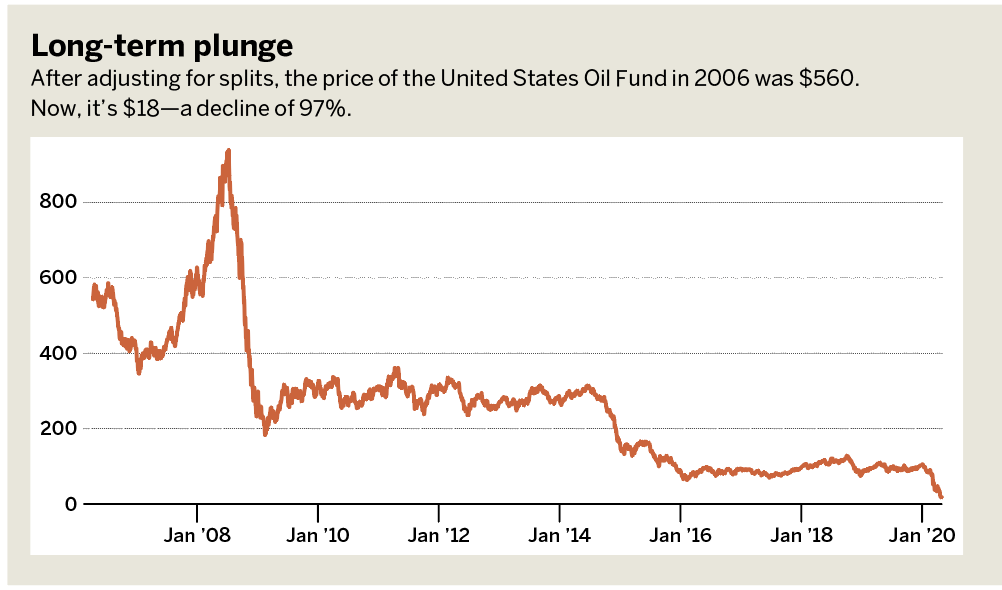

Need more convincing? Look at a long enough timespan of USO. After adjusting for splits, the price of USO in 2006 was $560. It’s now $18, which represents a 97% decline. See “Long-term plunge,” (below). UNG fared worse, after accounting for reverse splits and high management fees, it was the equivalent of $1,600 in 2007. It is $13 now—a 99% decline.

What commodity ETFs don’t have a considerable drag? Two of the biggest are the gold (GLD) and the silver (SLV) ETFs. The fund administrators literally keep gold and silver in vaults. Futures are created for the product, but not to the extent that oil and natural gas companies use them, which creates very little drag in the product—a monthly drag of 0.05% in gold and 0.1% in silver. For the diversification benefits that gold and silver provide to a portfolio of long stocks, that might be a worthwhile risk.

Briefly stated, gold and silver trade in and trade out. Don’t procrastinate. Don’t hold.

Investors can hold both longer without the worry associated with oil or natural gas.

Interested in increasing the probabilities even more? Consider a short put in silver or gold. For now, avoid oil and natural gas.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of data science at tastytrade.