The Strangle

This trading strategy can add a short premium and an element of time to a portfolio

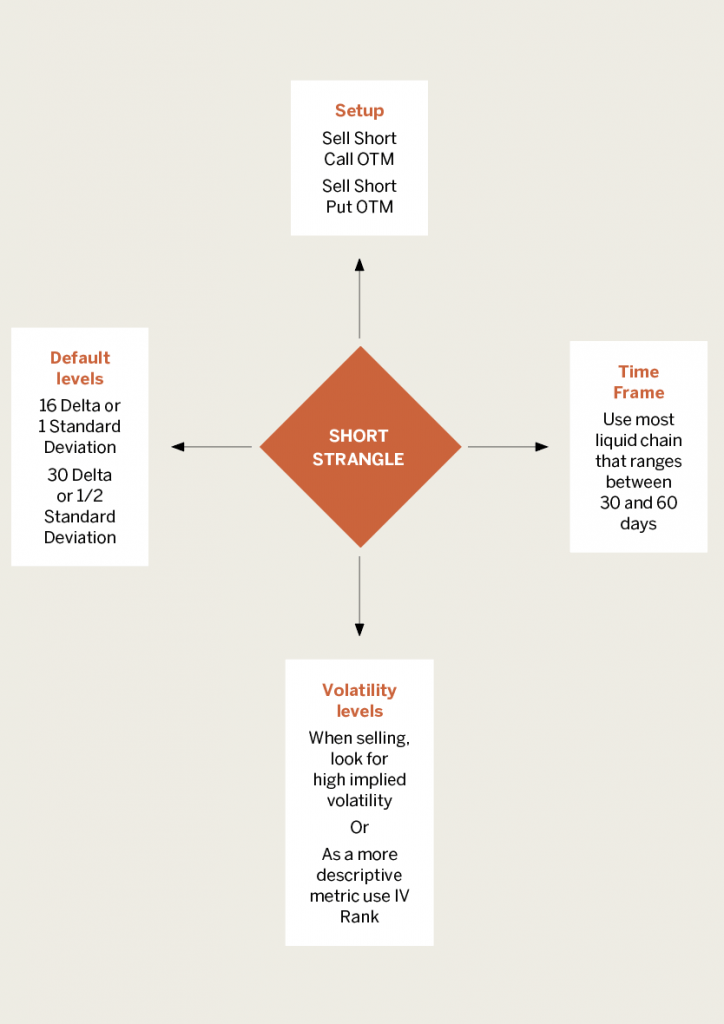

Elegant in its simplicity, the strangle captures a range of possible price movement in the underlying. The strategy consists of a naked short call and a naked short put (both sold out-of-the-money and both sold for a credit). To profit, the investor buys back before expiration at a lower price.

When choosing the strikes of a strangle, look to delta as the metric to guide the trade. Using the statistical measure of one standard deviation, approximate the level for the 16 Delta strike. Be more aggressive and take more risk. Sell the one-half standard deviation or the 30 Delta strike.

Selling a strangle means being short volatility. Sell when volatility is high. To determine when volatility is high, use the metric IV Rank, which is based on a scale from 1% to 100%. Anything more than 30% is considered high. The goal is to see a contraction or a reversion of volatility back to its mean.

Traders also short time, known as the Greek Theta, when they sell a strangle, meaning that when they sell a strangle they get paid for time. (When traders buy an option they pay for time.) As time passes, they collect positive theta in the form of profit. Because of that, the goal is to maximize the effectiveness of decay. By studying the shape of the theta curve, traders can determine the most efficient time to sell a strangle between

30 and 60 days.

Having a strangle in the toolbox of trading strategies can add a short premium and an element of time to any portfolio.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79