A Bullish Case for NFTs

COLLECTORS ARE BEGINNING TO EMBRACE ARTWORK THAT RESIDES ON COMPUTERS

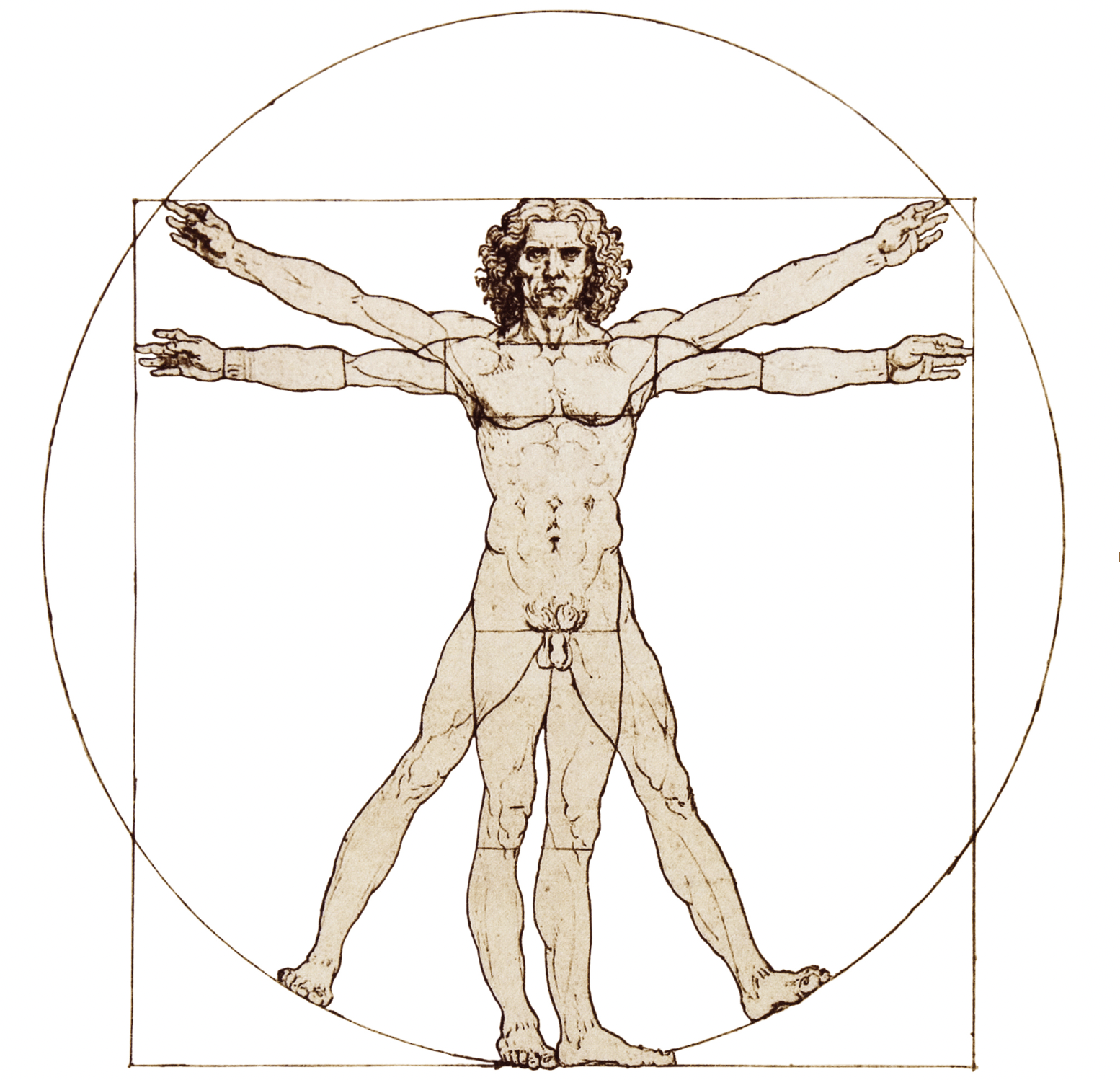

At some point in the 20th century, adding machines became so sophisticated that they crossed a line

and became computers. Their progression was all about numbers, practicality and programming.

But the rise of the computer hasn’t dominated the human spirit or dulled the need for human expression. In the form of non-fungible tokens, or NFTs, the visual arts are beginning to thrive in the digital world.

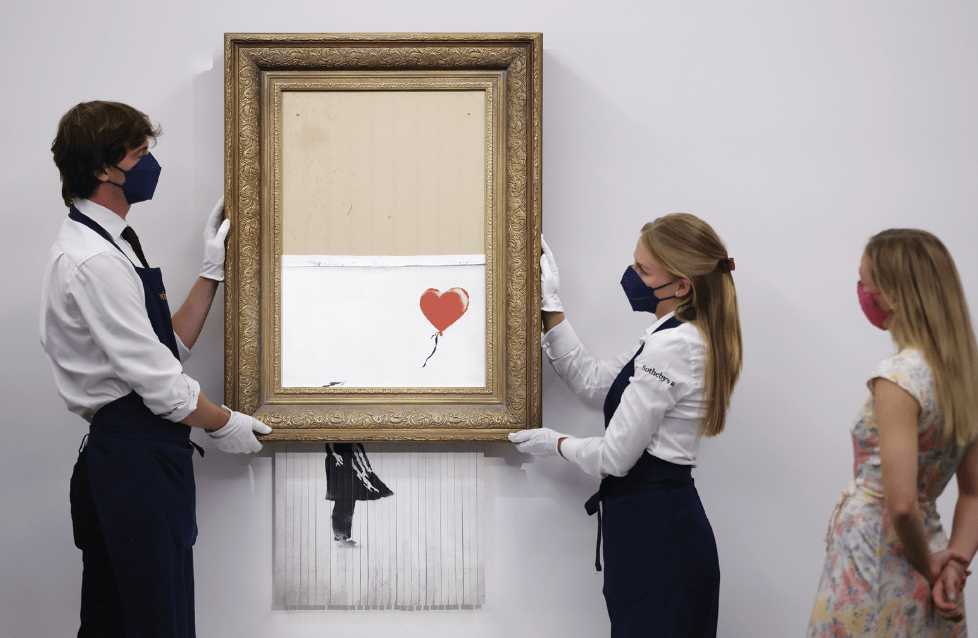

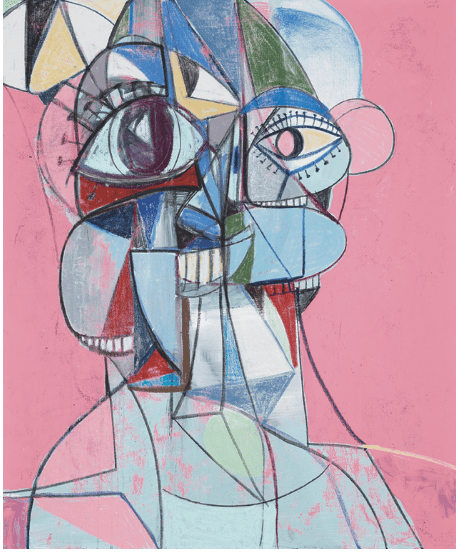

Artwork in what some consider a new digital medium is bringing tens of millions of dollars at auction, and some critics are lauding the best NFT artists as the Picassos of Generation Z.

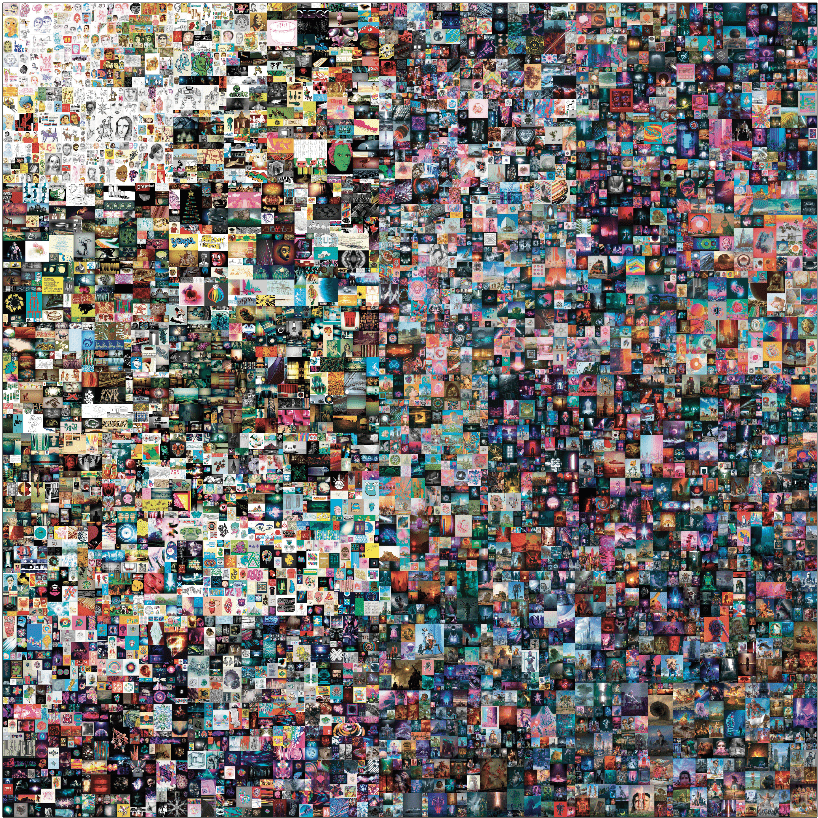

What’s more, NFTs offer more security than paint on canvas because the technology documents their digital authenticity and ensures their scarcity by preventing unauthorized duplication, proponents say.

Those advantages are combining to attract artists, collectors and speculators who buy or sell high-dollar NFT creations. Let’s take a closer look.

Perks of ownership

For owners, the advantages begin with the right to use a mobile phone to license the work of art to anyone, anytime, anywhere. But the potential benefits don’t end there.

Owners sometimes share in revenue from the sale of merchandise related to their artwork, receive a cut in the artist’s royalties from subsequent creations or qualify for a line of credit tied to the value of the art.

Possessing an expensive and acclaimed NFT can also enhance the owner’s status in some social circles. Placing the winning bid at a high-profile auction, for example, can bring invitations to attend exclusive events and join private clubs.

Owners also enjoy the peace of mind that comes with knowing that the blockchain validates the artwork’s authenticity and ensures its security. Because no one can change the digital record of NFT art, owners can fix their own terms and conditions, screen for unlawful use, and block copies and counterfeits.

The technology tracks benefits and privileges that accompany purchases, and neither side in a purchase, sale or licensing agreement can break the terms and conditions specified in the smart contracts that accompany the transfers of rights.

Besides, a pirate copy of an NFT has little value, in the same way that there’s only one genuine Mona Lisa, and a picture of a concert ticket won’t get anybody into a show.

As observers note: Seven billion people can own a screenshot of an NFT, but only one person can own the NFT itself.

Benefits for artists

For artists, NFTs offer a new way to monetize their handiwork and protect their intellectual property. Minting their works as NFTs gives them permanent, immutable, public proof that they own all rights and privileges associated with that work.

Once that’s established, artists can program NFTs to collect royalties on secondary sales, entitle buyers to add-ons or secondary benefits, sell equity in their works, and lock the NFTs into binding contracts for display in galleries, websites, businesses and homes.

Buying and selling NFTs has gone mainstream with highly publicized auctions at Christie’s and Sotheby’s. Artists can also connect with buyers by listing NFTs on global marketplaces like AtomicHub, Rarible or OpenSea. The online technology can eliminate shipping, customs, middlemen and even the auction houses.

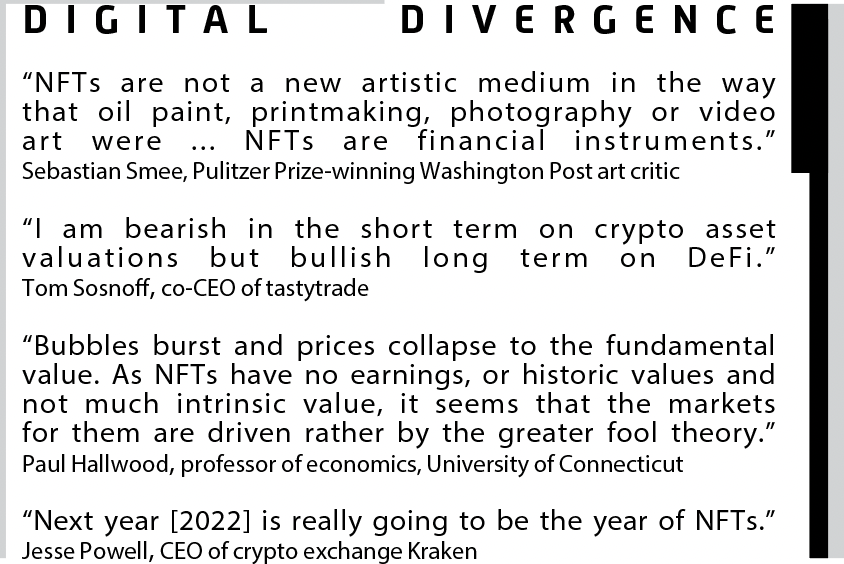

Yet, despite all the enthusiasm for NFTs, some artists and critics don’t consider digital creations art and doubt the motives of the people involved. (See “Digital Divergence,” below.)

But whatever some members of the art world think of digital images, artists aren’t the only people with expensive NFTs to sell.

Other beneficiaries

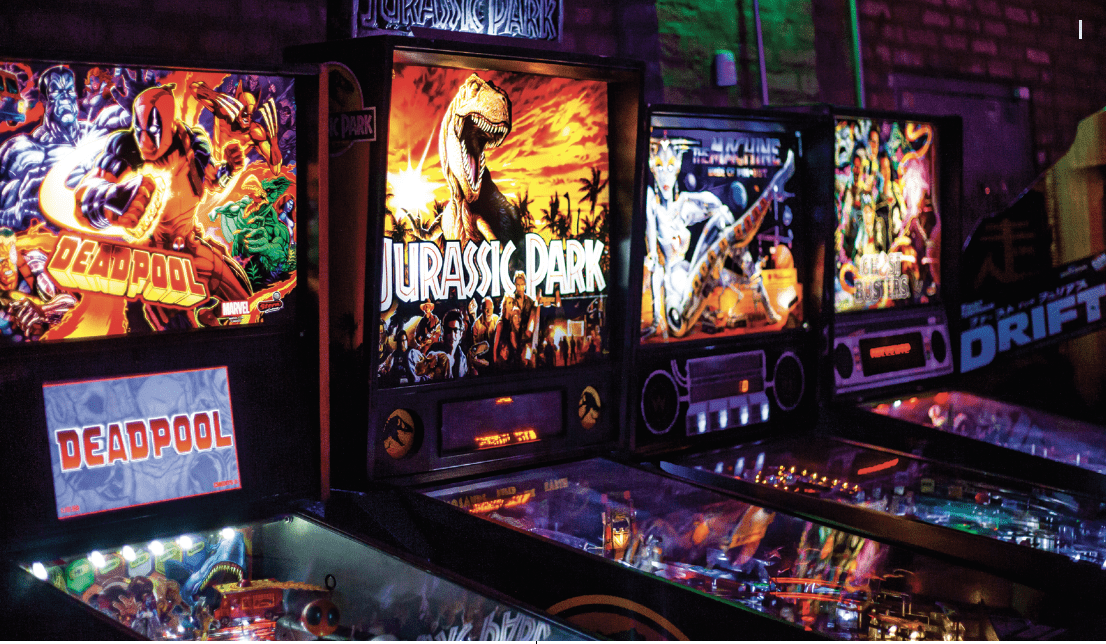

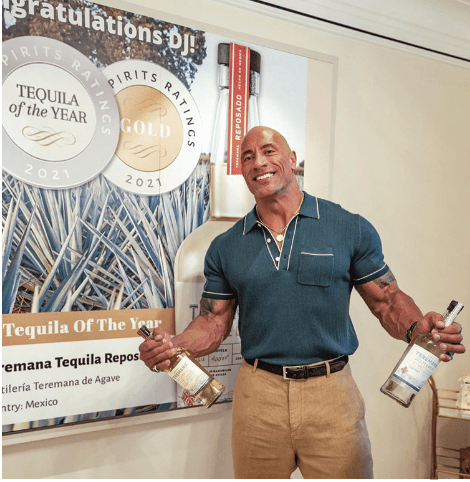

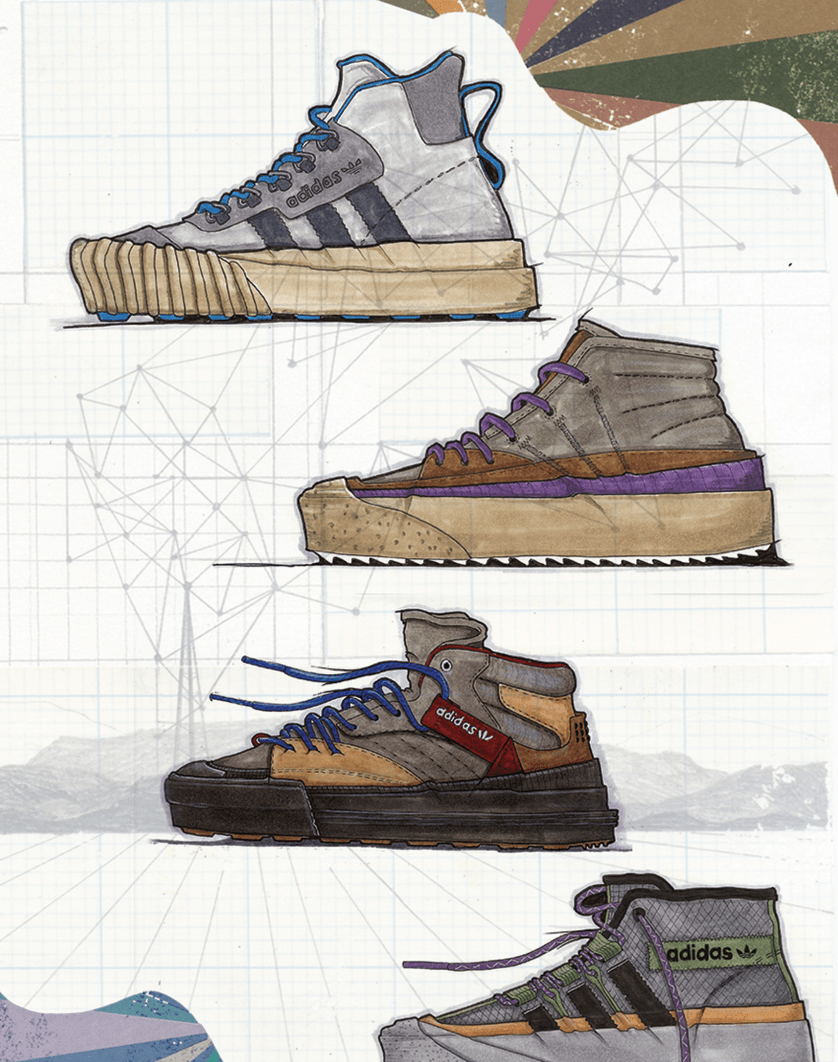

Nearly anyone who owns something scarce has an opportunity to cash in with an NFT. In fact, entrepreneurs are using them to create value out of thin air.

In one example, Golden State Warriors point guard Steph Curry sold his sneakers as an NFT. Others have hawked everything from badges to uniforms as collector’s items.

Whether they’re virtual collectibles or virtual art, NFTs could become even more valuable as life itself becomes more virtual.

The metaverse is taking shape as a massive digital playground that emulates the real world—like a giant Star Trek holodeck.

That’s pushing big business online. Officials at Microsoft (MSFT) and Meta (FB) expect the metaverse to generate $1 trillion in revenue in the coming years and trillions more in spillover economic activity.

Think of it as a new world order where NFTs seem right at home.

Mark Helfman, crypto analyst at Hacker Noon, edits and publishes the Crypto Is Easy newsletter at cryptoiseasy.substack.com. He is the author of Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency. @mkhelfman