ENERGY ISSUES

Nearly half of Americans (47%) are worried about the availability and affordability of energy. That’s more than double the number who felt uneasy about it two years ago when concern reached its lowest level in the history of the Gallup poll.

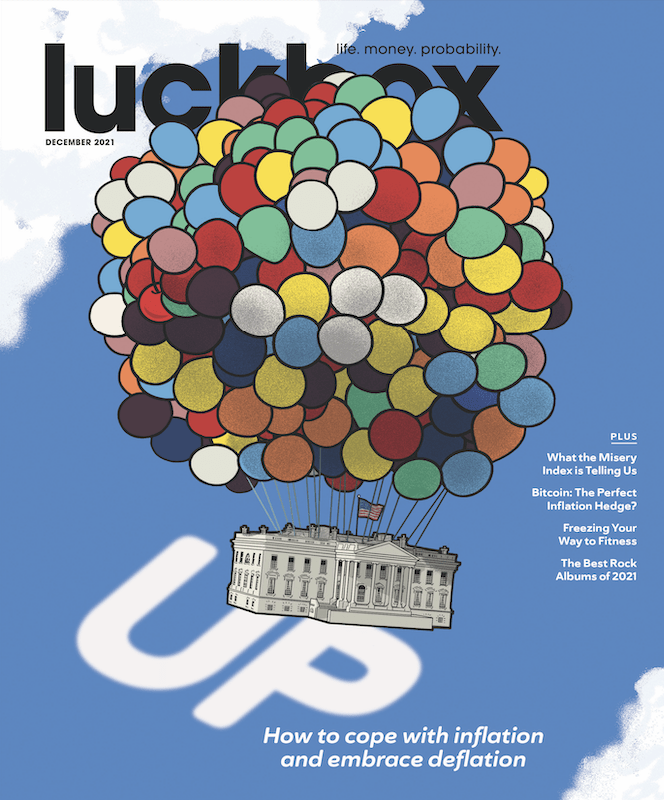

Many apparently blame President Joe Biden for the nation’s energy woes. In fact, polls indicate 38% of Americans don’t support his handling of energy policy.

We’ll soon see how the public feels about the president’s latest response to high gasoline prices. He’s releasing a million barrels of petroleum from the Strategic Oil Reserve every day for six months.

That sounds like a lot, but it’s not nearly enough to fuel the nation’s 19.7-million-barrels-a-day consumption. Plus, it seems minuscule compared with the 97 million barrels the world consumes in the average day.

Still, the administration had to do something. Inflation’s up, poll numbers are down and motorists are financially stretched. High energy prices place a special burden on the poor.

Root causes? Well, most of us understand energy problems aren’t solved easily. But that didn’t stop Luckbox from creating a special issue with diverse perspectives on the timely topic.

Our Fake Financial News columnist kicks things off by taking a long ride in her boss’s Tesla. She finds a lot to like but couldn’t abide the hefty price tag.

Readers also meet a physicist from the Netherlands who set out to write a book about the miracle of nuclear fusion as a clean and bountiful source of power. He ended up as a skeptic who’s convinced scientists and politicians are wasting time and money pursuing an impossible dream. Their best efforts can’t possibly bring it to reality in time to become a reliable and scalable source of clean energy.

In another article, that same fusion skeptic expresses optimism for carbon capture as a way of isolating and storing CO2 to keep it out of the atmosphere. But he doesn’t claim that scrubbing the air of greenhouse gases will be easy. Humankind has already released far too much carbon into the air, and emissions are continuing unabated.

The contrarian attitude of those articles continues with a story by the resident Luckbox economist. He does his best to dispel what he considers the myth of price gouging by oil producers, maintaining instead that supply and demand set prices.

Our economist holds forth more than once. In another article, he asserts that ecological guilt-tripping and ESG (environmental, social and governance) mandates have dried up funding for fossil fuel exploration and production, thus contributing to higher prices for a barrel of oil and a gallon of gas. The situation makes politicians’ demands for increased supply ring hollow, he contends.

Next comes an interview with a widely followed trader who’s also an energy analyst. Here, she recommends specific energy stocks to buy and shares her intermediate-term outlook for the price of oil. Spoiler alert: it’s a big number.

The energy report concludes with an update on Apple’s anticipated foray into electric vehicles. Will the company that revolutionized communications do the same for transportation? Time will tell.

And time will also tell when the nation and the planet can become carbon neutral. In the words of Chris Wright, CEO of Liberty Energy, “the sun doesn’t always shine and the wind doesn’t always blow.” The transition to net zero won’t happen anytime soon.