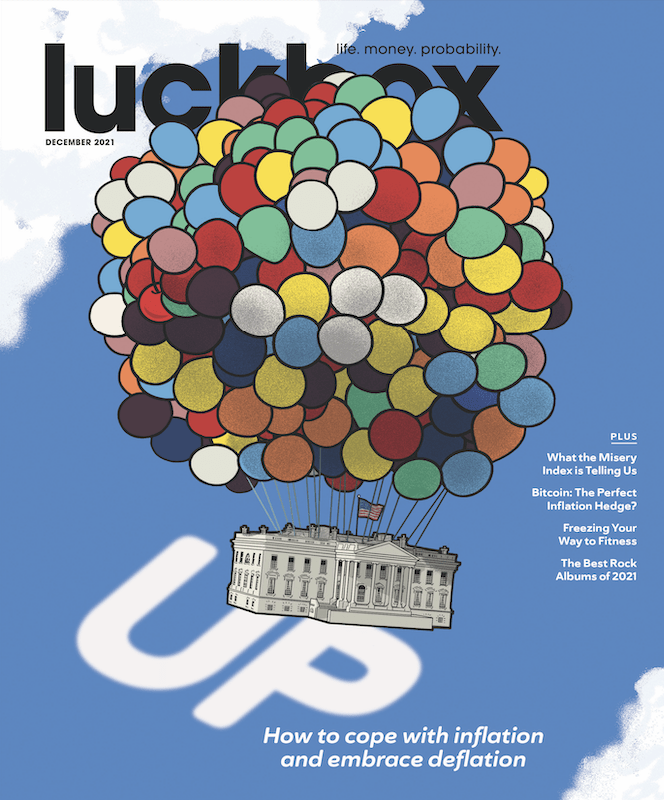

UP NEXT: The Issue with Inflation

On November 30th, Luckbox will release it next issue. The following is a sneak preview. To make sure The Issue with Inflation is in your inbox, subscribe for free here.

When it became apparent last month that inflation had reached 6.2%—the highest it’s been in 31 years—even the optimists began backing away from the idea that pandemic-related price increases might prove short-lived.

“It doesn’t look so transitory,” said former Treasury Secretary Larry Summers, who had been warning for months that pumping too much stimulus money into the economy could backfire. He could even have said, “I told you so.”

Just a month into President Joe Biden’s administration, Summers had written in a Washington Post op-ed piece that the upcoming $1.9 trillion stimulus package might set off “inflationary pressures of a kind we have not seen in a generation.”

The Biden Administration’s financial triage for workers and businesses came on the heels of a $2.2 trillion stimulus bill signed into law by President Donald Trump shortly before he left office.

All too soon, the year-over-year price of a late-model used car had increased 37%, the cost of a pound of lean ground beef surged 28%, and energy prices shot through the roof.

“I think that the policymakers in Washington, unfortunately, have almost every month been behind the curve,” Summers said.

Maybe. But Luckbox is happy to leave the monetary policy blame game to the politicos. Instead, let’s focus on staying in front of the markets.

The stock market’s longstanding buoyancy has been the direct result of upbeat consumer and investor sentiment. But look no further than the facing page to see that Americans are worrying about inflation. It troubles them even more than the deadly coronavirus. They’ve seen recent wage gains evaporate as prices rise, and they know no vaccine will protect against bloated price tags for vehicles, energy, groceries and healthcare—let alone higher education.

Luckbox readers, arguably more financially astute than the average American, feel more pessimistic (realistic?) than the general public about the economy. Fortunately, the magazine explores investment opportunities tied to the virtues of market volatility. After all, rising expectations for persistent inflation are likely to increase market volatility in the coming months.

Yet, this isn’t your father’s ‘70s-style inflation. Readers would do well to seek historical context and abstain from runaway-inflation hysteria. Look for wisdom from market veterans like Ed Yardeni, who sat down with Luckbox for an interview that commences on p. 34.

Don’t be afraid to follow where the quest leads. In the midst of so much inflation chatter, Luckbox Editor at Large Garrett Baldwin spoke with author Jeff Booth, a deflation acolyte with a fascinating take on the economy.

Without question, President Biden faces challenges. Families gathered around the dinner table this holiday season are sharing stories that reflect their fear of high prices. In its small way, Luckbox hopes to help allay those misgivings by presenting its annual forecasting issue. Perhaps salvation lies in probabilistic thinking.

Meanwhile, we defy you to find another source of information that can do as much as Luckbox to prepare you for inflation that no longer appears transitory.

Ed McKinley, Editor in Chief

Jeff Joseph, Editorial Director