The Food Sector Goes On Offense

Food and beverage stocks are having their worst year relative to the S&P 500 in more than two decades. This sector, known for stability, is leaving too many investors with a queasy feeling of FOMO.

At press time, prices had declined 2% for the year while the S&P had risen by 16%. This lackluster performance began in May with double-digit declines piling up for big brands like Kellogg, General Mills, Kraft Heinz, Conagra Brands and Campbell Soup.

But despite the sector’s struggles, we see reasons to consider investing in food stocks. Valuations have come down and appear reasonable. Dividends are ample and well-covered by earnings, with many in the sector offering dividends of 3.5% or even nearly 5%. Leverage ratios are also at multiyear lows, providing room for higher dividends or stock buybacks.

The timing may also be right for investing in food stocks. Over the past 50 years, food stocks have tended to outperform the market in the final four months of the year, as portfolio managers seek to protect gains from earlier in the year.

But aside from traditional value investors like Warren Buffet, Wall Street traders are lukewarm on the sector, favoring growth and tech stocks. In a world of Nvidia and 5% short-term rates, dividend yields of 4% may not appear compelling.

While value-minded investors view these companies as defensive safe havens during extended periods of inflation, recession and market downturns, Luckbox has a different perspective. We choose to focus on food-related stocks exhibiting growth potential—the ones taking the offensive by acquiring competitors, embracing advances in biotechnology, employing artificial intelligence or capitalizing on consumer trends.

In this food-focused issue we explore the sector’s opportunities. It begins with an assessment of the proposed Kroger-Albertsons merger. Next comes a run-down on the amazing health benefits and rampant fraud in the olive oil business. It continues with a visit to the scientists transforming food into medicine—perhaps the most momentous nutritional research since the discovery of vitamins.

We profile an agriculture-related company that has a familiar name but harbors one of the best-kept secrets in the world of artificial intelligence. That’s followed by a story on the market prospects of a key fertilizer ingredient, and then there’s an update on the industry churning out artificial meat.

It’s time to consider food beyond meat. Even amid its woes, the sector offers investors plenty of opportunity.

We offer two reports on the Ukraine war’s effect on the food supply; a study of the negative effects of market-distorting short selling; a piece on the volatility, correlation and capitalization of food-related stocks; and an article on the food industry’s plungers, recoveries and steadies.

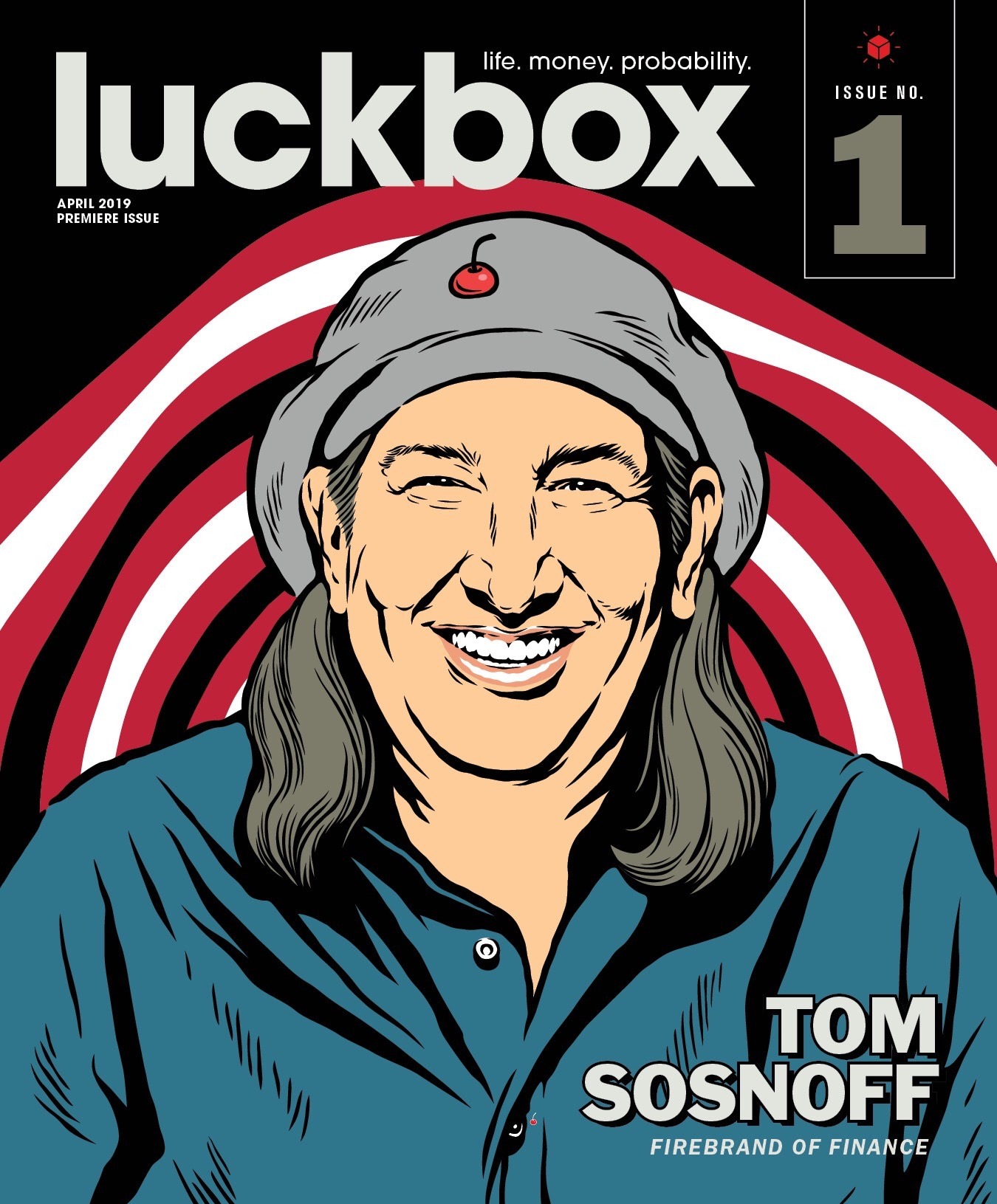

The July-October issue of Luckbox magazine is now live. Read it here.