FALSE PROPHETS

As we wrap up the annual prediction issue of Luckbox, our thoughts turn to Michel de Nostradame (aka Nostradamus), an enterprising early master of the side hustle. Although he was kicked out of med school for prematurely practicing apothecary, he continued practicing medicine during the plague. He was highly regarded as an astrologer and dabbled in the occult. But he established his true legacy as a seer with the publication of his Les Prophéties in 1555.

As a result of that book, Nostradamus is credited with predicting outlier events that include the Great Fire of London in 1666, the French Revolution in 1789, the rise of Napoleon in 1799, the rise of Hitler in 1933, the atomic detonations at Hiroshima and Nagasaki in 1945, the Apollo moon landings in 1969, and the 9-11 attack on the World Trade Center in 2001.

But most of his estimated 6,338 prophecies fell flat. His prediction that in 2021 a Russian scientist would develop a biological weapon that turns the living into zombies was especially wacked-out.

Still, Nostradamus deserves credit for being smart enough to play the long game—like the one-hit-wonder pop duo Zager and Evans. But the Italian prophet’s prediction that the world will end in 3797 still isn’t a good excuse to stop funding your IRA.

Nostradamus also understood the value of forecasting big events. Why go small when you can go big and really attract some attention?

He also had the foresight to predict the outrageous, a trait that author Nassim Taleb (The Black Swan) finds lacking among today’s popular financial forecasters. “Our predictors may be good at predicting the ordinary, but not the irregular and this is where they ultimately fail,” Taleb wrote. “Economic forecasters tend to fall closer to one another than to the resulting outcome.”

But any way you look at it, forecasting poses a reputational risk.

Two years before the Great Depression, famed economist John Maynard Keynes confidently declared that “we will not have any more great crashes in our time.” Wrong.

In 2006, as Alan Greenspan was completing his fifth and final term as Federal Reserve chair, he proclaimed that “the worst is behind us” with regard to the housing slump. Wrong.

The evening of Donald Trump’s presidential election victory, Paul Krugman, a Nobel Prize laureate in economics, predicted an immediate global recession. Wrong.

In light of the persistence of noise and false prophets, why does Luckbox insist on revisiting the art and science of prediction each year?

It’s the science that attracts us. From covering forecasting and the prediction markets for previous issues of Luckbox, we’ve learned that nearly anyone can learn to become better at divining the future—an invaluable skill for any active investor, gambler or prediction-market trader.

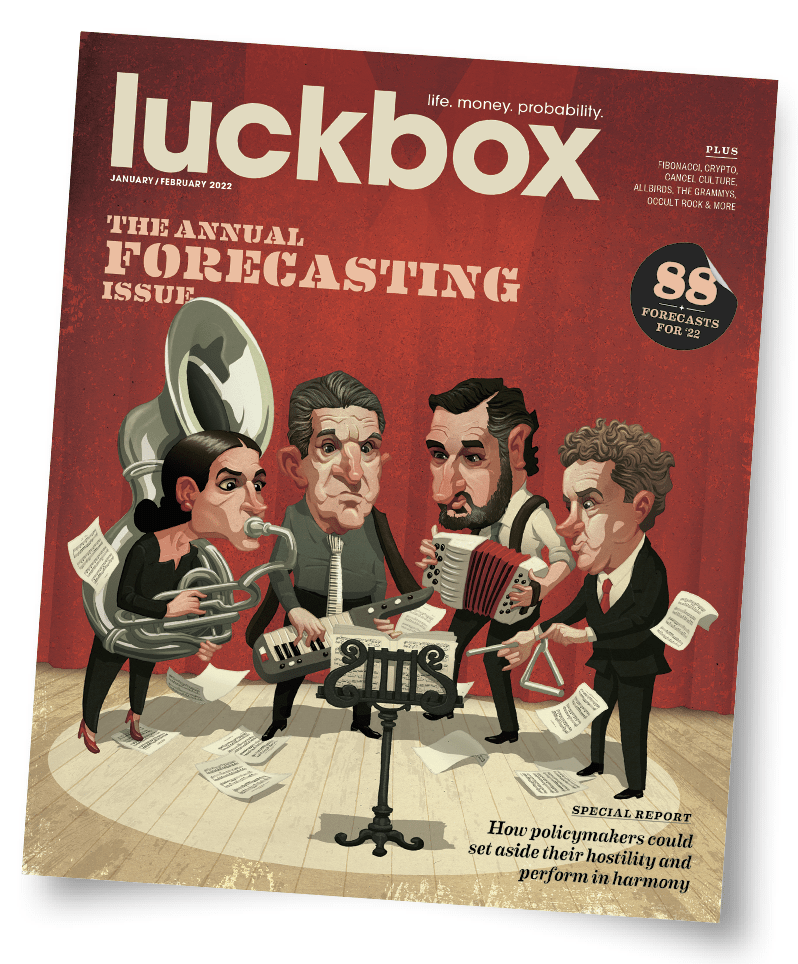

This issue continues our exploration of prognostication with an article on “adversarial collaboration,” a proven method of making better predictions that deserves the attention of America’s political class.

Next comes research that indicates winning—or losing—in the prediction markets can change the way one views the world. That’s followed by reports on what’s up with a couple of prominent prediction markets.

Then there’s an assessment of whether to trust the Fibonacci sequence to predict stock prices. That’s followed by long lists of jarring predictions for cryptocurrency, the Grammys, the political scene, the world of sports and life in general. It’s a total of 88 Luckbox forecasts for this year and beyond.

So, the magazine’s packed with stories about the science of forecasting, but what about the art? Readers may recall economist Nouriel Robini’s warning on the eve of the mortgage meltdown in 2008, Lehman Brothers analyst Elaine Garzarelli’s bearish vision of the markets just days before 1987’s Black Monday, and Lawrence Summers’ early 2021 alert on imminent inflation.

They were right.

The new issue will be available on Tuesday, Dec. 28. In the meantime, you can read the most recent issue here.