Affordable Futures

Retail investors can use new smaller futures contracts to hedge their portfolio bets

Hedge fund managers and other big investors have been using futures to reduce risk for years, but until recently the size of these products has prevented smaller investors from taking advantage of them.

Not anymore. Now, futures have become available to even the smallest accounts.

Suppose an investor owns $40,000 worth of large-cap stocks and would like to reduce some of the daily volatility. The market seems uncertain in the short term, so the investor would like to reduce risk but doesn’t want to sell some of the stock.

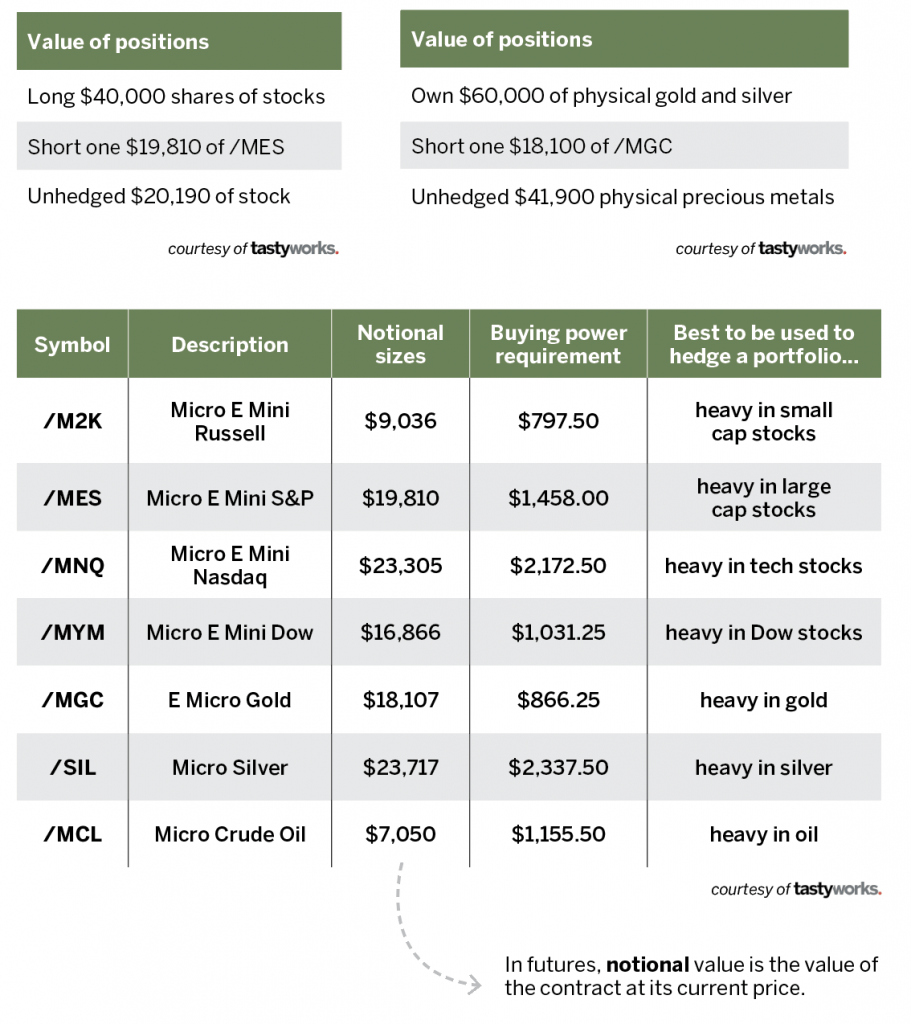

To hedge half the position, sell 1 /MES contract. At the current level of 3935, selling 1 /MES would hedge $19,810 worth of stock. Because only half of the position is hedged, the investor is still participating if the stock rises. Investors can also use futures to hedge positions they hold outside their account. For example, some might own precious metals, such as gold and silver.

Let’s assume an investor has stockpiled a combination of gold and silver worth $60,000 and wants to reduce risk for a short period of time without selling the metal.

Because gold and silver have a consistently high correlation, 0.80 over the last ten years, the investor may wish to sell a gold future to hedge the physical portfolio.

At a current price of $1,810 per ounce, an E Micro Gold contract (/MGC) would hedge $18,100 worth of gold and, theoretically, 30% of the precious metals.

Keep in mind that if gold and silver appreciate, the trading account with the future would show a loss, but the metals themselves would gain in value.

Precious metals aside, choosing the right futures contract depends on what’s in the portfolio. The table to the right offers advice on picking the right ones.

Keep the buying power requirement in mind. Hedging requires putting a bit of additional money into the account.

Michael Rechenthin, Ph.D. Ph.D. (aka “Dr. Data”), is head of research and development at tastylive. @mrechenthin

Sign up for free cherry picks and market insights at info.tastytrade.com/cherry-picks