Seeking Diversity

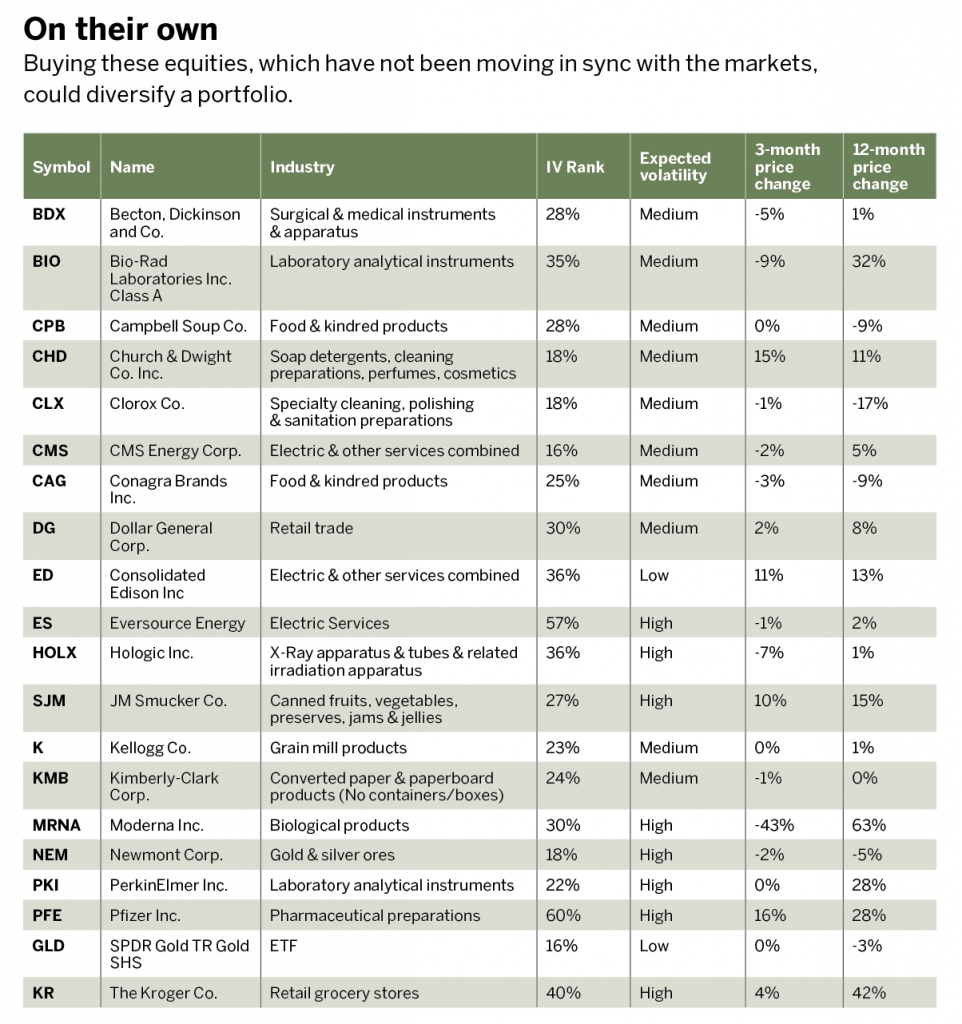

Rather than seeking to predict the next big thing, consider buying any of these 20 tickers to diversify a portfolio in the new year

When all of the stocks and exchange-traded funds (ETFs) on a portfolio page are colored either green for profit or red for loss, those holdings aren’t diversified.

But diversification is worth pursuing because it generally strengthens a portfolio by combining a variety of companies, components and strategies. It often reduces risk without reducing returns.

While simply adding stocks generally helps diversify a portfolio, it doesn’t if they all come from the same sector—such as technology, for example.

That’s where data science can come into play. Traders can easily scan the most liquid stocks and ETFs to diversify a portfolio that’s heavy in the S&P 500 Index.

The table tracks 20 tickers and ETFs that have been trading without correlation to the overall market, as measured by their six-month historical relationship with the S&P 500.

For many traders, the easiest way to diversify is by purchasing shares. But another method calls for buying 100 shares of the underlying and then selling a covered call against the shares held. That has the advantage of increasing “cash flow” because the money received for selling the call acts as an extra dividend to the portfolio.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of research and development at tastytrade. @mrechenthin

For more information on this quantitative way of trading, subscribe to cherry picks and market insights

at info.tastytrade.com/cherry-picks