Home in on Cyclical Stocks

Use a counter position to take advantage of the volatility of equities that move with the market

Use a counter position to take advantage of the volatility of equities that move with the market

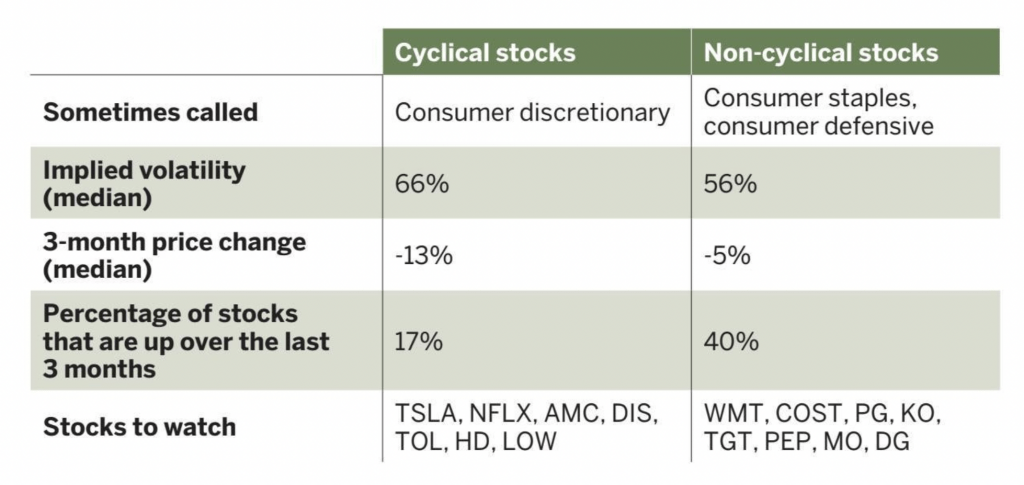

Cyclical stocks tend to move along with macroeconomic trends, going up in bull markets and down in bear markets. Demand for non-cyclical stocks can remain strong even in bear markets.

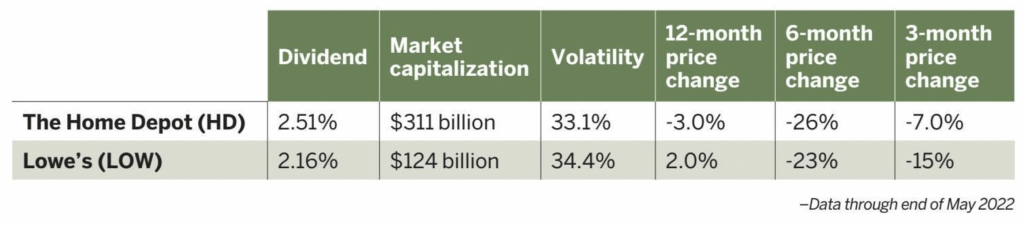

Volatility between cyclical stocks and non-cyclical stocks is significant. Because cyclical stocks have more volatility and are down the most, it’s interesting to take a counter position. In keeping with the outdoors theme of this issue of Luckbox, let’s look at the two biggest home improvement retailers: The Home Depot (HD) and Lowe’s (LOW).

Both have been down over the past six months but relatively flat compared with this time last year. The Home Depot is two-and-a-half times larger than Lowe’s in capitalization. Volatilities, which are the expected price movements, are both high—as are their liquidities—which means they are easy to trade with very little slippage.

So, here are some short-term bullish trade ideas:

Covered call

Buy 100 shares in either The Home Depot or Lowe’s and sell a call option in the expiration closest to 30 days away. The strike should be above the stock price—consider selling the one that is $5 to $10 away from the current price. This can easily lower the cost to purchase by 2% to 3%.

Bullish put credit spread

This would require considerably less money than a covered call. Here’s an example: With The Home Depot at a price of $304, sell the 295 put and buy the 290 put strike in the August expiration. Investors can do this for a credit of $170, with a risk of $330. Because the price is above the strikes, it would be a bullish higher-probability trade.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of research and development at tastytrade. @mrechenthin