Big Bets in Smaller Packages

Investors can express bullish or bearish opinions on cryptocurrencies by trading the CME’s affordable (and more secure) micro futures contracts

The Chicago Mercantile Exchange (CME) has for decades provided institutional investors and hedgers access to two-sided, leveraged products for markets underserved by other asset classes. These markets include currencies, metals (both precious and industrial), and soft commodities like wheat and corn.

These days, the landscape has shifted to include products tailored for active retail investors. The introduction of micro-futures in a wide variety of markets provides access to leveraged products with more appropriate sizing for risk management.

With the rise of cryptocurrency over the past few years, the CME sprang into action in 2018, looking to offer active investors a bitcoin futures contract (/BTC) that would provide access and leverage to the crypto market.

While drafting plans for the product, the exchange settled on five bitcoins as the total contract size. That made sense given the average price of bitcoin for the first three quarters of 2017 was around $2,100. However, by the end of the year, bitcoin rose in popularity and its price was soaring.

When the futures became available for trading on Dec. 18, 2017, the price of bitcoin was over $17,500, meaning a single futures contract controlled $87,500 of bitcoin ($17,500 x five coins).

While that remained an accessible product for institutional speculators and hedge funds, it placed bitcoin futures out of reach for most individual active investors.

In 2021, with bitcoin pushing new highs one after another, the futures contract reached a surprisingly high notional value of $346,675, with the contract price at $69,355.

Last year, CME went back to the drawing board and crafted the micro bitcoin contract (/MBT) in an attempt to offer cryptocurrency futures to a larger number of active investors.

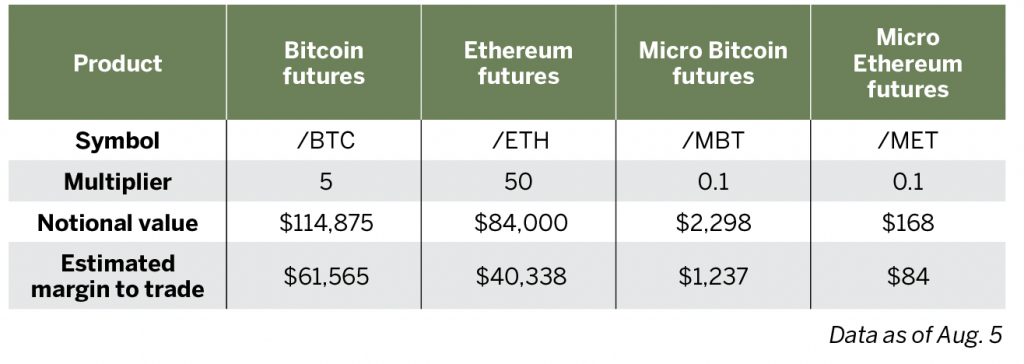

Micro bitcoin futures became available March 10 of last year, each contract controlling 0.1 (10%) of a single bitcoin. So even at the peak price of $69,355, each futures contract had a total value of $6,935, making it far more accessible for individual investors.

Last year also saw the CME’s introduction of futures on the second most popular cryptocurrency, ether. The larger contracts (/ETH) launched in February 2021, controlling 50 ether per contract, which at the time totaled $86,500 in notional value with ether trading for $1,730.

The micro ether contracts (/MET) were introduced in December of last year when the cryptocurrency was closer to its all-time high. Like the micro bitcoin futures, micro ether contracts control 0.1 of an ether coin. When introduced, each contract was worth $429 in notional value, 10% of the $4,290 price for ether. By the end of July with ether at $1,735, each contract was worth $173 in notional value.

So, why would an active investor favor trading cryptocurrency futures over buying and selling bitcoin or ether in the cash currency markets? For the same reasons more investors have used futures products in recent years.

One huge benefit of the futures market is the ability to express a bullish or bearish opinion on the cryptocurrencies. While some cash crypto exchanges and firms are starting to allow investors to sell short (bet on the price going down), most firms still only offer the ability to buy cryptocurrencies in the hope they will go up. Futures enable active investors to speculate in either direction for bitcoin and ether, all in the same account that holds an investor’s stock or options positions.

Another benefit of trading cryptocurrency futures is they’re provided by the CME. If they’re traded at a reputable brokerage, investors know they are trading a product from a respected exchange. This usually wouldn’t be worth mentioning but with multiple stories of investors unable to access their funds when crypto companies hit financial troubles, it’s worth considering the validity and security of how investors trade crypto.

Lastly, crypto futures enable active investors to trade the currencies with leverage, typically only requiring half the total value of the contract in margin to place a trade. That’s more than a typical futures contract, but the added volatility of cryptocurrency means the margins are higher for those contracts.

A couple of risks stand out with cryptocurrency futures, the first being the product itself. The market has demonstrated how volatile bitcoin and ether can be. Investors should be cognizant of the level of risk they are comfortable with, especially when trading with leverage.

There’s also some degree of liquidity risk—the ability to trade in or out of the futures at prices an investor chooses. That’s because of the lower liquidity of cryptocurrency futures, with fewer contracts trading per day than more popular products.

While futures liquidity is low, the options on futures liquidity for cryptocurrencies is non-existent, meaning investors will likely want to steer clear of the futures options.

Overall, bitcoin and ether futures provide active investors a more capital efficient, exchange-traded, secure and regulated way to play the crypto market to the bullish or the bearish side.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors.

@jamesblakeway