Natural Gas Finds a Savior

The rise of energy-hungry artificial intelligence has pushed the commodity’s prices higher

Energy markets have had a wild ride since the start of 2022. Crude oil prices surged that winter and spring when Russia’s invasion of Ukraine fueled American active investors’ fear of a global energy supply chain crisis. But for traders elsewhere around the world, all eyes were on natural gas prices (LNG).

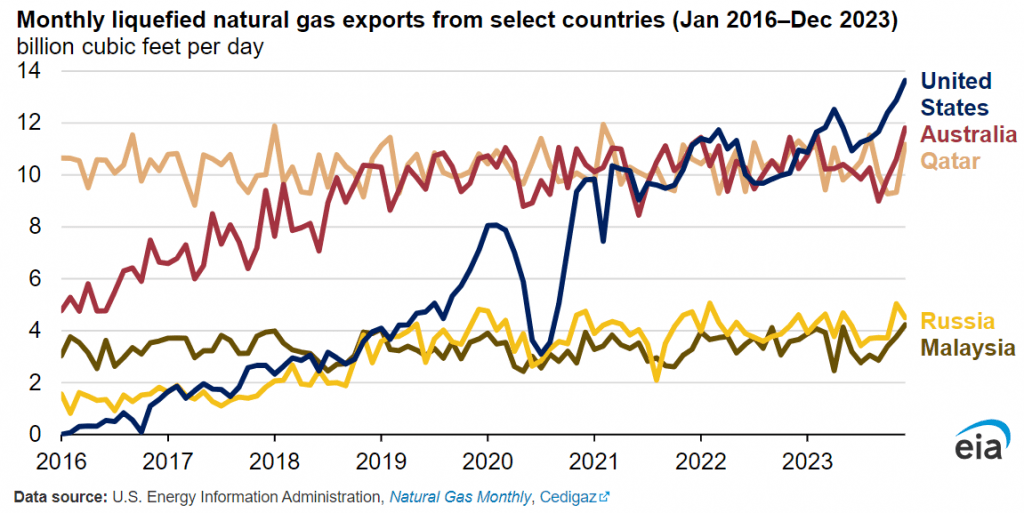

While the first few months after Russia’s incursion sent natural gas prices soaring, especially in Europe, American producers quickly stepped in and seized the opportunity. Already a significant producer pre-COVID, the U.S. had increased its LNG export capacity to 11.4 billion cubic feet per day (Bcf/d) by the end of 2022. Likewise, peak capacity rose to 13.9 Bcf/d, overtaking the two largest LNG exporters at the time in Australia and Qatar.

The rise of U.S. LNG export capacity in 2022 marked the beginning of a multi-year rout in natural gas. From their peak in August 2022, natural gas prices ($/NG, continuous natural gas futures) fell from a high of $10.028 per metric million British thermal units (MMBtu) to as low as $1.522 per MMBtu, a decline of more than 84.82%.

But it wasn’t just supply coming into market. Fear of a European energy crisis didn’t materialize in 2023, not just because of increased imports from the U.S. but also because the 2022/2023 winter and spring were warmer than anticipated; European inventories weren’t drawn down as much as feared (the same goes for the U.S.). Here in the U.S., LNG export facility closures (Texas’ Freeport plant) and delayed permitting at the federal level has led to oversupply in the domestic market.

But natural gas may have found a savior in recent months that has pushed assets higher in other corners of the market: the rise of artificial intelligence.

To train large language models (LLM), you need vast amounts of data. Data centers aren’t cheap to build and require a great deal of cooling to keep servers operating. A recent Goldman Sachs report highlighted said that by 2030, 60% of energy for data centers will come from LNG. The current power demand for data centers is around 11 gigawatts (GW), and analysts at Tudor Pickering Holt & Co believe power demand will grow to 42 GW by 2030, leading to an additional 2.7 Bcf/d of incremental natural gas demand.

But we’re keeping it simple here for the sake of brevity: If AI is the real deal, then natural gas has found new demand in the market—not just in the U.S. but anywhere in the world where data centers are constructed to build AI capacity.

The oversupply that wrecked natural gas prices in 2022 and 2023 may soon be a distant memory, and significant, multi-year lows may have been found. Traders may likewise find natural gas prices increasingly sensitive to earnings releases from companies like Nvidia (NVDA), Broadcom (AVGO), Micron (MU), and others, as the AI technological revolution gathers pace. This is an evolving narrative that warrants close attention over the coming months as new cross-asset relationships emerge.

Christopher Vecchio, CFA, head of Futures and Forex at tastylive, forecasts economic trends in a number of countries. @cvecchiofx