Oil and the Dollar

Crude oil and the U.S. dollar have a marriage made in a therapist’s office. Sometimes there’s frustration, sometimes there’s tension—but they are forever tied to each other. As if to celebrate this union, crude oil and the dollar are doing something they’ve only done 11 times in the past 35 years. They’re moving in the same direction.

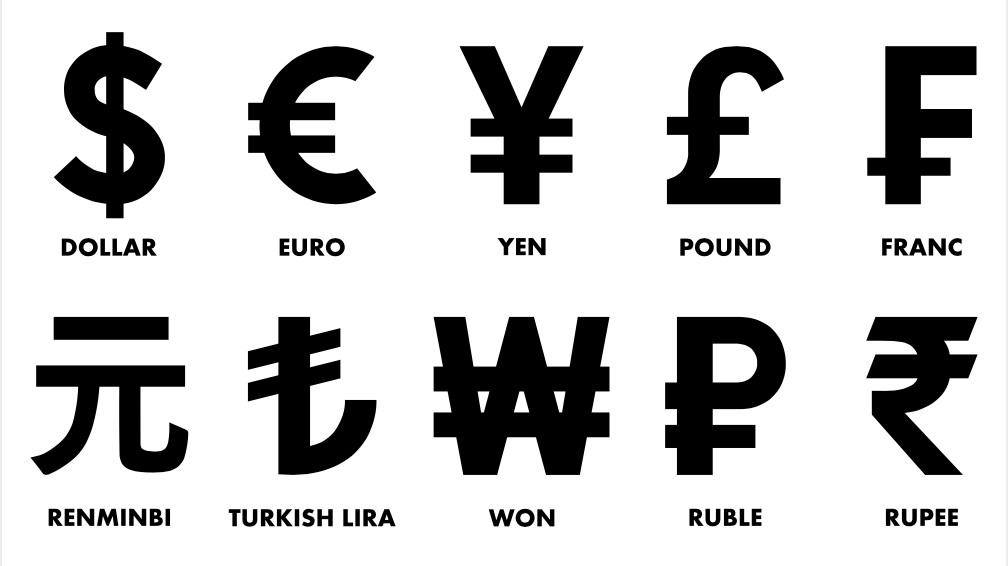

Traders often ask if the value of the dollar relative to other key global currencies works as a major factor in driving oil prices. Well, when filling up a car’s gas tank, Americans pay with dollars, not with euros or Japanese yen. So, why would a relationship exist between currencies and crude?

Typically, the price of oil is inversely related to the price of the U.S. dollar. What’s more, barrels of oil are priced in U.S. dollars across the world. The easiest way to think about this is from a non-U.S. oil producer’s point of view. In Saudi Arabia, for example, an oil producer needs riyals to spend but has to sell oil in dollars. When the dollar’s strong, he can sell oil at a lower price and convert fewer but stronger dollars into riyals. When the dollar’s weak, he needs to sell oil at a higher price to convert a larger quantity of weaker dollars into the riyals. Because all currencies are interrelated, this activity trickles through to other currencies—like the yen and euro, for example.

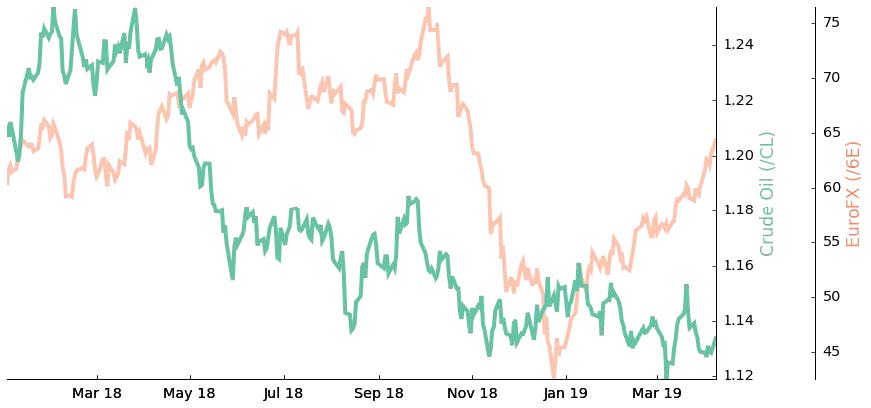

Crude and the euro

When the dollar rises, the euro falls, and vice versa.

This works for oil buyers, too. Because crude is a global commodity priced in U.S. dollars, it’s logical to think that when the value of the dollar declines, buyers would need more dollars to purchase the same 42-gallon barrel of oil. In other words, the dollar and crude oil should be inversely correlated, moving in opposite directions. But now, that relationship is flipped on its head.

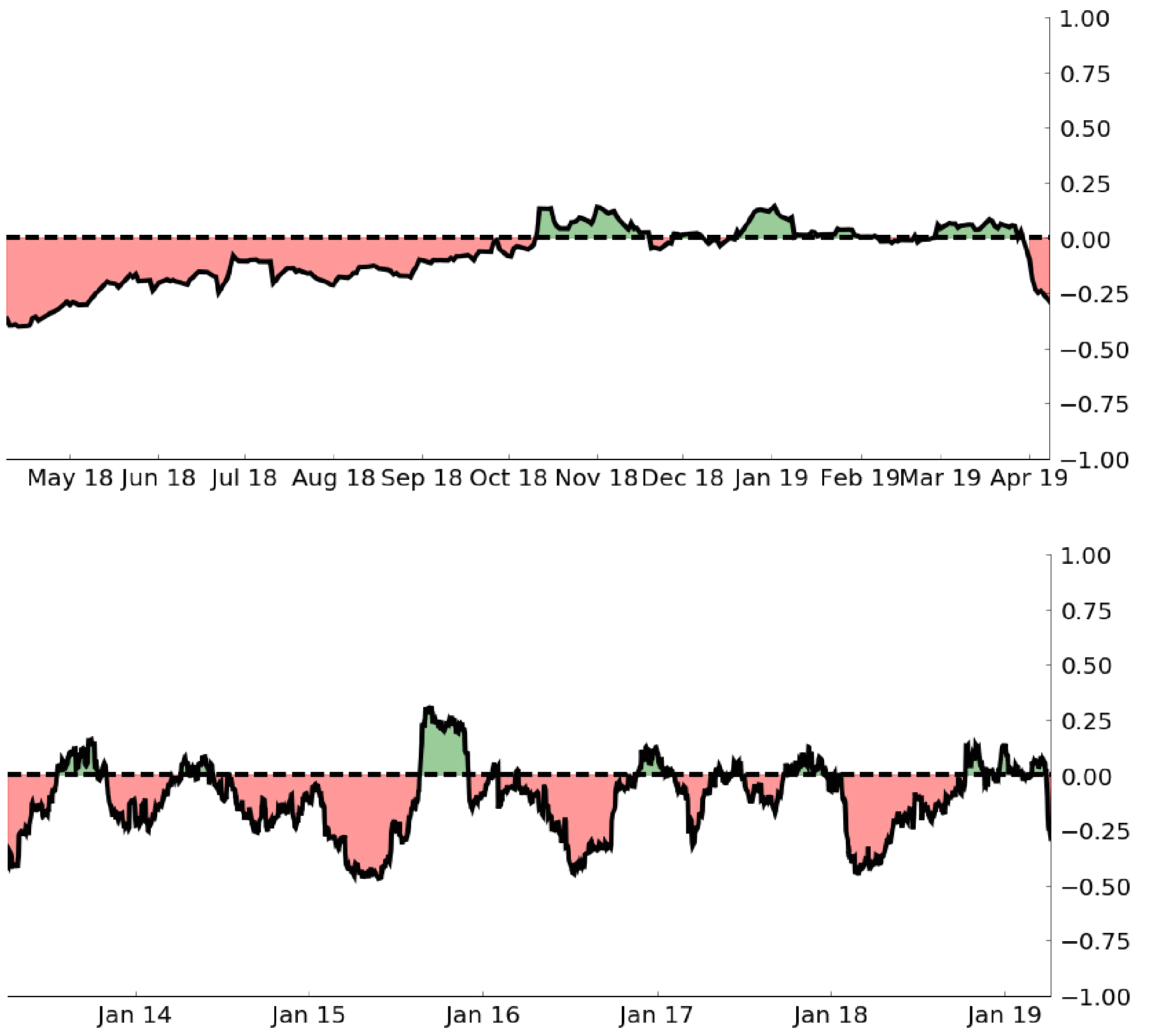

Crude and U.S. dollar correlation

Historically, crude oil has had a -0.25 correlation to the dollar, or about a +0.25 correlation to the euro (left chart). With a looser correlation of just -0.25, however, the market goes through these periods of divergence, but always seems to revert back to normality (right chart).

Historically, crude oil has had a -0.25 correlation to the dollar, or about a +0.25 correlation to the euro (left chart). With a looser correlation of just -0.25, however, the market goes through these periods of divergence, but always seems to revert back to normality (right chart) »

Oil prices and the U.S. dollar are rallying in tandem—a correlated movement that has occurred only 11 times since 1983. Crude (/CL) was up 12% in March 2019 (see “Crude and the euro,” above), while the dollar (UUP) is also up 3.5%. When looking at the dollar, use EuroFX (/6E) as a currency proxy. Remember when the dollar rises, the euro falls, and vice versa.

Crude in euros

Looking at the price of crude oil in EuroFX terms, observers see a larger percentage rally than they would observe looking at crude priced in dollars.

Crude oil and the dollar are doing something they have only done 11 times in the past 35 years.

There’s a negative correlation (statistically significant inverse relationship) between changes in the value of the dollar and the price of oil. Historically, crude oil has had a -0.25 correlation to the dollar (or about a +0.25 correlation to the euro). With the looser correlation of just -0.25, however, the market goes through periods of divergence but always seems to revert to normality. You can see how an example of this in “Crude and U.S. dollar correlation,”).

With a dynamic correlation and large price movements in both underlyings, a “pairs” trade in EuroFX and crude could be interesting. If investors want to get short oil, then selling it against the euro would present a greater extreme than the dollar.

Trade ideas

Here are three ways to construct a “pairs” trade in EuroFX and crude with differing levels of exposure to the products.

Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the main flagship programming slot called Splash Into Futures.