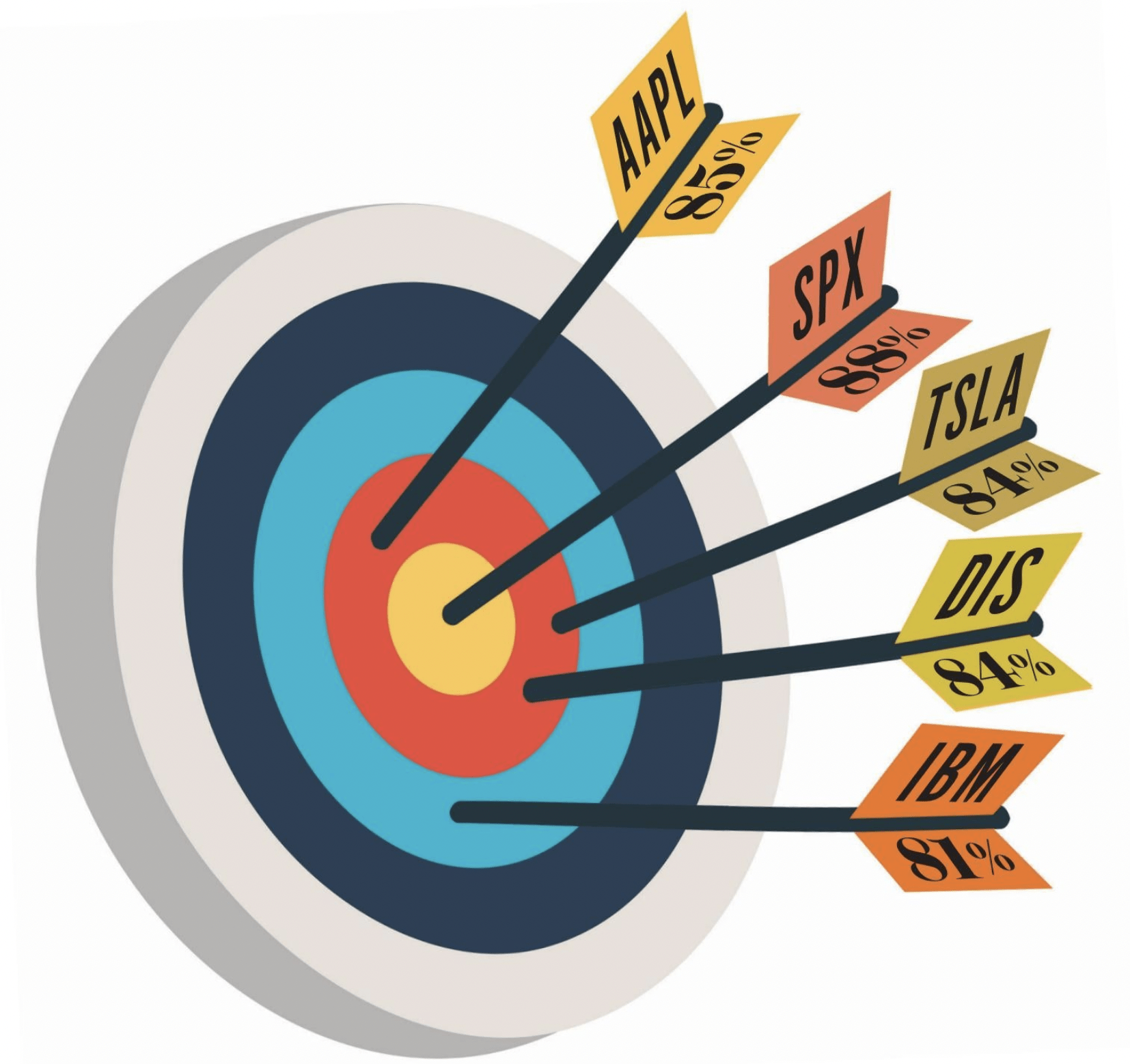

Crypto Too Volatile? Fight Fire With Fire

Going long on one cryptocurrency and short on another tends to cancel out the wild price fluctuations

When it comes to crypto volatility, fight fire with fire.

Remember when bitcoin was under $5 back in 2011? Or when it was over $50,000 back in 2021? How about this year when it lost half that value?

That trip down memory lane shows why bitcoin specifically, and cryptos in general, are some of the more volatile assets. As the leader of the crypto asset class, bitcoin’s volatility is certainly greater than the leading stocks in equities or bonds. That’s why experienced stock and bond investors might hesitate to put money into cryptos—they’re just too volatile.

But there’s a way to reduce the volatility of a crypto position that’s familiar to most investors. Diversification in stock and bond portfolios reduces non-systematic risk. There’s another way to diversify, though, that reduces volatility with volatility. Combining an investment in bitcoin with a smaller short position in another crypto like ether can significantly reduce the volatility of the crypto exposure.

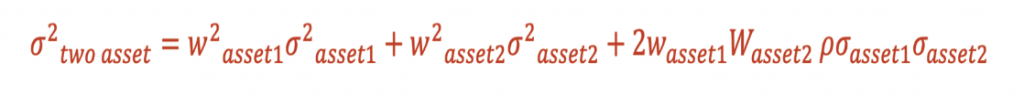

There’s a formula pulled from statistics that shows how it’s done.

The formula determines the combined variance of two variables using four inputs.

Sigma is the variance of an asset’s returns and is volatility squared. W is the percentage weight the asset has in the portfolio. For example, $1,000 of bitcoin and $1,000 of ether in a portfolio would each have 50% ($1,000 / $2,000) weight. is the correlation between the percentage price changes in the two assets. Plug values for those inputs into the formula to get the variance of the two-asset portfolio, then take the square root of the variance to get the volatility.

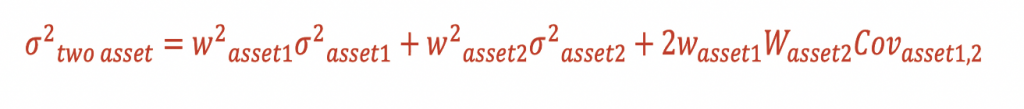

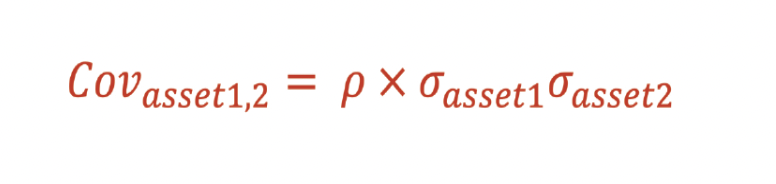

When adding variances of two variables (stocks), it’s necessary to factor in the relationship between them. The reader might see that the previous formula is a little different than what’s found in a stats book. Traditionally, the formula for the variance of two assets uses their covariance, not their correlation.

Covariance measures how two variables, like bitcoin and ether, move together. If the covariance of two cryptos is positive, it means that when one crypto has a large percentage price change up, the other does, too. Correlation takes covariance one step farther and shows the strength of that relationship in a range between -1 and +1. As a number, correlation is more useful and easier to interpret, and covariance is equal to correlation times the volatilities of the two assets. That’s why we use it in the formula:

Let’s see how the formula works. If bitcoin has a volatility of .90 and ether has a volatility of 1.10, bitcoin’s correlation to ether is .92, and the weights of each are 50%, the volatility of the bitcoin plus ether portfolio would be .98. That’s higher than the volatility of bitcoin.

But what if the ether position was short and about 5% of the portfolio? Using .95 for the weight of bitcoin and -.05 for the weight of ether, the volatility of the portfolio would be .80—lower than both bitcoin’s and ether’s volatility. Because ether has a higher volatility than bitcoin, its impact on the volatility of the bitcoin/ethereum portfolio is greater. It doesn’t take much short ether to reduce the risk of a bitcoin position significantly.

An interesting property of cryptocurrencies is their infinite divisibility, making specific dollar investments possible. For example, an investor could buy 1¢, or $1, or $10,000 of bitcoin. It also means that an investor can work with small amounts of crypto, say buying $95 of bitcoin and shorting $5 of ether. That type of exposure might be more palatable to an investor looking to get some experience in the crypto market.

Now, there are a couple of caveats. First, the investor has to be able to short ether. It’s possible to do so, but not every broker or crypto exchange allows it. Second, the long bitcoin/short ether position assumes that bitcoin will outperform ether if they both rally. That is, the investor has to believe that bitcoin will maintain its dominance in the crypto space. If ether outperforms bitcoin, or ether rises and bitcoin falls, that could lead to significant losses.

Beyond crypto, this method of reducing risk can be applied to equities and bonds, too. Adding relatively small short positions in more volatile, highly correlated products can reduce the risk of a portfolio, and the amount of risk that’s reduced can be quantified by that formula.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate. @thetompreston