Day Trading in China

Even in a communist country, people like to make money

The Chinese began gambling at least 4,000 years ago, and they’ve made it a tradition ever since. It’s the reason that Macau has some of the busiest casinos in the world. Some might find a penchant for games of chance incongruous with a planned economy that enforces control over its people with hard and soft power. But the pull of gambling is just too great. And believe it or not, that’s relevant to trading.

It turns out that even in a communist country, people like to make money. Chinese 30-somethings are using the latest and greatest tricks to squeeze out a little more alpha. Jack Ma’s money market fund and other interest-bearing products were hot until people realized the returns were pitiful.

Then, savvy Chinese discovered the capitalist joys of peer-to-peer lending and enjoyed returns commensurate with the risk. But that was a little too free-market for the Central Committee, and last year the People’s Bank of China shut most of the P2P lending sites down, probably keeping the few that are open for the benefit of the well-connected. What, then, were the majority of return-hungry Chinese to do?

They day-trade stocks.

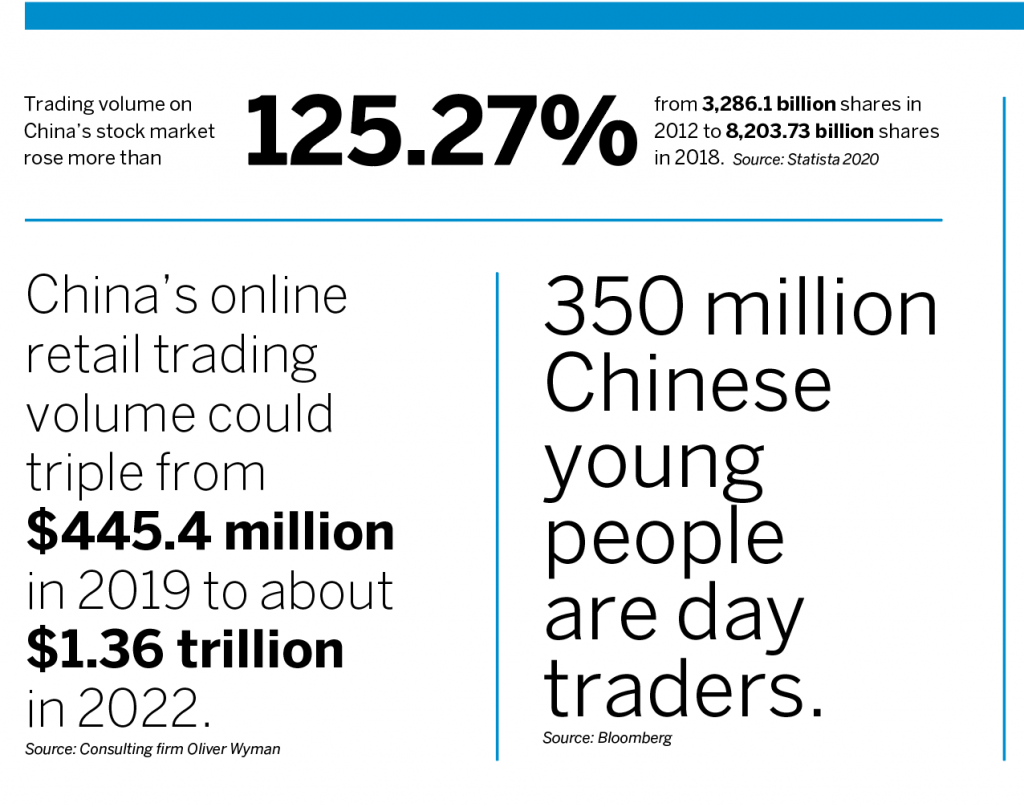

But it’s difficult for Chinese nationals to trade stocks on U.S. exchanges. It’s not forbidden by their government, but to trade U.S. stocks they need U.S. dollars. Converting renminbi to dollars is where the difficulty lies. So hundreds of millions are turning to the Shanghai Stock Exchange. The renminbi is good to go with the SSE, and technology is enabling people to trade.

Day trading stocks, buying and selling shares intraday, can be more fast-paced than a game of craps. The nearly never-ending stream of changing numbers can become addictive. But for making money, day trading stocks amounts to a 50/50 bet. That’s gambling.

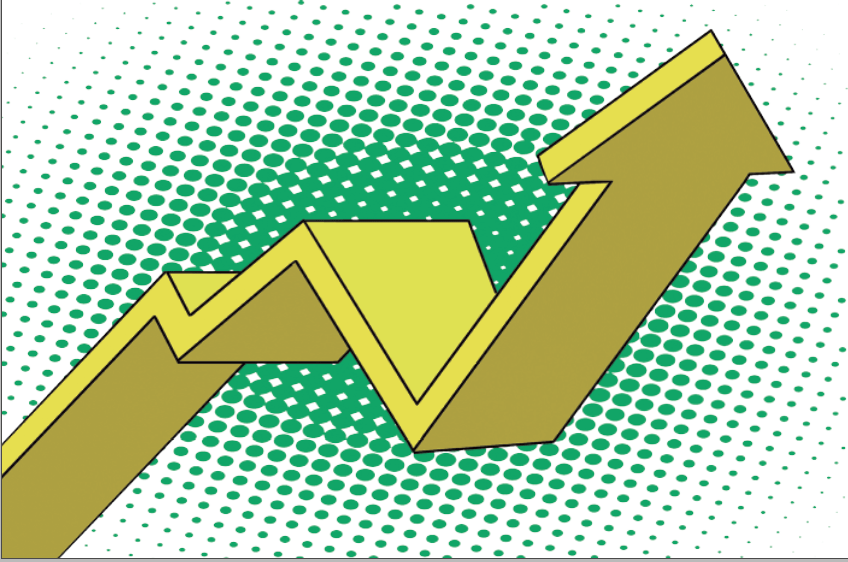

But, some might say, the SSE 50 Chinese stock index had a great return in 2019! That surely means there’s a better chance that a stock will go higher than lower. Over time, that might be true. But that works for buy-and-hold, not day trading, which doesn’t offer millennials the thrill they seek.

Despite an upward progression of stock prices, the intraday “noise” in prices is unpredictable. Day trading that noise amounts to a coin flip. Even though a stock might rally over time, its price goes up and down in fits and starts, with the occasional up move not offset by a commensurately large down move.

Enough of those occasional up moves constitute a rally. But trying to determine which up move in a stock’s price will be maintained and not sink back down at a given minute of a trading day is a complete guess. That doesn’t mean that out of hundreds of millions of day traders a few won’t succeed. But it does mean the odds aren’t on their side.

And even though profits and losses from day trades are a wash, the commissions, fees and slippage in execution mean that most Chinese people who try day trading leave with less money than when they started. Sounds like gambling.

Now, the general secretary of the Chinese Communist Party could force everyone who wanted to trade to start with options. That’s right, evil capitalist derivatives. Why? Used intelligently, options can tip the odds in an investor’s favor.

The SSE lists options on the exchange-traded funds (ETFs) for the SSE 50 and, since late last year, the SSE 300. Investors who think the SSE 50 might go higher could sell an out-of-the-money put. It will have a higher probability of making money than buying shares of the SSE 50 ETF. Investors who think the SSE 300 might drop could sell an out-of-the-money call.

No, don’t day-trade options. Use them to speculate on market moves that might run from a few weeks to a few months. While the profit on a short put might be less than on long 100 shares of an SSE 50 ETF if the index makes a big move higher, those big moves higher are less frequent than one might think. And the short put can still be profitable if the SSE 50 doesn’t move from its current price or even drops a bit.

Options trading with smart strategies can lift trading from 50/50 bets to a consistent source of profits. Will all those Chinese day traders see the light? I hope they do, or at least until their government shuts them down.

Tiger Brokers is an online brokerage startup that caters to Chinese investors who want to invest in overseas securities, particularly stocks listed on the U.S. and Hong Kong exchanges. More than 70% of Tiger’s individual brokers were under age 35 as of December 2018, according to the company’s prospectus. More than 85% made more than $40,000 annually. Wall Street billionaire Jim Rogers is an investor.

Tom Preston, quantitative strategist for tastytrade, is the purveyor of all things probability-based and the poster boy for a standard normal deviate.