Home Economics

Even when it comes to a house, active investors don’t have to be passive

Sitting down? Good. At home? Even better. Because beneath you lies your biggest single investment. Or should I say so-called investment? That would be your house.

That’s where most people place most of the money they’ve earned. For others—those with significant savings in a 401(k) or trading account—a house might seem to have a lower value. But individually, the stocks, options, futures and funds in those accounts may have a lower value than the home. Put another way, a home is the single biggest piece of undiversified risk in most financial portfolios.

Fluctuating value

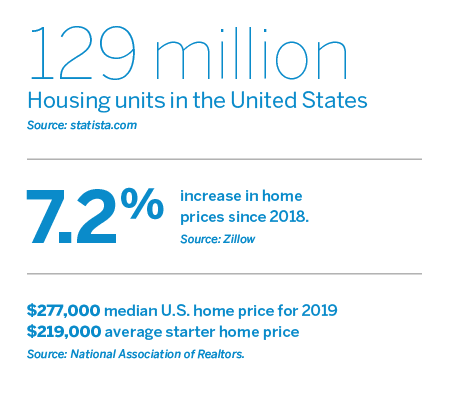

One of the difficult aspects of a home as an investment is that unlike stocks, options and even mutual funds, it’s hard to know exactly what it’s worth until it comes time to sell it. Real estate brokers’ sites can give an idea of what home prices are in the area, but so many variables come into play that it takes a lot of work to come up with a reasonably accurate value for a house. What’s more, house prices fluctuate.

A home’s value is sensitive to the strength or weakness of not just the local economy but also the national economy. Interest rates are an important determinant of demand for real estate, particularly residential. The reason is that when people seek a mortgage, a higher interest rate means higher monthly payments. Higher monthly payments mean fewer people can afford the mortgage, which means less demand for real estate.

The opposite—lower interest rates—can mean more demand for real estate. And as mortgage rates from different banks across the country tend to hover around a national average, with some regions higher or lower, demand depends on the overall interest rate environment. Interest rates fluctuate, creating fluctuating demand for homes.

As the prices for other things—such as cars, gas and food—go up and down, the extra savings or spending can make a monthly mortgage payment possible or impossible, again influencing the demand for a house and its price. So, the country’s monetary policy, overall employment rate and even consumer confidence can influence the value of a home. But even so, real estate is a safe investment, right?

Despite the ups and downs of supply and demand, real estate prices generally have gone up between 1% and 4% a year, outside of some notable crashes. Yes, certain real estate markets have seen much higher increases, but those gains tend to be short-term, and catching them is a matter of timing.

Slow recovery

In some markets, it took 10 years for home prices to recover from their collapse in 2008 and 2009. That said, residential real estate prices aren’t typically very volatile. For example, between July 2018 and July 2019, the price of the average home in the U.S. had about 1.7% volatility. That’s extremely low compared with the volatility of the S&P 500, which averaged about 19% during that time.

But because of the size of the value of the average home—about $280,000—the dollar amount of that volatility was about $4,600 per year. That means the average home could see prices land between $275,400 and $284, 600 about 68% of the time in a year. If a home’s value is larger, the price range is wider, too. And that was a period of relative price stability for houses, not like 2008 to 2009.

Also, the time it takes to complete a real estate transaction is usually measured in weeks, if not months. Compare that to a few milliseconds for an online stock trade, and it’s clear why real estate, even in the best scenario, is not a liquid investment.

So, even someone who knew the price of a home might crash next week would find it tough to sell it in that time. Every investment entails risk, and choosing when to enter and exit is an important way to manage. Real estate isn’t exactly safe by that measure. But technology is beginning to help manage it in other ways.

Short-term rentals

The recent growth (and more recent crash) in the short-term rental market has let homeowners monetize their homes with relatively low barriers to entry. Renting out a spare bedroom via Airbnb or one of its competitors has been a way to generate extra income.

The short-term rental market was valued at $100 billion in revenue in 2016, and grew to $167.9 billion in 2019.

From the perspective of an investment, though, the income from a rental is reducing the cost basis of a home, thus reducing its risk. That’s how it works when selling calls against stock. The cheaper the asset becomes, the less risk it carries. Unfortunately, the coronavirus has killed the short-term rental business for now. Whether it comes back or not, and when, are the big questions.

On the other hand, quarantining to stop the spread of COVID-19 means people are working from home. In May, Facebook’s Mark Zuckerberg said as many as 50% of its employees might be working from home in the next five to

10 years. And if Facebook’s doing it, other tech companies might encourage it, too. It not only keeps people healthy, but also saves on real estate expenses. That could potentially boost real estate values and generate a tax break.

Investing in REITs

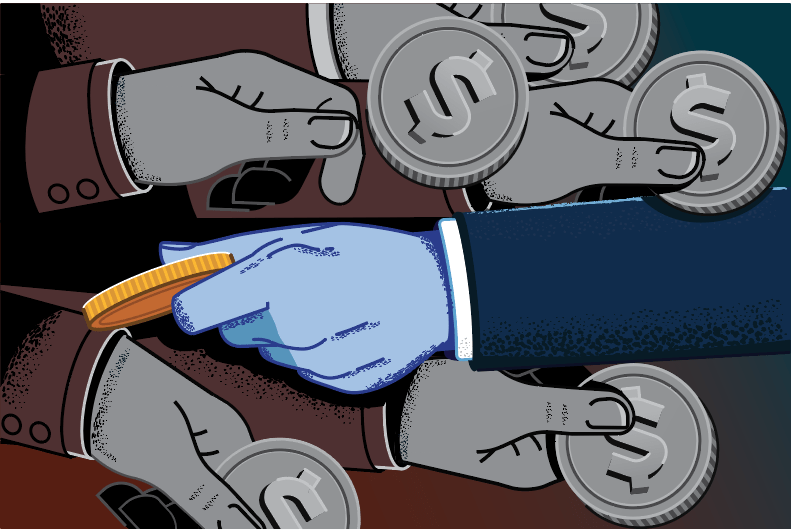

But real estate may seem a bit long-term. Some may want to go directly to the capital markets. If they’re willing to take risk, they can find partial hedges for real estate. Some publicly traded residential real estate investment trusts, or REITs, have options listed on them. Essex Property Trust (ESS), AvalonBay Communities (AVB) and Equity Residential (EQR) are examples.

The key is to understand there’s a performance difference between the price of the REIT and the price of a home. The REIT might rally while the price of a house stagnates or drops—or vice versa. But traders who think that over time their houses will generally rise and fall with the REIT, could sell call verticals in the REIT’s options to generate credits to protect from real estate drops.

A home is the single biggest piece of undiversified risk in most financial portfolios.

For example, with ESS trading at $242, the short 260/270 call vertical with 30 days to expiration was worth about $1.20. With each option representing 100 shares of stock, each Essex Propety Trust option would cover about $24,000 of a home’s value. Ten options would cover $240,000.

That relationship is imprecise, but it puts some context into the number of call spreads to sell. Selling three 260/270 call spreads would cover about one-forth of a home’s $280,000 value and generate $360 in credit before commissions. If that call spread expires worthless, the trader keeps the $360. If Essex rallies 7.5% past 270, the three call spreads would create a $2,640 loss.

But if the $280,000 home rallies 7.5%, it would add $21,000 to its value. Investors need a funded trading account to do that, and they should understand that the gains in a home aren’t immediately available to cover the potential loss of the trade. But it’s something to consider for anyone who doesn’t want to remain a passive participant in the biggest so-called investment in the portfolio.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate.