Qualcomm (QCOM): The Price is Right for This AI Innovator

Artificial intelligence is coming soon to mobile devices. Qualcomm looks well-positioned to benefit.

- Nvidia leads the AI chip market for servers and data centers but has less dominance in other sectors.

- Mobile devices, particularly smartphones, are poised for significant AI-focused upgrades soon.

- Qualcomm, with expertise in mobile chipsets and connectivity, is uniquely positioned to capitalize on the upcoming mobile device upgrade cycle.

While Nvidia (NVDA) currently reigns supreme in the data center space, the battle for AI dominance is far from over.

In early June, Apple (AAPL) officially joined the race, turning up the heat in a crucial battleground: the smartphone market. However, the edges of AI extend beyond smartphones to encompass a myriad of consumer and commercial devices, including laptops, PCs, and wearables.

In addition to Apple, other companies seek to establish themselves as the Nvidia of AI in other market segments. One such company is Qualcomm (QCOM), an AI innovator in the mobile side of the tech market. Others include Advanced Micro Devices (AMD), Arm Holdings (ARM) and Intel (INTC).

While most of these companies are AI heavyweights, Qualcomm’s stock, with its modest P/E ratio, appears particularly enticing for investors looking to capitalize on the AI boom.

Qualcomm is a key player in the mobile chip sector

Most investors and traders think of Nvidia, Advanced Micro Devices (AMD) and Intel (INTC) when they think of AI chips. However, these companies focus heavily on the data center and server niches of the emerging AI segment.

In the global smartphone market, however, Qualcomm remains a dominant player. Qualcomm is a technology company and a communications specialist. Qualcomm provides both the processing power and communication capabilities essential for mobile technology. This dual expertise uniquely positions Qualcomm to excel in the mobile market, which includes smartphones, tablets and other connected devices.

Qualcomm’s mobile chips, such as the Snapdragon processors, serve as the brains for many smartphones and tablets. They provide the computational power needed for various applications, from gaming to multimedia, highlighting Qualcomm’s role as a tech company with a significant presence in the mobile device market.

Qualcomm is also a leader in wireless communication technologies, particularly its 5G modems. These modems are crucial for enabling mobile devices to connect to cellular networks, facilitating high-speed data transfer and reliable communication. Qualcomm’s innovations in this area have driven many advancements in mobile connectivity, making its technologies a cornerstone of modern communication technology.

This extensive expertise allows Qualcomm to deliver comprehensive technology that enhances both the performance and connectivity of mobile devices. Qualcomm ensures devices run efficiently and stay connected, creating a vital bridge between these two industries by integrating processing power with advanced communication technologies.

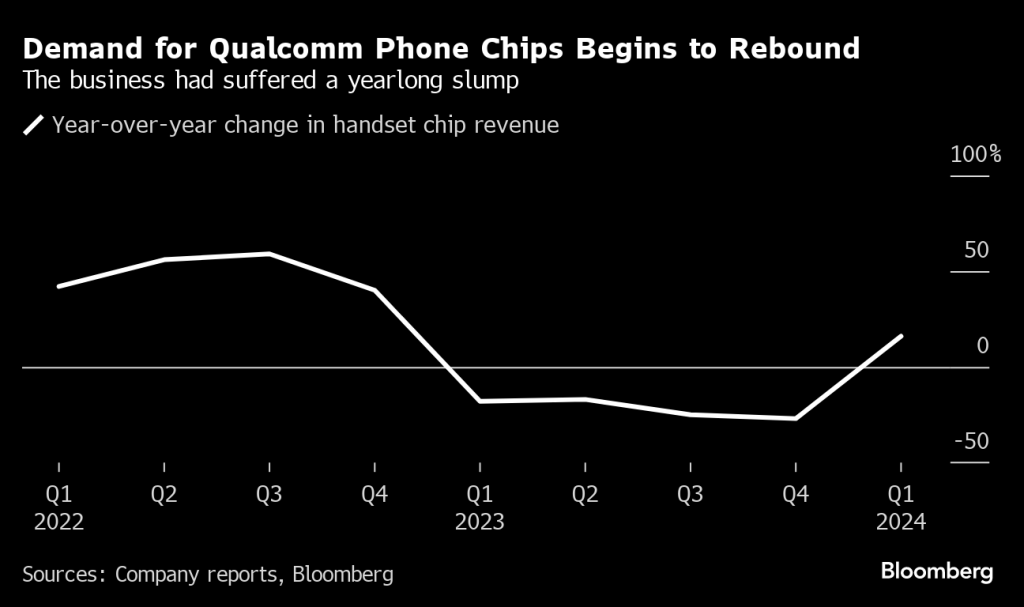

Because AI operations and platforms require advanced processors, some analysts forecast that the smartphone sector will soon enter a significant upgrade cycle. As highlighted below, Qualcomm has already seen an uptick in demand for its mobile chips.

How manufacturers of mobile devices are using AI

The mobile segment of the tech market has been flying under the radar, but that changed in mid-June when Apple unveiled a significant part of its AI strategy.

At its recent Worldwide Developer Conference, Apple announced plans to incorporate generative AI features throughout its operating systems and make them available to developers. Rolling out the new capabilities will take time because it will require new software and upgrades to existing hardware.

Initially, Apple plans to upgrade its existing Siri platform with its Apple Intelligence technology. Apple Intelligence is akin to the large language model approach popularized by ChatGPT. The platform will rely on complex algorithms and statistics to understand and process queries, like the autocorrect feature already in use.

Other operations set for an AI upgrade include messaging, mail, and notes. For example, users could generate unique images using AI, in conjunction with their photo albums, to create personalized messages. For example, imagine wishing a close friend a happy anniversary with an old wedding photo and a customized message.

Apple will partner with OpenAI, the creator of ChatGPT, to provide some of these AI capabilities, including text generation. However, Apple will limit AI-focused features mainly to its newest Apple devices due to the need for advanced chips, such as Apple’s M1 chip. Apple also will require users to opt in to use the AI features. That indicates the initial deployment of Apple’s AI is akin to a beta version.

Alphabet and Samsung have an early lead on Apple

While Apple’s foray into AI represents a significant step, the company is viewed as a late bloomer compared to Alphabet (GOOGL) and Samsung (SSNLF). Alphabet, for example, has already started processing AI-focused operations directly on its devices via the Gemini “Nano” app.

Gemini Nano processes AI tasks directly on Pixel devices, as opposed to processing such requests on Google servers. In contrast, Apple devices won’t process the OpenAI-powered capabilities, leaving these queries vulnerable to connectivity disruptions. Moreover, users in the Google ecosystem don’t require the latest devices, as Gemini Nano is available for models such as the Pixel 8 and Pixel 8a.

Samsung’s existing answer to Apple Intelligence, known as Galaxy AI, is also well ahead of Apple. Thanks to the forward vision of its management, Samsung devices already offer powerful AI-focused features, particularly in photography, video, and language/text/audio processing. For example, Samsung devices use AI during the capture and editing processes for photos and videos.

Impressively, Samsung phones, through the built-in dialer app, can translate phone calls in real time. Additionally, the texting feature includes a split-screen “interpreter mode” that can transcribe and translate conversations, even when the device is offline. Galaxy AI can also summarize documents, websites, and notes, closely matching what Apple has promised from Apple Intelligence.

However, Apple Intelligence users will be limited to only one language (English), while Galaxy AI supports 13 languages. In comparison, Google’s Live Translate can automatically translate text-based messages in up to 21 languages and audio-based messages in six languages.

This multilingual capability highlights a significant advantage for Samsung and Google over Apple in the global market, where language support is crucial for user adoption and satisfaction.

Qualcomm has significant potential in mobile

Mobile devices will need substantial advancements to efficiently handle AI-focused operations and queries while ensuring secure, reliable, and robust connectivity. Qualcomm, with expertise in mobile chipsets and modems, is uniquely positioned to meet these evolving needs.

Qualcomm’s Snapdragon processors already feature integrated AI engines capable of handling complex tasks directly on the device, such as natural language processing, image recognition, and real-time translation. By processing AI tasks on the device itself, Qualcomm minimizes the need for constant data transmission to cloud servers, enhancing speed, efficiency, privacy, and security. This positions Qualcomm as a vital player in the AI-powered future of mobile technology.

Power efficiency is a crucial consideration for Qualcomm. The company’s AI engines are designed to perform complex tasks with minimal power consumption, which is crucial for extending battery life in mobile devices. Qualcomm employs adaptive AI technologies that optimize performance and power usage based on the current task, ensuring devices run efficiently without draining the battery.

Korean tech giant Samsung already uses Qualcomm’s latest processor—the Snapdragon 8 Gen 3—for its Galaxy AI platform. These processors come with advanced neural processing units (NPUs)—specialized components designed to handle AI and machine learning tasks efficiently. NPUs significantly enhance the capabilities of mobile devices to perform complex AI computations directly on the device. This underscores Qualcomm’s integral role in shaping the future of mobile AI, as its technologies are seamlessly woven into the next generation of smart devices.

Analysts expect the high-speed, low-latency connections provided by 5G technology to be a critical building block for mobile AI, enabling real-time data analysis, augmented reality (AR), and virtual reality (VR). Qualcomm designs its modems are designed to deliver stable and robust connectivity, ensuring the seamless operation of sophisticated applications that rely on consistent, reliable internet access.

Highlighting the importance of Qualcomm’s modems, Apple recently renewed its supply agreement with Qualcomm, ensuring that Snapdragon 5G Modem-RF Systems will be used in Apple smartphone launches for 2024, 2025, and 2026. Despite Apple’s efforts to develop modems, it has yet to succeed, reinforcing Qualcomm’s leadership in the field. This ongoing partnership indicates that Qualcomm will remain a pivotal player in mobile connectivity soon.

Qualcomm’s valuation is compelling relative to other AI innovators

Qualcomm’s recent financial performance underscores its strong position in the market. On May 1, Qualcomm announced robust earnings for the first three months of the year, comfortably beating expectations for both revenue and profits.

Even more importantly, the market responded positively to Qualcomm’s guidance for the current quarter. In Q2, Qualcomm expects revenues of $8.8 billion to $9.6 billion and earnings per share (EPS) of $2.15-$2.35. Both figures exceeded analyst forecasts, which were closer to $9 billion in revenue and $2.17 per share in earnings.

These results are particularly impressive given the high number of earnings disappointments in Q1, especially from companies with lofty AI ambitions such as Dell (DELL), Salesforce (CRM) and Snowflake (SNOW). Additionally, many analysts predict a strong upgrade cycle as global smartphone users trade in their devices to access emerging AI capabilities. Qualcomm cited these favorable tailwinds in its most recent earnings report, highlighting the company’s advantageous position in the market.

Given Qualcomm’s performance and promising outlook, one might assume its valuation has skyrocketed like other AI leaders in 2024. However, that hasn’t been the case, making Qualcomm’s narrative even more compelling. Currently, Qualcomm’s trailing twelve-month GAAP P/E ratio is about 29, slightly below the sector average of 30.

In contrast, many high-flying AI stocks have P/E ratios far exceeding their industry averages. For instance, Nvidia’s current P/E is around 77, while Broadcom (AVGO) has a P/E of approximately 76—both well above the sector average of 30. These elevated ratios likely reflect expectations of faster growth for these companies compared to Qualcomm in the coming quarters.

However, managers at Qualcomm aren’t sitting on their hands. The company has partnered with Arm Holdings to develop an innovative and powerful processor for the PC market. This offering, known as the Snapdragon Elite chip, is designed to compete with existing heavyweights in this niche, such as AMD, Apple and Intel.

Importantly, Microsoft (MSFT) recently announced it will outfit its next generation of Surface laptops and tablets with Qualcomm’s Snapdragon Elite chips. This partnership highlights Qualcomm’s ability to frontier new markets, and potentially achieve higher levels of growth. If Qualcomm sees favorable outcomes from these endeavors, the company could easily be awarded with a higher earnings multiple.

Final takeaways

Qualcomm shares currently offer a compelling value proposition. For the year to date, Qualcomm stock has seen impressive gains, with shares up about 60% since the start of 2024 and about 85% over the last 52 weeks.

If the current bull market remains intact, shares of Qualcomm should see further appreciation in 2024. However, with the major market indices bumping up against all-time highs, some investors bullish on Qualcomm’s AI potential may elect to wait for a more attractive entry point.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.