Testing Vaccines and Trading Strategies

Yes, active investment strategy has a lot in common with testing vaccines

As though real-life were imitating a medical drama, COVID-19 is providing a glimpse into vaccine development. Testing a vaccine is perhaps the most important step in the process of making it available to the public.

First, researchers don’t want to make someone sick from the test itself. Second, they want it to be effective in preventing people from getting the virus. It’s that second part where it gets interesting, at least from a probability standpoint.

COVID-19 vaccine testing, just one example of the hundreds of thousands of drug and therapy trials in a year, relies on what’s known in the statistics world as hypothesis testing, and the theory behind it has been shown to be sound.

It’s helped create drugs that have extended and enhanced lives for 100 years. But don’t be alarmed that no pharmaceutical gives perfect results. Most of the time, they work as advertised, but sometimes they don’t. The goal is to keep that difference between predicted results and actual results small. The smaller the difference, the more confident patients feel.

Beginning with “null”

Statistical hypothesis testing, whether in medicine or finance, starts with what’s called a “null hypothesis.” For a vaccine, the null hypothesis might be “the vaccine makes no difference in whether the people in the test got COVID-19 or not.” The scientists’ goal is to show that the null hypothesis is not true.

In other words, they want to show that the vaccine did prevent people in the test from getting COVID-19 within a certain statistically “significant” level, known as the p-value. The p-value quantifies the confidence in the results of the study, indicating the probability that the results that show the vaccine works are valid, as opposed to occurring by chance.

The idea behind the p-value is that if a drug had no effect at all, the data showing that it did have an effect is far out on the edges of the statistical distribution, indicating a low probability it would occur. That’s why the lower a study’s p-value (for example: .05 p-value is lower than .10 p-value, and .01 p-value is lower than .05 p-value), the more confident one can be that the drug will have the effect intended by the pharmaceuticals company. That means that with a small p-value, if 1,000 people took the vacine and did not contract COVID-19, and in reality the vaccine didn’t protect them at all, then those 1,000 people are the human versions of black swans. A numbers guy has to take that vaccine.

That said, two types of errors occur in drug trials to test the hypothesis that the drug works: a false positive, called a Type I error, and a false negative, called a Type II error.

Cataloging the errors

A false positive error indicates the null hypothesis that the vaccine doesn’t work is actually true, and that taking the vaccine doesn’t actually protect patients from COVID-19.

A false negative error indicates the null hypothesis is actually false, and means the vaccine doesn’t do any good when in reality it does. A Type I false positive error means take the vaccine and then go out into the world and contract the virus. A Type II false negative error pours that valuable vaccine down the drain.

Readers can dig into the details of the statistical methodology and theory of all this, but it’s important to understand the Food and Drug Administration and pharmaceuticals companies accept some error in drugs. Generally, they can reduce Type I errors by choosing small p-values, and they can lessen Type II errors by using bigger sample sizes.

But scientists can’t eliminate all errors. If they insisted upon perfection, doctors would still be using leaches to bleed off excess bile. Yes, some might not get the benefit of taking the vaccine, but the vast majority does. The human species thrives as a result.

Drowning in stats

When it comes to trading and investing, hypothesis testing and p-values can help evaluate strategies. And if they’re good enough for medicine, then they should be good enough for money. Actually, even more so. The reason is that massive amounts of data is available for studies of finance.

In drug trials, it’s not always possible to test another 1,000 people. But stock, options and futures prices have been recorded for decades. With computers, accessing another 1,000 data points of financial info is trivial.

When the research team at tastytrade creates studies of trading strategies, the p-values are under .01 and the probability of a Type I or Type II error is negligibly small, largely because of the amount of data used. That’s why investors can feel confident using that research to inform trading decisions.

Long-term trading success isn’t attributable to luck. Look, any single trade based on any logic might make or lose money. That would be a low p-value, high probability of Type I and Type II error scenario. In a large 1,000-plus sample of high probability, positive theta, high liquidity trades, there will be some losers and there’s a chance, albeit small, that the overall result could be a loss.

But that’s true for any trading or investment theory or strategy. The difference comes with having the numbers on one’s side.

Tom Preston, Luckbox features editor, is the purveyor of all things probability-based.

Vaccine Myths

What’s true and what’s not

Older adults don’t need vaccines.

People never outgrow the need for a yearly flu vaccine. Plus, grown-ups need otther vaccines, too, including:

The shingles vaccine, which is recommended for adults

60 and older.

The two pneumococcal vaccines, which are recommended

for those 65 and older.

Vaccines contain harmful levels of toxins.

Vaccines don’t have many other ingredients besides antigens. For instance, tiny amounts of formaldehyde and thimerosal (a preservative that contains mercury) can be used to kill the virus when the vaccine’s being made. Aluminum is also sometimes used to help the vaccine work better.

I got all my vaccinations as a child, so I’m finished with shots.

Not so. The immunity provided by vaccinations wanes over time.

I don’t need to get vaccinated against diseases that

have been wiped out in the United States.

Get vaccinated to help keep those contagious illnesses

out of circulation.

Shots can give people the flu because they contain a live virus.

Most types of flu shots are made with a killed version of the virus. They cannot give people the flu. Plus, one type of flu vaccine is made without using the flu virus.

Source: WebMD

Longevity facts

10 to 15 years of research is usually performed before a vaccine is made available to the general public.

Source: N.Y. State Department of Health

2.5 million The number of deaths prevented by vaccines each year.In the past 60 years, vaccines helped eradicate one disease (smallpox) and are close to eradicating another (polio).

Source: dosomething.org

Vaccinations will prevent more than 21 million hospitalizations and 732,000 deaths among children born in the last 20 years.

Source: CDC

In 2013, black Americans had the highest death rate, with 861 deaths per 100,000 people. Whites had 731, Native Americans or Alaska Natives had 592, and Asian or Pacific Islanders had 405 —the fewest.

Source: CDC

Gender matters: women live, on average, about five years longer than men. Life expectancy for U.S. women born in 2012 is about 81 years; for men, it’s 76 years.

Source: CDC

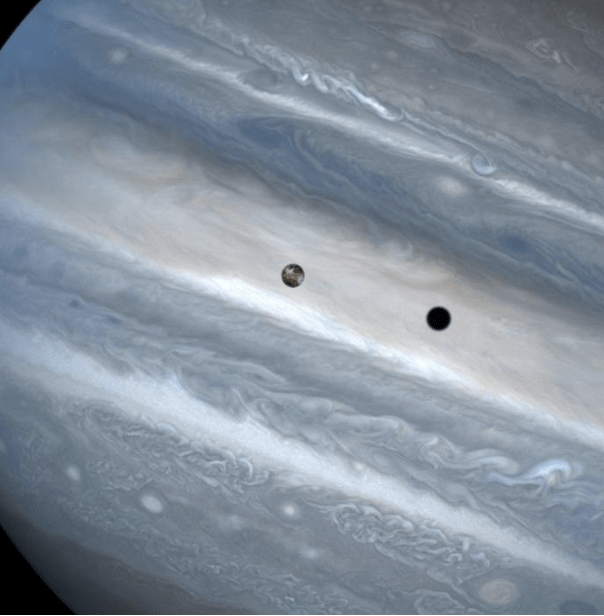

Fast-tracking a vaccine

In late March, Johnson & Johnson (JNJ) selected a lead vaccine candidate for the coronavirus responsible for COVID-19, and announced it would rapidly create enough manufacturing capacity to deliver over 1 billion doses of it—even though the vaccine won’t be ready for human trials until September, and despite any evidence that the vaccine will work.

If clinical trials succeed, the company thinks the vaccine could be ready for emergency use early in 2021—an unprecedentedly short timeline made possible by the FDA’s eagerness to combat the COVID-19 pandemic.