Q3 Earnings Season: Threat of a Government Shutdown Could Delay Post-Earnings ‘Volatility Crush’

November and December are typically the least volatile months, but in 2023 the threat of a government shutdown in November could delay post-earnings “volatility crush”

- Due to the seasonality of volatility, November and December are traditionally among the least volatile months on the calendar.

- One reason for this relates to the post-earnings “volatility crush” in Q3, which refers to a broad-based pullback in options prices after earnings season.

- The normal Q3 post-earnings volatility crush could get temporarily delayed in 2023 due to the threat of a U.S. government shutdown on Nov. 17.

Quarterly earnings season for Q3 is poised to ramp up on Oct. 13, when some of the country’s largest banks are scheduled to release their financial results for the July-September 2023 period.

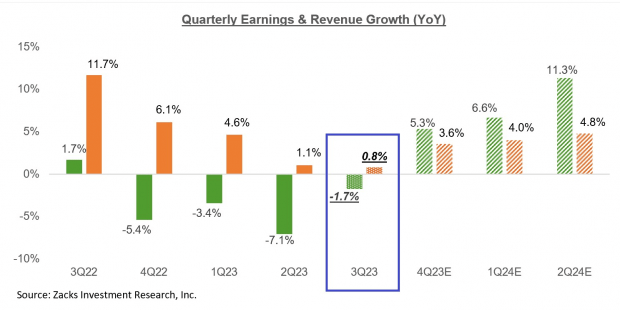

Current projections suggest that the earnings slowdown which first emerged in Q4 of last year has persisted through Q3. That said, earnings growth in Q3 isn’t expected to be as anemic as it has been for the last three quarters.

Prior to Q3 of 2023, the last three earnings quarters saw negative growth of -5.4%, -3.4% and -7.1%. In comparison, Q3 earnings are only expected to shrink by about -1.7%.

Notably, that negative trend is expected to reverse course in Q4. Current projections indicate that starting in Q4 2023, corporate earnings growth will once again turn positive, as illustrated below.

Considering the relatively rosy situation highlighted above, investors and traders may be willing to tolerate weaker earnings results in Q3—assuming that earnings guidance remains robust, and matches up with the expectations outlined above.

If that scenario does unfold, Q3 earnings season could actually be relatively uneventful. But even if the market does get volatile during the next several weeks, November and December are expected to to constitute a period of relative calm in the financial markets.

There are two primary reasons for this.

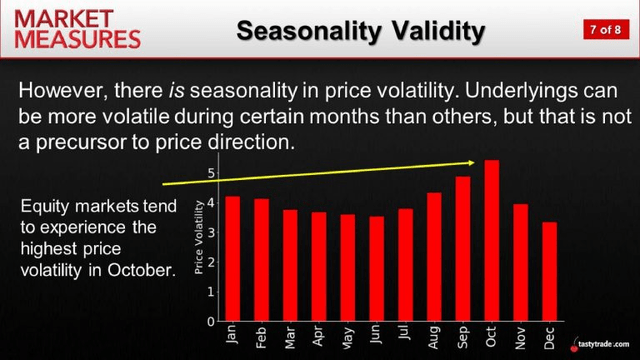

First, according to historical data, volatility in the markets tends to be seasonal. As highlighted below, the period after Q3 earnings (i.e. November and December) has traditionally been one of the quietest periods on the calendar. December is typically the least volatile month of the year.

While nobody knows for sure why the months of November and December have historically been the least volatile on the calendar, some have theorized that it’s due to holidays and vacations. The month of November features Thanksgiving, while December brings Christmas and New Year’s Eve.

Many Americans save their personal holidays for this time of year because they can combine their vacation days with national holidays, to create an extended getaway.

The Q3 earnings effect

On top of that, the conclusion of Q3 earnings season also creates a bit of a vacuum in the financial markets when it comes to price volatility.

Corporate earnings represent an unknown, which is why options prices typically rise heading into an earnings event. Elevated options prices reflect the potential for a bigger move in the underlying stock during an earnings event, due to the risk of a potential surprise in the data.

However, once an earnings event passes, options premiums typically decrease, and in many cases substantially. This phenomenon is often referred to as the “volatility crush.”

In November and December, however, the post-earnings volatility crush is typically compounded because these two months are traditionally the least volatile on the calendar. As a result, experienced investors and traders (including market makers on options exchanges) tend to shun options purchases, which removes some of the underlying demand in the market.

Therefore, the post-earnings crush in November and December can be even more pronounced than usual, due to the simultaneous seasonal volatility crush that is associated with the winter holidays.

That said, one has to keep in mind that past performance isn’t an indicator of future returns—there’s no guarantee that November and December of 2023 will be as quiet as previous years.

That’s especially true this year, considering the military conflicts that are currently unfolding in Eastern Europe and the Middle East. In such times, there’s always the risk that something substantial and unexpected could occur.

One additional wrinkle in 2023 relates to the potential for a government shutdown in November.

As most investors and traders are aware, American lawmakers recently passed a stopgap measure to fund the government through Nov. 17.

That means the threat of a potential government shutdown will rear its head once again in early November. Considering that wrinkle, the traditional seasonal volatility crush could be delayed by a couple of weeks in 2023.

On the other hand, Congress could just easily decide to pass another stopgap measure that funds the government through the winter holidays, and pushes the government funding showdown into early 2024.

More Background on the “Volatility Crush”

“Volatility crush” in the options trading universe generally refers to a collapse in the value of an option. Most often, investors and traders refer to a “vol crush” in the wake of a corporate earnings event, or when stability returns to a chaotic market.

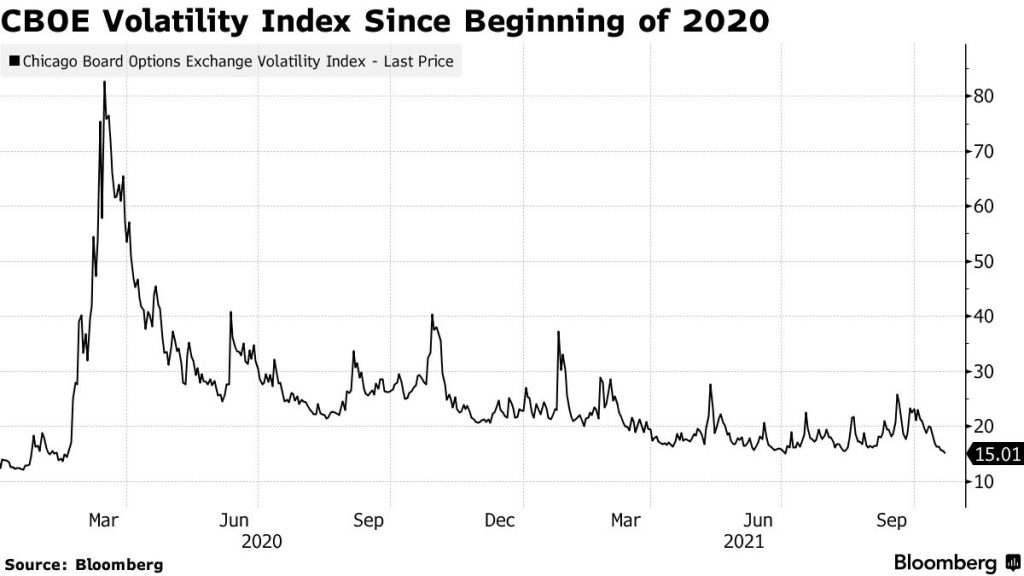

For example, after the stock market endured a sharp correction amidst the onset of the COVID-19 pandemic, volatility spiked to all time highs, as measured by the CBOE Volatility index (VIX). But over the ensuing months, volatility contracted heavily, ultimately rewarding short volatility players, as illustrated below.

Circling back to earnings season, it’s also common to observe a volatility crush in the wake of a corporate earnings event.

Earnings season is unique because options prices (i.e. implied volatility) tend to increase heading into the release of an earnings report. Then, in the wake of earnings, that added premium typically bleeds out rather quickly—the so-called post-earnings volatility crush.

For more background on the volatility crush phenomenon, readers can check out this installment of Options Trading Concepts Live on the tastylive financial network. To learn more about the seasonality of volatility in the financial markets, this previous post is also recommended.

To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.