It’s Time to Fade the Rally in Japanese Stocks

The Japanese stock market was one of the world’s best performers in 2023, but a stronger yen could weigh on valuations in 2024

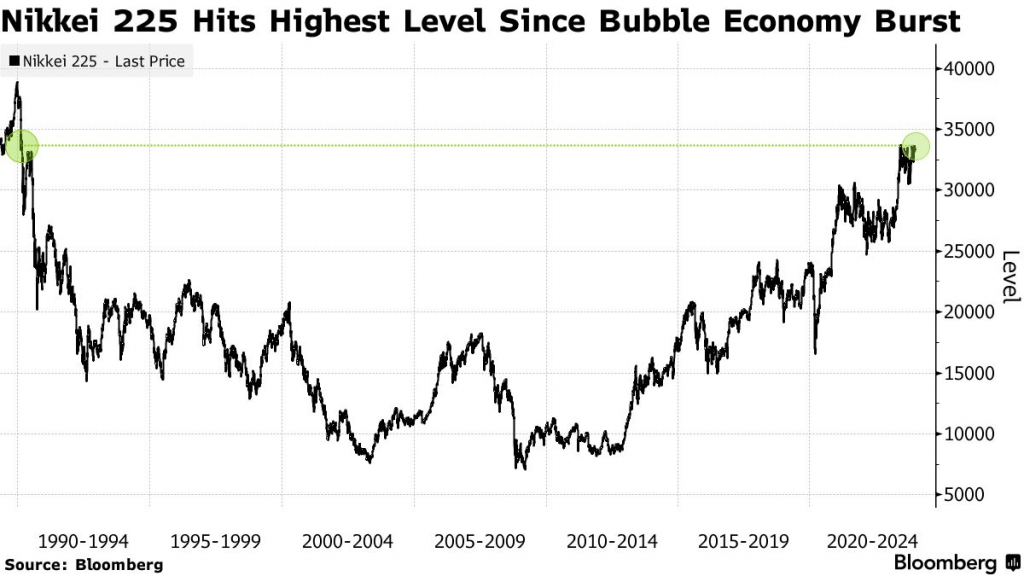

- The Japanese stock market was one of the world’s best performers in 2023, with the Nikkei 225 index rallying by about 35% over the last 52 weeks.

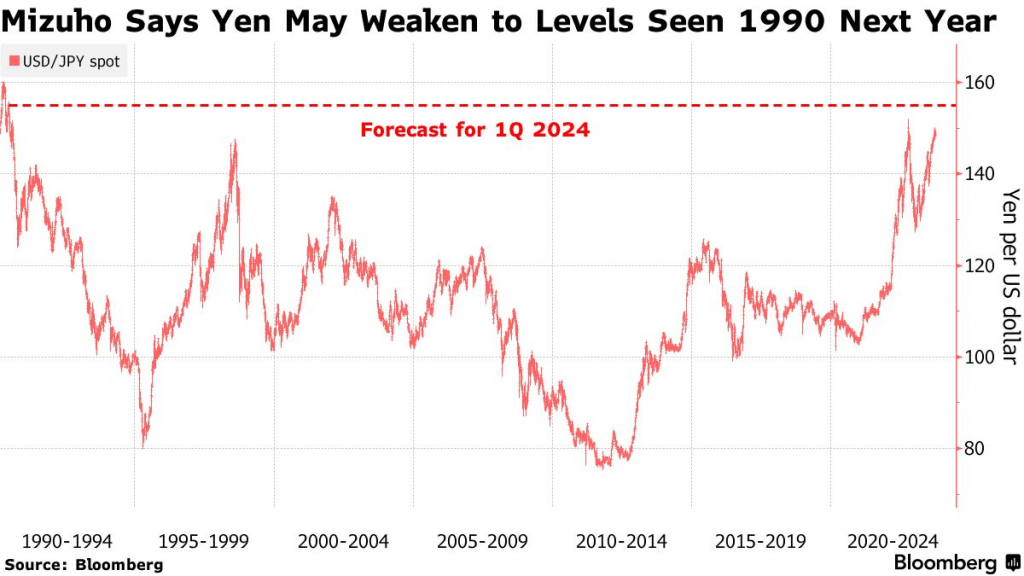

- That rally was due, in part, to a record weakening of the Japanese yen, which dropped to a 33-year low against the U.S. dollar.

- This year, the yen could strengthen against the dollar—especially if the U.S. Federal Reserve drops interest rates—which could serve as a headwind for Japanese stocks.

During the last year or so, the rally in the Japanese stock market has been one of the world’s most surprising developments. The Nikkei 225—one of the most recognized Japanese stock indices—is up about 35% during the last 52 weeks.

In addition to the Japanese stock market, the rallies in Bitcoin and the American tech sector were a couple of the other hot trends in 2023. Of the three, however, Japanese stocks appear the most susceptible to a pullback.

That’s not because the rally has stalled out, though. Japanese stocks have started fast out of the gate in 2024, with the Nikkei 225 already up 7%. The Nikkei 225 is currently trading around 35,500, which is only 8% lower than its all-time high of 38,195.

Considering recent momentum, it’s entirely possible the Nikkei 225 climbs further in the coming weeks, and breaks through its all-time high at some point in H1 2024. Positive drift is a strong phenomenon in the financial markets, and when underlying stocks or ETFs pull close to their previous all-time highs, they often break through them.

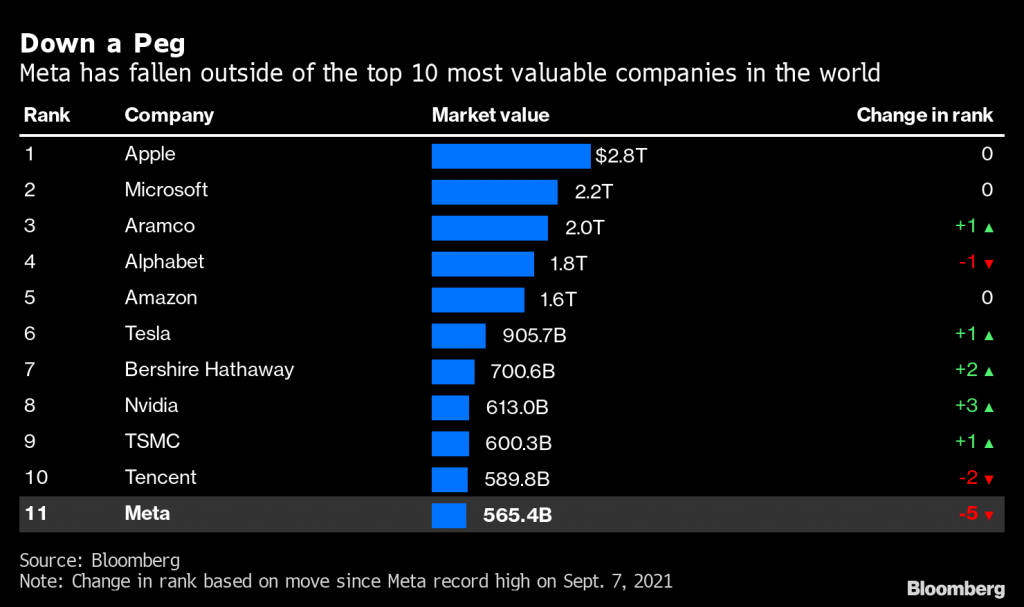

However, it’s a lot harder to envision the Japanese stock market replicating the same level of success it produced in 2023. And there are several reasons for that—a couple of which tie back to the original reasons that Japanese stocks rallied in the first place. At the top of the list, however, is the fact that the Japanese market doesn’t boast any of the world’s top tech companies.

Large-cap tech companies have become the darlings of the international marketplace. Six of the top 10 most valuable companies in the world hail from the tech sector (and seven of the top 11). Moreover, if Amazon (AMZN) and Tesla (TSLA) were categorized as “tech” companies, those figures would rise to eight of ten (and nine of 11).

Japan has a lot going for it, but it doesn’t boast a deep bench of internationally-recognized tech leaders. In their place, Japan has some of the world’s best-known automobile manufacturers, a diverse array of top-notch electronics companies, and some well-run companies from the chemical and financial sectors.

For example, Toyota (TMC) and Sony (SONY) are top-notch enterprises with global brand recognition, but they aren’t in the same league as the likes of Alphabet (GOOGL), Microsoft (MSFT) and Nvidia (NVDA). In the current market environment, many global investors and traders have been drawn to the impressive potential (and profits) of the big-name tech giants.

The lack of big-name tech heavyweights in the Japanese stock market therefore serves as a sort of governor on the country’s stock market, throttling back its potential. But that’s not to say there aren’t attractive opportunities in the Japanese market.

Toyota (TM), for its part, appears poised to steal back some of the global market share that legacy automobile manufacturers have lost to emerging EV manufacturers. Some Japanese companies, such as Canon (CAJFF), are aggressively trying to climb back up the innovation ladder.

But in the current market environment, it seems improbable that the Japanese market could remain a global leader (in terms of performance) without a larger presence in the tech sector. Certainly, that could change in the future, especially as the field of robotics advances because Japan has several key leaders in that sector, including Fanuc (FANUF), Yaskawa Electric Corporation (YASKY) and SoftBank Robotics.

The primary factors that drove the Japanese stock market higher in 2023—weakness in the Japanese yen and some impressive corporate governance reforms—aren’t likely to trigger much additional upside in the Japanese stock market during the foreseeable future. Especially considering the multitude of new, exciting opportunities that are opening up elsewhere in the world as a result of the ongoing AI revolution.

A Potential Reversal in the Yen

Last year, one of the key themes supporting the rally in Japanese stocks was weakness in the Japanese yen. The relative value of the yen is often a central theme for the Japanese corporate sector because many companies are so heavily reliant on exports. According to the World Bank, exported goods and services accounted for roughly 22% of the Japanese economy in 2022.

As a result of that reality, Japanese companies often rely on a weak yen to help grow their sales, because a weak yen makes Japanese products and services relatively more attractive. Last year, from January through November, the yen steadily weakened against the U.S. dollar.

During that period, the U.S. dollar/Japanese yen (USD/JPY) exchange rate weakened from about 129 to 151. For reference, the USD/JPY exchange rate has ranged between roughly 105 and 151 over the last five years. That means in 2023 the yen was bumping up against its lowest levels versus the dollar in the last five years.

Looking back further, 151 in the USD/JPY exchange rate actually represents an extreme over the last 33 years, as well.

In fact, one has to go all the way back to the early 1980s to identify a period in which the USD/JPY exchange rate was significantly higher than it is today. Considering that market context, it’s a lot easier to understand why a bullish trend developed in the Japanese stock market during 2023. Looking ahead, however, the yen may be susceptible to a reversal of fortune.

This year, the U.S. Federal Reserve is expected to lower benchmark interest rates in the United States for the first time since 2020. And when that occurs, the USD/JPY exchange rate could actually start moving in the opposite direction, pushing the yen higher than the dollar. A development that would undoubtedly weigh on Japanese stocks.

Moreover, one can’t overlook the fact that the average price/earnings (P/E) of Japanese stocks has risen to roughly 14. That’s just shy of the metric’s previous peak, which is closer to 14.5. Taken all together, that means the current lofty valuations in the Japanese stock market could serve as a headwind, as well.

Impact of Corporate Governance Reforms Running Out of Steam

One of the other key themes that pushed Japanese stocks higher in 2023 was a strong domestic push to improve and reform corporate governance in the country. The Tokyo Stock Exchange (TSE) announced in March last year that it would compel companies trading below their book values to devise new capital improvement plans, with the intent of unlocking additional upside potential in the companies’ shares.

Regulators in Japan have been focusing on corporate governance reforms because roughly 40% of Japanese companies were trading with a Price-to-Book (PBR) ratio of less than one in 2022. In comparison, that figure was 5% for the S&P 500 and about 24% for the STOXX 600. By improving the corporate governance dynamic, regulators hoped to make Japan’s equity market more attractive and accessible to global investors.

To get there, Japanese regulators have been encouraging companies to hold less cash, to shutter unprofitable divisions/subsidiaries and to invest in new initiatives and technology. In addition, Japanese companies have been encouraged to increase stock buybacks and/or increase dividends.

Those moves have been well received by the investment community both inside and outside Japan. There’s no doubt that the relative attractiveness of the Japanese stock market has been improving. According to one researcher, if improving sentiment caused Japanese households to contribute an additional 1% of assets into the stock market, that could unlock an additional $150 billion in fresh buying power.

These reforms have likely contributed to the recent rally in Japanese stocks. And if additional reforms are unveiled, that could eventually lead to a rerating of the overall Japanese stock market. But this process will take time. First, to see if the companies actually adopt and sustain the new reforms, and second, whether the reforms have a material impact on future growth and profitability of the affected companies.

It’s not easy to distinguish what portion of the 2023 rally was attributable to the weakening yen, and what portion was attributable to the drive to reform corporate governance. But that might be easier to decipher if the yen starts weakening against the dollar. If the yen shifts direction, and Japanese stocks start to wobble, that would be an important indicator.

Importantly, there’s no guarantee that things will develop as expected—the yen, for example, could continue to weaken in 2024. And if that is the case, the rally in the Japanese stock market may be extended. However, that scenario would require a hawkish pivot by the U.S. Federal Reserve, triggering a strengthening of the dollar. And that doesn’t seem likely at this time.

The above information and data therefore suggests that Japanese stocks may be a “hold” at this time, and possibly even a “sell.” And that would be especially true if the Nikkei 225 index climbs to a fresh all-time high.

In addition to the Nikkei 225 index, investors and traders can track and trade the Japanese stock market using the following ETFs (sorted by 52-week performance):

- WisdomTree Japan Hedged Equity Fund (DXJ), +44%

- iShares Currency Hedged MSCI Japan ETF (HEWJ), +39%

- WisdomTree Japan Hedged SmallCap Equity Fund (DXJS),+38%

- Xtrackers MSCI Japan Hedged Equity ETF (DBJP), +35%

- First Trust Japan AlphaDEX Fund (FJP),+19%

- iShares MSCI Japan Value ETF (EWJV), +19%

- iShares MSCI Japan ETF (EWJ), +15%

- Franklin FTSE Japan ETF (FLJP), +14%

- ProShares Ultra MSCI Japan (EZJ),+14%

- Franklin FTSE Japan Hedged ETF (FLJH), +13%

- iShares JPX-Nikkei 400 ETF (JPXN), +13%

For more background on country-focused ETFs, check out this installment of Options Jive on the tastylive financial network. And to follow everything moving the markets in 2024, including the currency markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.