Trading VXN, the Nasdaq’s Version of VIX

Investors and traders use the VIX, a well-known gauge of market volatility, to track “fear” in the marketplace.

An increase in the VIX signifies that near-term options prices in the S&P 500 are rising, which can be an indication that “insurance” on the stock market is getting more expensive.

Earlier this year, the VIX spiked to an all-time high as fear of the coronavirus pushed uncertainty in the financial markets to critical levels. That drew a lot of trading interest, which is common when extreme moves occur.

At that same time, other VIX-related products also rose in volume. Products like VXX, UVXY and SVXY, whose values are tied to the VIX, made big moves and provided plenty of new trading opportunities.

Depending on one’s trading approach and market outlook, the VIX may have been an appropriate method of accessing a particular trade, or hedge, during those tumultuous times.

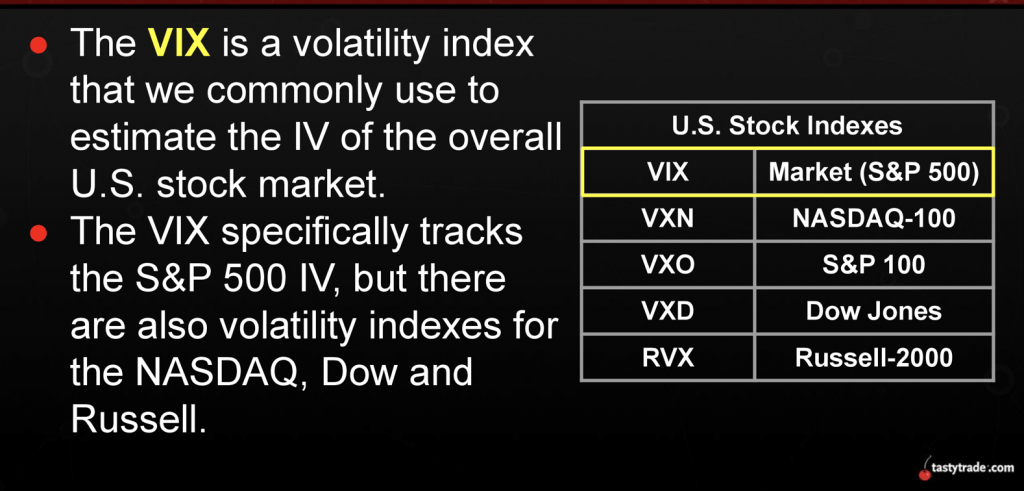

However, as highlighted recently by tastytrade, the VIX isn’t the only choice for trading and tracking market volatility—especially with highly diversified portfolios. The VIX, for all its glory, is S&P 500-specific and provides no information on the volatility of thousands of other stocks.

Plenty of market participants trade the Nasdaq, the Russell 2000, bonds, currencies and precious metals in addition to the S&P 500. Each of those products has a volatility index that one can track and trade—much like the VIX.

For example, the VXN is similar to the VIX, but is tied to the Nasdaq 100 instead of the S&P 500. The VXN measures the market’s expectations of 30-day volatility using the prices of near-term Nasdaq 100 options. As shown in the graphic below, each of the major stock indices in the United States has its own associated volatility index.

The above means that traders focusing on the Nasdaq 100, or the broader technology sector, might want to follow the VXN in addition to the VIX. The VXN provides targeted insight on the technology-heavy Nasdaq, and that distinct difference may provide even more context on opportunities in the markets.

As with the VIX, market participants can use futures and options to trade the VXN, which may be attractive to investors and traders attracted to the technology sector

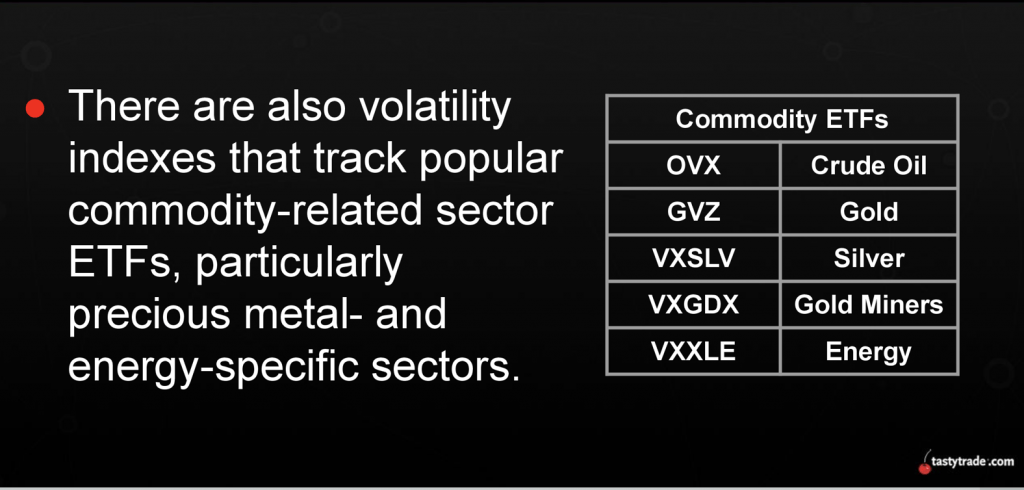

Besides equities, one can track and trade commodities and other segments of the market, using tailored volatility indices. Examples include crude oil, gold, silver and the “gold miners” as shown below.

Depending upon one’s market focus, an investor or trader might prefer to track or trade one of the above volatility indices instead of VIX, or in addition to it.

One never knows where opportunity may arise, so it’s better to follow multiple indices than just a single index.

To learn more about volatility indices, readers may review a new installment of Best Practices on the tastytrade financial network.Additional information on all things VIX is available in Luckbox magazine.

“Sage Anderson” is a pseudonym for a contributor who has traded equity derivatives and managed volatility-based portfolios as a prop trading firm employee. He is not an employee of Luckbox, tastytrade or any affiliated company. Readers may direct questions about this blog post or any other trading-related subject, to support@luckboxmagazine.com.