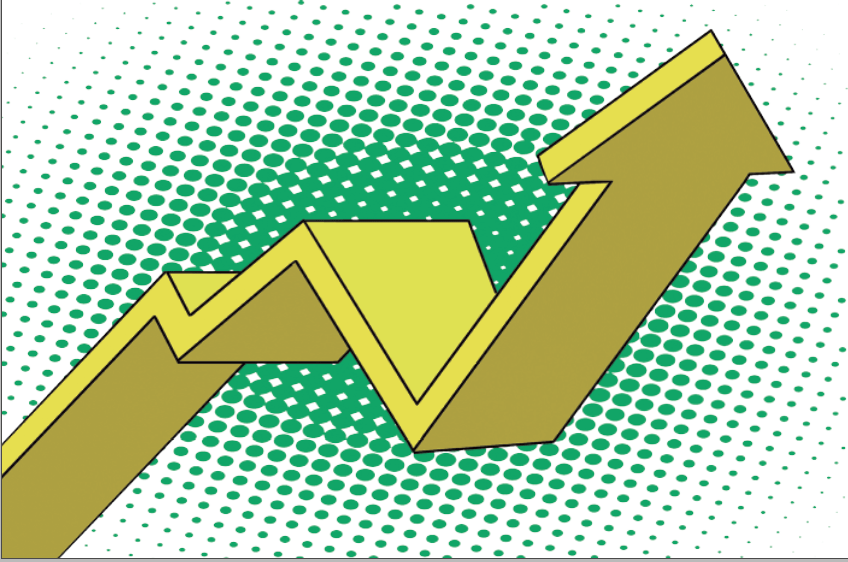

Trading with a Casino’s Edge

Active investing isn’t gambling for traders who know the odds

When someone’s interested in options trading but doesn’t know quite how to approach it, ask a question that provides context just about everyone understands. “Who makes more money, the casino or the gambler?” They always get the answer right.

Casinos make more money than the players. Even though a skilled blackjack player who counts cards might make money over time, those winnings are dwarfed by the profits of a casino.

Why? Casinos are probability-based businesses. They determine game payouts by calculating the probability of a gambler winning and then paying out smaller amounts to winning gamblers than they theoretically should.

The difference between what the casino actually pays out compared with what it theoretically should pay out in a completely fair bet is called its “edge.” In blackjack, for example, the casino has about a 0.5% edge overall.

That may not sound like a large amount, but over the thousands of hands of blackjack played in an hour in a casino multiplied by the dollar amount wagered, 0.5% equates to a lot of money. Nice work if you can get it.

Stay small

What casinos don’t do is what gamblers hope to do: make a huge profit on a small bet. And sometimes inexperienced traders can fall into that same trap of trying to reap huge returns from a single lucky options trade.

But even though that might happen once, it’s hard to do that trade after trade, month after month, year after year. In fact, gambling with options is a good way to lose money. Nobody wants that.

So, here’s the next question to pose: “Would you like to make money the way casinos do? Legally?” Invariably, the answer is “yes.” That leads to an explanation of why traders can make money over time by selling out-of-the-money options.

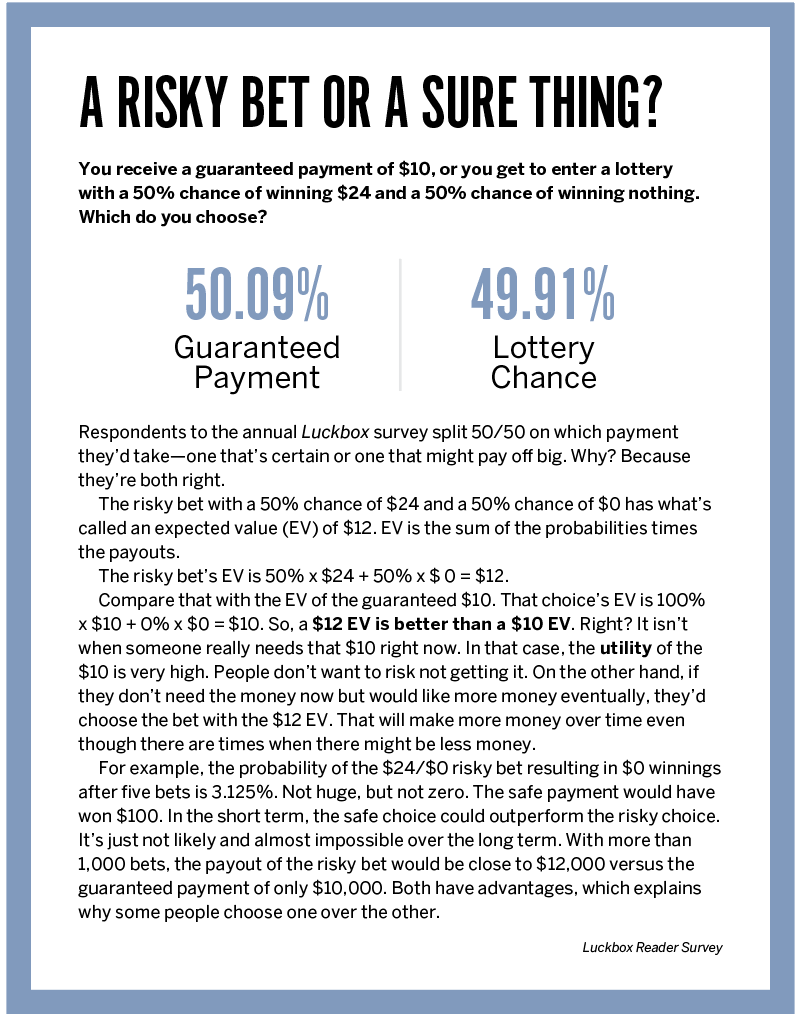

The payout on the short option is greater than the probability-based theoretical payout should be. It’s not much, but like a casino, anyone making lots of small trades—each with a high probability of profit—can earn significant returns over time.

So, basing trades and investments on quantifiable probabilities is a logical choice for just about everyone—except, of course, Wall Street analysts and money managers. A self-directed trader can make many small bets that each have a greater than 50% probability of making money.

Calculating the edge

But how can a trader figure out the edge of a short options trade, assuming that options are fairly priced? Casinos can calculate their edge because the rules of the games and all potential outcomes are clearly defined. But that’s not necessarily the case with options trading.

There is, however, a simple hack to estimate the edge in a short option. It’s the difference between a stock option’s individual implied volatility and the overall volatility for all the options on that stock, multiplied by the option’s vega.

As a refresher, an option’s implied volatility is the volatility that, when plugged into an options pricing formula, makes the option’s theoretical value equal to its market value. The overall volatility of a stock’s options is a VIX-style weighted average, and it’s used to determine the probability of a stock reaching some price in the future.

Vega is how much an option’s theoretical value changes when volatility changes.

The overall volatility is used to calculate an expected high and low range for a stock, and because it incorporates most of a stock’s options in its calculation, it’s often lower than the implied volatility of individual options.

The lower overall volatility means smaller potential price changes in the stock than the prices of the individual out-of-the-money options with higher implied volatility indicate. That difference between the volatilities can be interpreted as an edge.

For example, a trader who’s bullish on Wynn Casinos (WYNN) might consider shorting a put. When WYNN was trading for $124.50, its overall volatility was 41%. The 95 put with 56 days to expiration was trading for 0.80, and it had an implied volatility of 50% and a vega of 0.06.

The difference between the 95 put’s implied volatility and the overall volume is 9% (0.09). So, 0.09 times the option’s 0.06 vega equals 0.0054, or 0.54%. That’s very close to the edge the casino has in blackjack.

Multiply that 0.0054 by the option’s 0.80 price to get 0.00432. Multiply that by the $100 contract size of the option, and the actual dollar amount of that edge is $0.43.

That may not sound like a lot. But over the course of thousands of trades over the years, those small numbers add up, just like they do in a casino.

Does that mean selling options when their implied volatility is higher than the overall volatility is a guaranteed winner? Unfortunately, the answer is “no.”

Just like casinos sometimes lose bets no matter how small the probability.

And if some gambler walks in with $100 million of crypto profits and sits down at a blackjack table to make one massive bet, the payout on a winning hand could bankrupt the casino.

That’s why casinos have table limits. They know that while they might lose one bet, they’ll probably win the majority of 10,000 bets. Approach trading in the same way, with lots of small trades, none of which could bankrupt you.

So, don’t gamble. Look to profit the same way that casinos do. Keep the probabilities on your side and the edges positive.

Tom Preston, Luckbox features editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate. @fittypercent