Beyond Beyond Meat

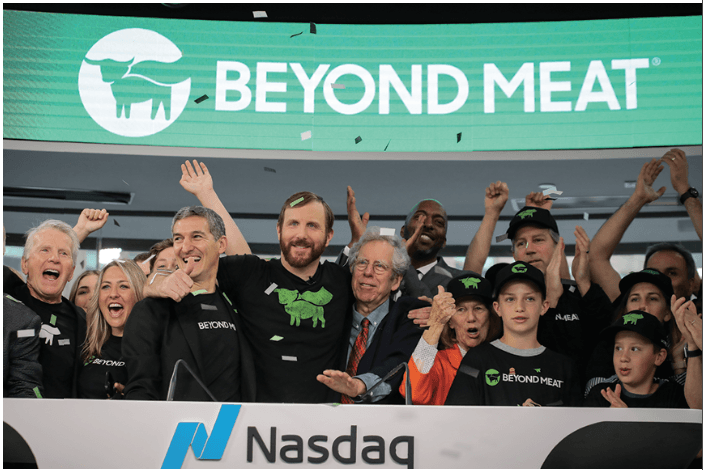

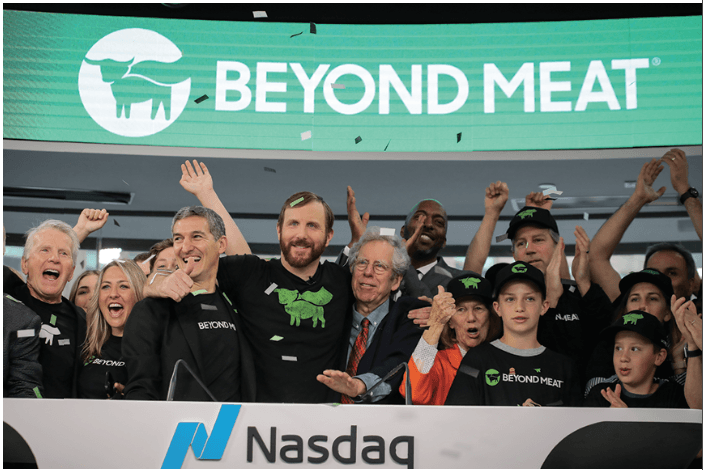

The IPO’s 163% gain presages a tectonic shift in American views on food and health

When shares in Beyond Meat Inc. (BYND) rose to 163% of their IPO price on the company’s first day of trading on Wall Street, it meant more than just a bonanza for the company’s new stockholders. It meant the investment bankers who took Beyond Meat public failed to understand the new food system. The bankers didn’t recognize the market’s hunger for healthier food, so they left more than half of the company’s value on the table.

This kind of IPO pricing surge hadn’t occurred in more than 20 years—not since back in the ‘90s when spikes in internet- and telecom-related company stock prices created the dot-com bubble. Spikes occur when the incumbents don’t understand rapid changes in the market.

So, let’s examine a bit of history because the telcom boom bears similarities to what’s ahead in food and health.

Last October, Chris Andersen sat down for an interview in his New York office. Anderson belonged to the core team at Drexel Burnham Lambert, working alongside Michael Milken, who’s know for helping to originate high-yield bonds. Although now in his 80s, Anderson still works as an investment banker and had just finished reading the book Sugar: The World Corrupted: From Slavery to Obesity, by James Walvin. That led him to tell me the story of the first big Milken offering of $1.1 billion in junk bonds to underwrite MCI Advertising in 1982. It was the largest junk debt offering of its time.

Consider what was happening in those days. Judge Harold H. Greene had just set in motion the breakup of AT&T in 1982. Some Americans were still talking on party-line phones. Most still rented their handsets from the phone company. Telcom was on copper. Signs inside the Bell System read:

There are two giant entities at work in our country, and they both have an amazing influence on our daily lives … one has given us radar, sonar, stereo, teletype, the transistor, hearing aids, artificial larynxes, talking movies and the telephone. The other has given us the Civil War, the Spanish-American War, the First World War, the Second World War, the Korean War, the Vietnam War, double-digit inflation, double-digit unemployment, the Great Depression, the gasoline crisis, and the Watergate fiasco. Guess which one is now trying to tell the other one how to run its business?

By the end of the ‘80s, AT&T wrote off $6.8 billion in infrastructure as the world moved to fiber and wireless. Cisco, Microsoft, MCI, AOL and McCaw emerged. In the 35 years since, information services have expanded 100-fold. Entirely new markets have formed.

Fast forward to today. American farmers are stuck in a rut, squeezed on price by commoditization and stuck in a corner because of a trade war. What’s on their minds? “How do I de-commoditize my market?” is the question many of them would like to answer.

But if everyone buys the newest genetic crops from Monsanto, the company increases supply and drives down price. And farmers who grow a differentiated product, like organics, still sell to the same grain elevator. Whether the market is a monopoly like AT&T pre-1982, or a near monopsony for ag products made up of ADM, Bungee, Cargill and Dreyfus (ABCD), a handful of people are setting price and innovation comes to a halt. Innovation happens when the consumer’s voice influences products.

Milken, one of the smartest investors ever, underwrote $1.1B in telcom in debt because it unlocked the size of the market. When MCI began offering wireline services in different bundles, it revealed the size of the market to entrepreneurs. Milken revealed latent demand. With that information in hand, Milken led the 80’s underwriting of the explosion in information technology.

Similarly, Beyond Meat gave the world a glimpse of unmet investor demand.

The food/ag market is operating circa 1985. Amazon represents a proxy for MCI. While some debate Amazon’s ability to scale or question the Indigo Ag business model, it doesn’t matter if those two companies survive because their reshaping of the market will drive food system innovation for the next 50 years.

Why? Because Americans do not eat well. They spend about $1.5 trillion a year on food that’s heavy on carbs and sugar. Carbs are cheap and some claim sugar is addictive. To invest in food innovation requires addressing the high cost of good food and the problem of sugar addiction. Milken would say: “Understand latent demand, expose that demand to entrepreneurs and watch the market adapt.”

That harkens back to Anderson’s Yoda-like lesson, which spawns two thoughts: 1. The size of latent demand is the substitute cost Americans spend on healthcare costs for diabetes, cancer and other problems traceable to poor nutrition, which comes to between $500 billion and $1 trillion annually; and 2. Innovators should make good nutrition more addictive than sugar.

If people want to live to 120 and reduce the cost of healthcare, it would require reaching those two goals. Up to $1 trillion is available to the innovator who moves a healthcare dollar to good food.

In the meantime, innovation can de-commoditize farming and attract more capital. Remember that AT&T seemed great until it was broken up. Then innovators revolutionized telcom beyond imagination.

And what’s the future of ABCD? AT&T figured out how to adapt and grow. It just took external innovation to speed things up. Goliath needs David. In fact, a smart Goliath creates a David. That brings an influx of capital.

Similarly, a huge shift is occurring in food:

1. Millennials want high-quality food and aren’t bothered by genetically modified, or GMO, foods. They will be fine with gene-editing because they see gene-editing curing their parent’s cancer.

2. The general consensus on market demand is wrong. The solution is to lower healthcare costs by offering better-tasting healthy food.

3. About 60% of people base purchase decisions on price. Innovators bring the cost of good food below the cost of bad food. Lower prices expand demand.

4. Consumers of the future will choose food not because it’s GMO or non-GMO. They will pick foods based on health, fair trade, absence of fertilizer, pro-biotics

5. Sugar is becoming the new tobacco. Soon, someone will bring a class action suit against the consumer products goods industry because of sugar-laden food. Companies that offer that kind of food could wind up paying for the healthcare costs of diabetes if the plaintiffs win.

Those facts and predictions are based on the work of innovators and startups that are sending the first signals of a changing market. And while markets may seem slow to change, the law of accelerating returns teaches that in the long run change will exceed everyone’s wildest dreams.

Beyond Meat represents an early market signal. More are on the way. It’s a complex market, but it will reveal itself the way telcom did in the ‘80s. Incumbents will adapt as they did then. Spending on healthcare will decrease and spending on better food will increase. Food and health will not get 5% better—they’ll be 10 times better.

And somewhere along the line the bankers will figure out how to price arbitrage. For now, unfortunately for most investors, the alpha is in the private market until the public market learns to price the opportunity. But keep a close watch because these changes are happening quickly. Looking back in 10 years it will seem obvious that the nation was choosing the path to better health.

Carter Williams is managing director and CEO of iSelect Fund, a venture fund focused on the convergence of agriculture, food and health. @jcarterwil