The Top Cannabis Stocks

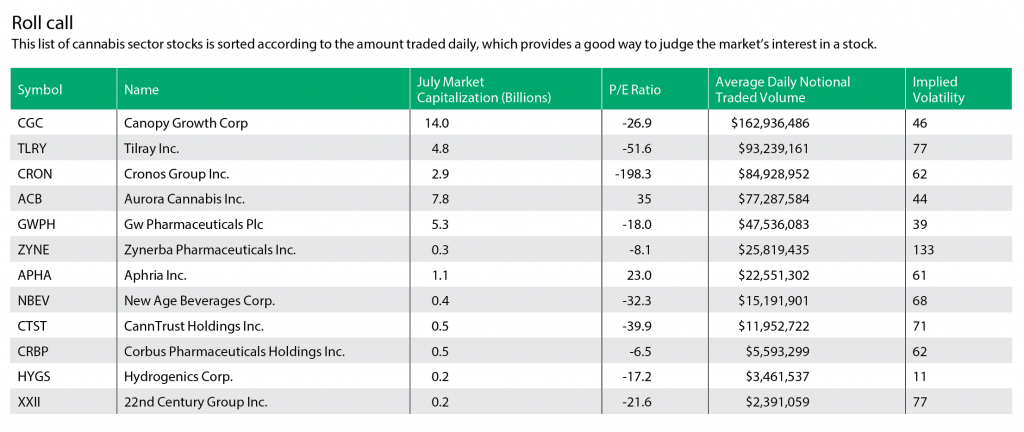

With legalization of pot gaining traction across the country, it’s no surprise that cannabis stocks are becoming more popular. The list of publicly traded cannabis companies below is sorted according to the amount of stock traded daily. For example, Canopy Growth (CGC) trades an average of $162 million daily.

All of the ticker symbols mentioned here are considered cannabis stocks, which is actually more difficult to quantify than it may seem. Some companies like Canopy Growth, Tilray (TLRY) and Cronos Group (CRON) are directly related to the cannabis industry and therefore make the list.

Other companies, such as AbbVie (ABBV), didn’t make the list, even though they appear in other cannabis-related lists. For example, AbbVie markets Marinol—synthetic cannabis that combats weight loss and vomiting in chemo patients and patients with AIDS. While it offers that and other cannabinoid receptor drugs, it’s too much of a stretch to count it as a “pot stock.”

Several things stand out with these companies:

Negative earnings. Most cannabis stocks haven’t made money yet, as shown in negative price-to-earnings (P/E) ratios.

Small companies. Many just aren’t as big as more mainstream companies.

High implied volatilities. The average healthcare stock has an implied volatility of 14%. The average pot stock has an implied volatility of 66%. That means the average pot stock has an expected daily volatility nearly five times greater.

The market is placing a ton of risk on these stocks—caveat emptor. But with the right strategy, luckbox feels OK with high volatility. Instead of buying the stock outright, consider selling the at-the-money put or buy the stock along with a short-call. That may provide more room to be wrong and therefore a high probability of success.

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade. To sign up for free

cherry picks and daily market insights, visit tastytrade.com.