ON Semiconductor: Long-Term Bargain Hunting in the Chip Business

Shares in the company are well off their peak, but a rebound may be on the horizon.

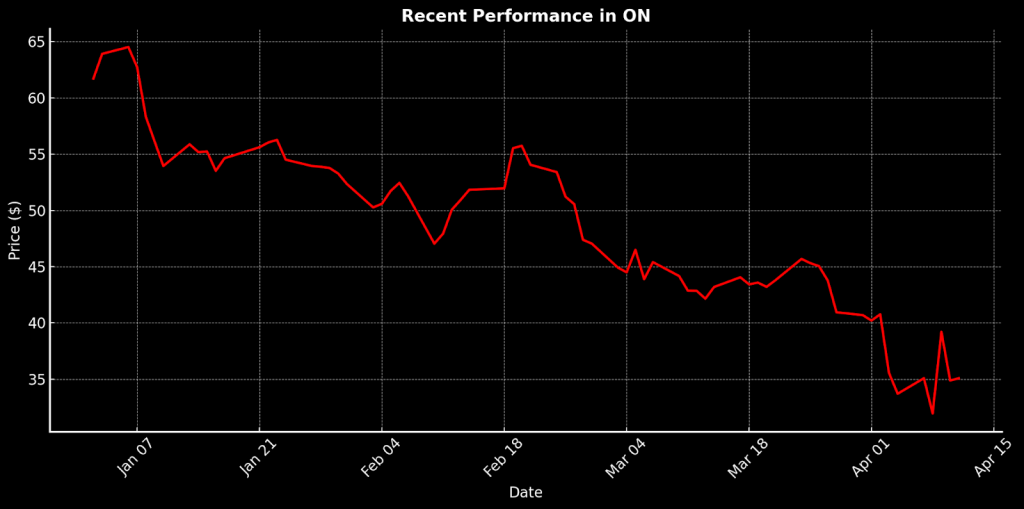

- ON Semiconductor’s stock has dropped nearly 45% over the past 52 weeks.

- But despite challenges, the company is well-positioned in high-growth areas like electric vehicles, industrial automation and energy storage.

- It also has a strong portfolio in silicon carbide (SiC) chips and intelligent sensing technology.

- After the sell-off, the stock offers a compelling valuation, supported by a discounted P/E ratio and strong backing from analysts.

The recent turbulence in the stock market has left many stocks reeling, and ON Semiconductor (ON) is no exception. But when chaos strikes, opportunity often follows—and right now, shares of ON Semi could be presenting just that.

Despite being hammered by geopolitical challenges and economic uncertainty, ON remains a powerhouse in high-growth sectors like electric vehicles, industrial automation and energy storage. Today, we explore why this might be the company’s moment to shine.

Headwinds mount for automotive chips

ON, a global leader in semiconductors, specializes in energy-efficient technology for a wide range of industries, including automotive, communications, industrial automation and consumer electronics. The company, founded in 1999 and based in Phoenix, operates on a global scale, with a strong presence in North America, Europe and Asia.

Known for its expertise in analog and power semiconductors, ON has positioned itself as a player in the transition toward electrification and automation by providing essential components for cutting-edge technology. Its diverse products include silicon carbide (SiC) chips, automotive image sensors, power management products and industrial automation systems—making it an integral part of industries poised for growth, such as electric vehicles (EVs) and industrial robotics.

A pillar of ON’s strategy has been its leadership in the rapidly expanding silicon carbide (SiC) chip market. SiC technology plays a crucial role in enabling energy-efficient power conversion, giving the company a strong foothold in electric vehicles. The company’s acquisition of Qorvo’s silicon carbide JFET business has enhanced its capabilities in that market, positioning it as a leader in the SiC niche behind only STMicroelectronics (STM). Neanwhile, ON’s intelligent sensing technology, including radar, lidar and time-of-flight sensors, is essential for autonomous vehicles and smart cities. Its power solutions, which account for a material portion of its revenue, enable advances in energy storage, industrial robotics and renewable energy, providing the company with multiple avenues for long-term growth.

Despite such progress, the company has faced challenges in recent years, particularly as global economic conditions have weakened. The current trade war, particularly tariffs on semiconductor imports, has increased pressure on the industry as a whole. Like many of its peers, ON has had to contend with these headwinds, which have led to higher costs and reduced demand in some markets. Moreover, the broader semiconductor market, particularly in analog and power semiconductors, has experienced a downturn, with ON’s stock dropping significantly from its 2023 peak. Over the last 52 weeks, shares have fallen by roughly 45%.

However, the news isn’t all bad. ON has made strides in operational efficiency, shifting production capacity toward higher-value products and optimizing its supply chain. These strategic moves, along with a growing presence in the EV and industrial automation markets, position the company for success, even as it navigates macroeconomic uncertainties and geopolitical risk.

Weak earnings guidance dampens sentiment

One of the reasons that shares in ON have been under pressure is the company’s Q4 (and full year) earnings report. Last quarter, the company posted revenue of $1.72 billion, just missing analysts’ consensus estimates of $1.76 billion. Non-GAAP earnings per share came in at $0.95, below the $0.97 the market expected. Despite that, its non-GAAP gross margin for the quarter remained strong at 45%, signaling an ability to manage costs effectively in a turbulent market. However, the company’s revenue performance was negatively affected by a decline across three key business segments: power solutions, advanced solutions and intelligent sensing.

Looking ahead, ON’s guidance for the first quarter of the new fiscal year was below expectations, projecting revenue of between $1.35 billion and $1.45 billion, which is considerably lower than analysts’ forecast of $1.69 billion. This projection constitutes an 18% quarter-over-quarter decline, driven by soft demand in the automotive and industrial sectors. The company also anticipates a drop in its earnings per share, with a forecast range of $0.45 to $0.55, well below Wall Street’s estimate of $0.89. This guidance reflects continued struggles the semiconductor market, including overstocked inventories and uncertainty in the economy.

ON’s automotive segment, which produces a large portion of its revenue, faced a particularly sharp decline in Q4, growing only 8% sequentially. The company attributed that softer automotive demand to saturated inventory and geopolitical concern, including the uncertainty surrounding President Trump’s aggressive tariff policies on global automotive sales. These issues, coupled with the broader challenges in the industrial sector, are a big reason for the softened guidance. Overall, the near-term outlook remains uncertain, mirroring the challenges faced by many other companies.

Valuation looks favorable, but risk is elevated

As a result of the sharp pullback in its stock, ON is now trading at a significant discount compared to its sector peers. This suggests a compelling opportunity for investors, particularly those looking for exposure to a company with strong growth potential—albeit with some near-term uncertainty because of the headwinds in the automotive sector and broader economy.

The company’s P/E ratio of 9.8 stands well below the sector median of 25.2, suggesting ON is undervalued relative to its peers. A lower P/E ratio typically indicates investors are paying less for each dollar of earnings, which can be a strong signal of an attractive investment, especially in sectors poised for recovery or growth. In ON’s case, its underperformance in the automotive and industrial markets has contributed to this lower valuation, but the company’s focus on high-margin sectors like electrification and industrial automation provides the potential for a sharp recovery, once these markets stabilize.

ON’s price-to-sales (P/S) ratio of 2.1, compared to the sector median of 2.6, underscores the stock’s strong relative value. The P/S ratio provides insight into how much investors are willing to pay for every dollar of revenue. A lower P/S ratio can indicate a stock is undervalued, and in ON’s case, this could reflect an opportunity for investors to acquire shares at a more reasonable price relative to the company’s revenue generation. With the automotive sector in a temporary slump and soft demand for chips, the market may be pricing in more pessimistic growth prospects than are warranted by the company’s diversified product portfolio.

Its price-to-book (P/B) ratio of 1.7 is likewise attractive, compared to the sector’s median of 2.9. The P/B ratio reflects how much investors are willing to pay for each dollar of net assets. A lower P/B ratio usually indicates a stock is trading at a discount to its book value, offering potential for investors looking for value. This depressed P/B ratio suggests the market may not fully appreciate the value embedded in its high-quality assets.

Of the 32 analysts covering ON, 19 rate the stock as “buy” or “overweight,” indicating a consensus that the stock has significant upside potential. The average analyst price target of $59 per share is also considerably higher than its current price of $36, which could offer attractive upside for investors willing to weather near-term volatility.

Takeaways

All told, ON Semiconductor’s stock presents a compelling opportunity, with its undervalued valuation metrics and strong positioning in notable growth areas, such as electric vehicles, industrial automation and energy storage. Despite recent headwinds in the automotive sector, including soft demand and tariff concerns, the company’s diversified product portfolio, strategic acquisitions and continuing improvements in operations suggest the company could regain its footing soon.

Still, the latest bout of market volatility means a prudent approach might be dollar-cost averaging (DCA) into a new position (or adding to an existing one). Investing gradually over time can help mitigate the risk of buying too heavily into a potential market correction, while still gaining exposure to a stock that could experience substantial upside once macroeconomic conditions stabilize. This strategy could be particularly effective for those looking to balance the near-term risks with ON’s attractive long-term prospects.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.