Trading the Market’s Revised Outlook for Interest Rates in 2022

Market activity suggests the Federal Reserve will raise benchmark interest rates by another 0.75-1.00% on September 21, with the federal funds rate now expected to peak somewhere between 4.25% and 4.50% in Q1 2023.

As evidenced by the big drop in the major U.S. stock indices on Sept. 13, interest rates remain one of the most influential drivers of the market in 2022.

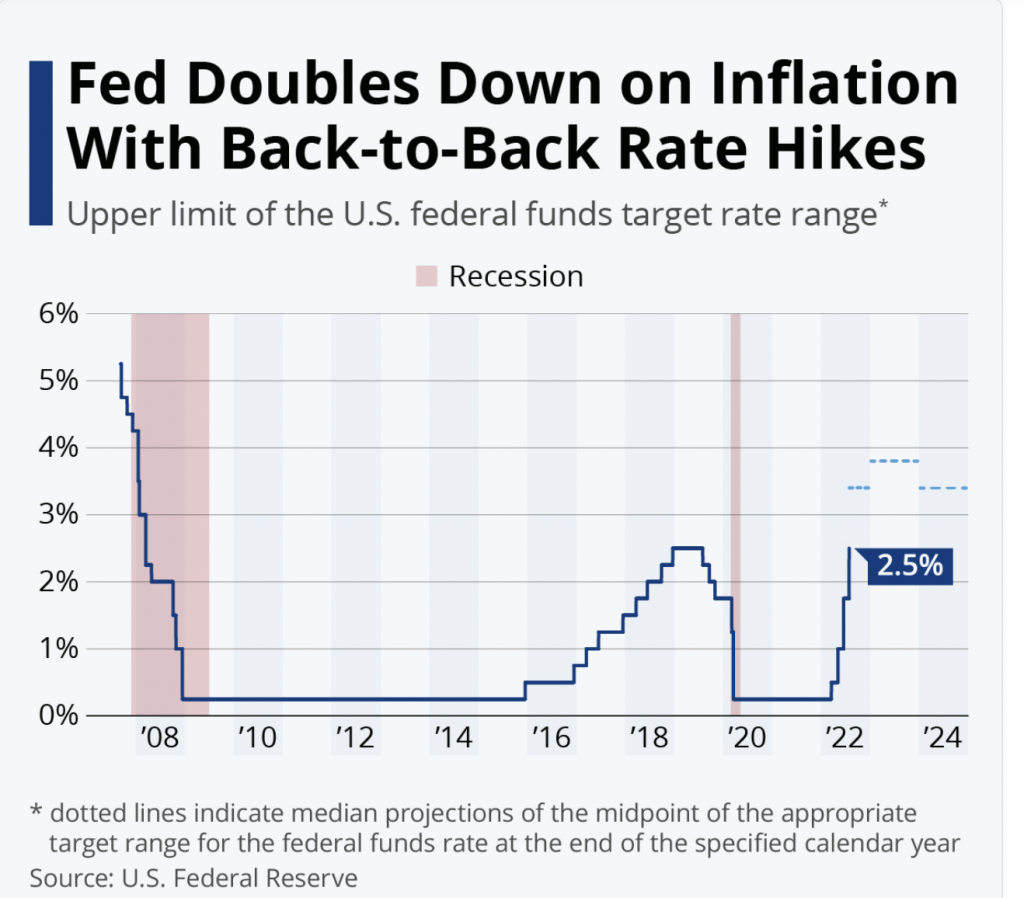

Interest rates became a focus on Wall Street back in March of this year when the U.S. Federal Reserve raised the federal funds rate for the first time since 2018.

At that time, leaders at the Federal Reserve increased the federal funds rate—the benchmark for short-term interest rates in the U.S.—by a quarter of a percentage point. The federal funds rate is often quoted with a range, and in the wake of that March 2022 Fed meeting, the target range for the federal funds rate was 0.25%-0.50%.

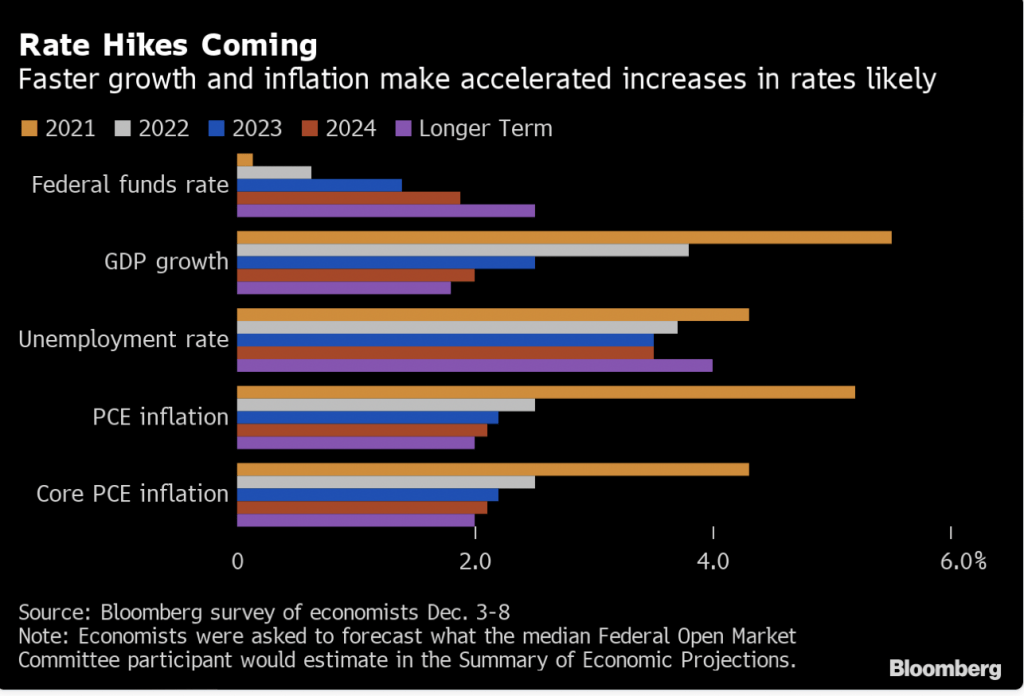

Back in March, most projections indicated that the federal funds rate would increase to roughly 1.75%-2.00% by the end of the year.

Unfortunately, however, economic conditions in the United States have forced the Federal Reserve to adopt a more aggressive approach. Inflation has been running red-hot in the U.S. (and around the world) during 2022, and leaders at the U.S. central bank have been aggressively raising interest rates to help cool it down.

Just days ago, the U.S. government released inflation figures for August, and while inflation has cooled somewhat since June, the August figures were still higher than anticipated.

According to the August report, inflation has been running at about 8.3% during the last 12 months. That’s down slightly from the June reading of 9.1%. But most had been hoping that the Fed’s hawkish approach would have pushed the August number down to 8%, or lower.

As most are well aware, the stock market responded quickly and definitively to the latest inflation report, with the major indices cratering on Sept. 13.

Prevailing opinion suggests the Federal Reserve will now have to tighten rates more than expected at its next meeting, which is scheduled for Sept. 20-21.

Where Do Interest Rates Go From Here?

At present, the federal funds rate is targeted at between 2.25% and 2.50%. As referenced previously, when the Fed first started raising rates back in March, most projections suggested that the federal funds rate would end the year at around 2.00%. That means as of September, benchmark rates are already above the year-end projections.

Based on recent activity in the interest rates market, the expectation is that the Fed will raise rates by another 0.75-1.00% next week, during the September 20-21 meeting. That means by September 21 the new range in the federal funds rate will likely be either 3.00-3.25% or 3.25-3.50%.

Moreover, updated forecasts now suggest that the federal funds rate could rise as high as 4.25% by the end of 2022, or early 2023. And that revision is mostly due to the August inflation figure. In comparison, as of late August, most projections suggested that the federal funds rate would end 2022 at around 3.50%.

With two meetings left in 2022, that means that U.S. central bankers could raise rates by another full point during one of those meetings, or by a half-percentage point during each of them.

Obviously, the precise path taken by the Fed will depend heavily on the pace of inflation in September and October. If there are any downside surprises to the inflation figures during those two months, the Fed may decide to temper its approach. Slowing growth in the economy, or weak employment numbers could also weaken the Fed’s resolve.

Regardless, most analysts see the federal funds rate peaking between 4.25-4.50% during H1 2023. If benchmark rates move any higher than that, most expect a severe contraction in the underlying economy. And that outcome is littered with serious pitfalls, as well.

For reference, the last two meetings of the Federal Reserve are currently set for Nov. 1-2 and Dec. 13-14.

For more background on the federal funds rate, and its role in the financial markets, readers can check out a new installment of Truth or Skepticism featuring tastytrade co-founder Tom Sosnoff and longtime business pundit Dylan Ratigan.

To learn more about trading interest rates using U.S. Treasury yields, readers are encouraged to review these previous episodes of Small Stakes on the tastytrade financial network:

- Small Stakes: Introducing the Small Treasury Yield (S10Y)

- Small Stakes: How to Trade Interest Rate Futures

- Small Stakes: Managing Stock Risk with Bonds

For daily updates on everything moving the markets, readers can also check out TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.