Covered Strangle

A bullish bet with some added protection

Investors often hear they should “buy low and sell high.” But when the opportunity arises, they can feel reluctant to commit capital. The inverse is also true. They may hesitate to sell stocks because they fear they’ll miss out on profits.

As discussed in the August Luckbox, a covered call is an excellent strategy for counteracting the second situation. However, there’s still the question of how investors can buy low and sell high. With covered strangles, they can do both.

A covered strangle combines strategies that when used together can lead to limited upside profit potential and the capacity to generate income. The first component is a covered call, a two-part strategy consisting of long shares of stock and short calls. For more information, refer to the Cheat Sheet from the August Luckbox. The second component, a short naked put, increases the initial credit collected, decreasing cost basis and/or increasing possible income.

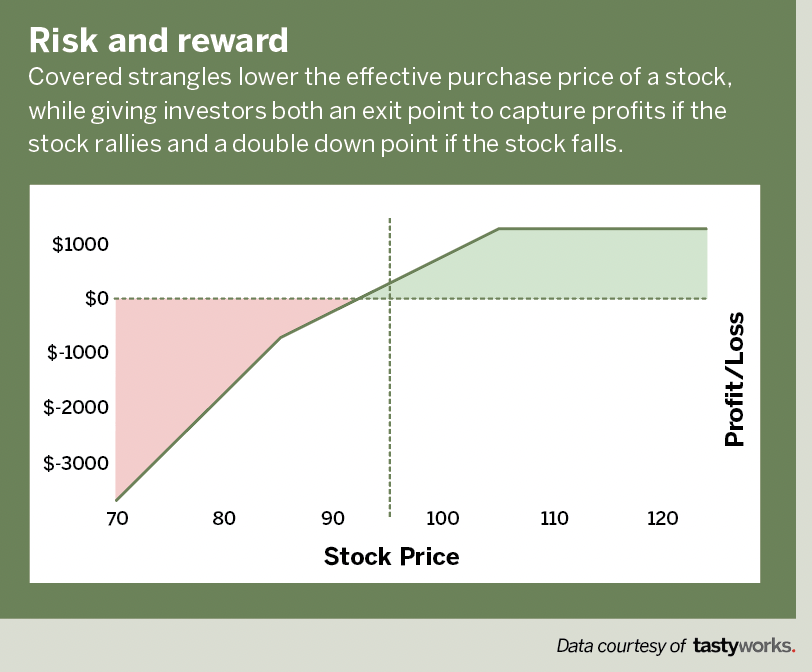

Investors use a covered strangle when they have a bullish bias on an underlying. The short call component of the covered strangle provides an upside cap to the potential returns but does reduce the cost basis for the long shares, providing some downside relief.

The short put component also reduces the cost basis for the long shares because of the additional premium. The short put acts as a place to “double down” on an existing position, so if the underlying drops to the strike price of the put, then the investor buys 100 more long shares.

Consider an example of a covered strangle in Exxon Mobil Corp. (XOM). Assuming Exxon has a share price of $95, it would cost $9,500 to buy 100 shares and an investor could sell a call with a strike price of $105 for approximately

$1.35 per share.

To turn this covered call into a covered strangle, the investor would then sell a put that has a delta similar to the call, such as the $85 put for $1.60 per share. This would then make the effective purchase price $92.05 per share for Exxon, while providing a profit target and an opportunity to double down on this position.

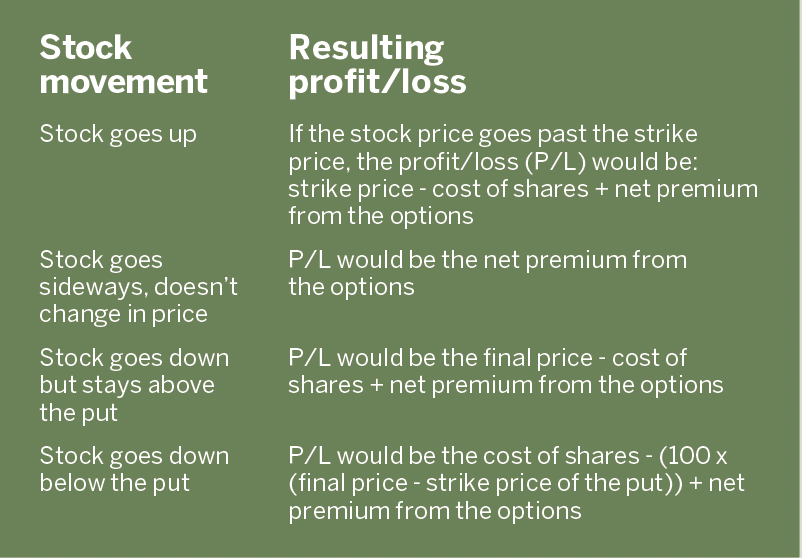

The table P/Ls assume 100 shares, 1 call, and 1 put. So the resulting P/Ls should be multiplied by 100 when trying to work out the numbers.

Eddie Rajcevic, a member of the tastytrade Research Team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11