Metrics & Mechanics

Alleviate the guesswork and reduce the risk of trade decision-making

The market reacts to the decisions of millions of traders and even expresses their emotions. It does both by establishing equity prices from moment to moment. That’s why a well-defined set of mechanics can help alleviate the guesswork of trade decisions. This cheat sheet was created with those mechanics in mind.

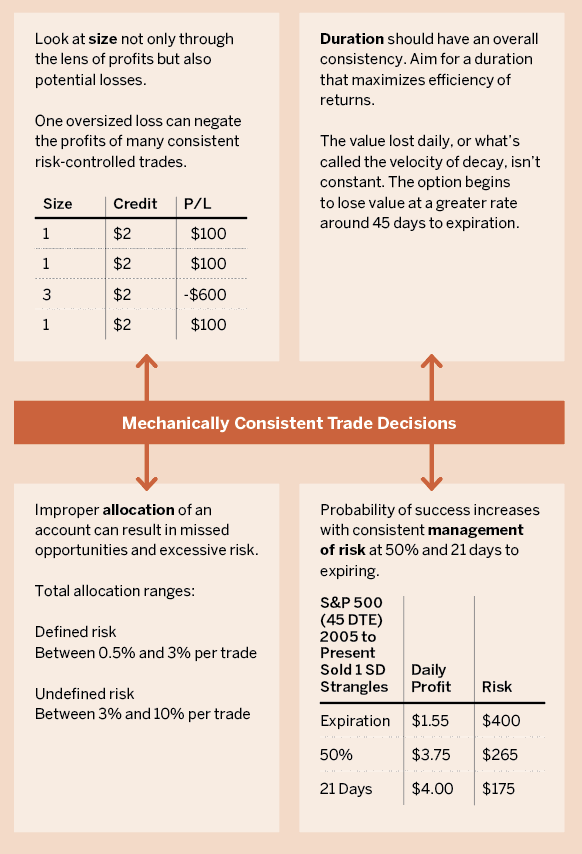

First, consider size consistency. As one reviews the metrics and plays through the scenarios and outcomes, the game of multiples begins to occur. Take what a trader might make on a one lot position and multiply it by 10 to reflect how sweet the outcome could be. In the table to the right, size emerges as a hidden danger: Put on too much and give the profit away. Stay consistent with size. While the hope of a significant return is seductive, the reality of a big loss can make for a bad day.

This observation also fits for the duration. Consider moderation. Forty-five days is the magic number to maximize theta decay. So, we place a trade between 30 and 60 days.

Find proper allocation. Failure to do so can lead to missed opportunities and excessive risk. Use the table as a guide for allocation of defined- and undefined-risk trades.

Finally, don’t guess when to get out of a trade. Follow the rule of 50% or 21 days: If the trade reaches 50% of max profit, then it’s time to close out. But, either way, always close out at 21 days.

Research has established that consistent trade mechanics improve profits and heighten the probability of success. Consistency keeps traders on track and in the game, ultimately limiting guesswork in trade decision-making.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79