Delta Force

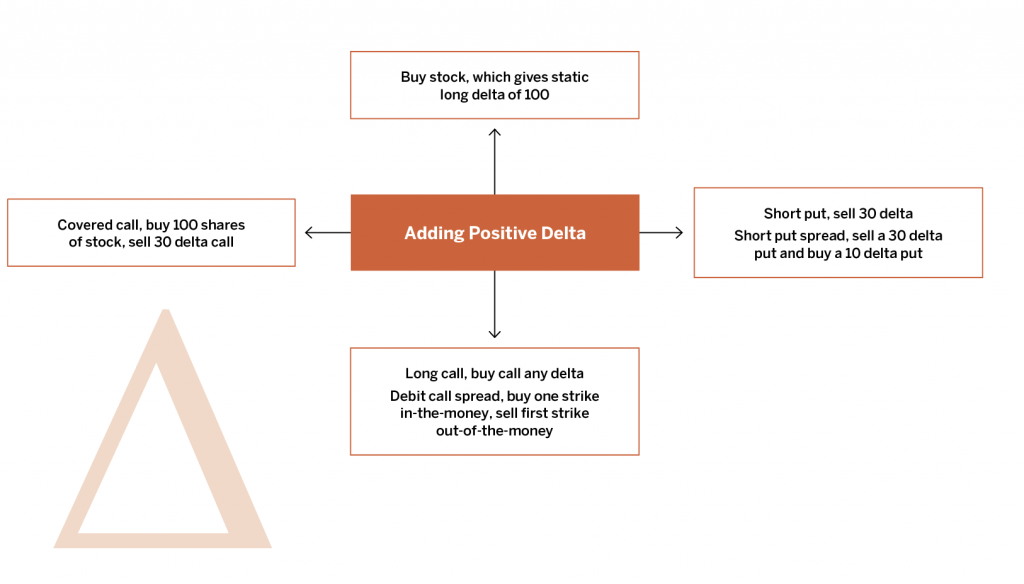

Choose from the many ways to add positive delta to a portfolio

A contrarian strategy suggests buying into weakness and selling into strength. From that standpoint, the market currently resides in the territory of buying into weakness. To take that approach, know the ways to get long on an underlying. That can also be called adding positive delta to a portfolio.

Delta tells which way a position needs to move in order to profit. When delta is positive, the underlying needs to move higher. It’s the opposite when negative. So if the assumption is bullish, an investor needs positive delta.

Traders can choose from many ways to add long delta to a portfolio. The easiest and arguably most efficient way is the purchase of outright stock. That will generate a positive delta of 100 and, regardless of movement of underlying, will remain at 100. That means that if the underlying moves up $1, the position profits by $100.

Using options is another way to add positive delta. If a trader is long the stock and sells a 30 delta call against it, she creates what’s known as a covered call. The premium collected from the sale of the call improves basis while adding 70 (100 delta stock – 30 delta call) positive deltas.

Other ways to get long with options include defined-risk strategies such as the short put- or long call-spread, or naked strategies such as the short put or long call. The number of long deltas gained by each strategy dictates the risk of the overall position.

Recognizing multiple ways to add long delta—and at varying risk tolerances based on delta—allows for greater flexibility when getting long.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team.

Active Investor Alert!

Follow @mikehart79 on Twitter for daily trading ideas and tactics.