This or That: Gold-focused ETFs Outperform Gold Mining Stocks During Recessions

Gold prices are up about 10% so far in 2023, but for those expecting a recession to develop in the foreseeable future, it may be best to avoid gold mining stocks

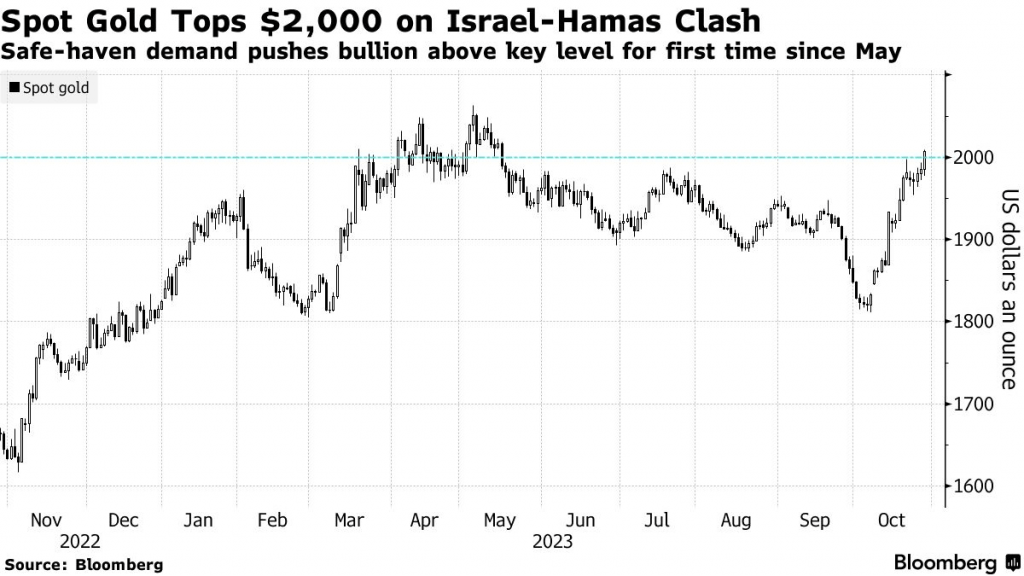

- Gold prices are up roughly 10% so far in 2023, and recently pushed toward the previous all-time high, which was set in August of 2020.

- Traditionally, gold prices share an inverse correlation with the U.S. dollar, but of late, both assets have been appreciating in value.

- Historical data suggests that if a recession were to materialize, gold-focused ETFs like the SPDR Gold Trust (GLD) would likely outperform gold mining stocks.

As predicted, the U.S. economy grew in robust fashion during Q3. Last quarter, U.S. gross domestic product (GDP) grew by 4.9%.

Excluding the post-pandemic recovery, that’s one of the strongest quarterly growth rates in the United States over the last decade. However, it may be premature to pop the champagne.

Going forward, the economy is expected to grow at a much slower pace, and potentially even slip into negative territory at some point in H1 2024.

Considering that backdrop, many investors and traders are likely asking themselves where they can park capital. And for some, the answer might be gold, or gold-focused securities.

Gold prices have actually been on the move lately, with the world’s best-known precious metal recently rallying above $2,000/ounce—about $75 per ounce short of its all-time high. Gold is up about 10% so far in 2023.

Considering all that’s happening in the world at the present moment (e.g. two major world wars and a potential economic slowdown), it’s difficult to pinpoint whether the recent bounce in gold prices was attributable to a “flight to safety,” a strategic rotation, or simply because gold is the “flavor of the month” in the markets.

Regardless, there’s undoubtedly some market participants that are looking to take advantage of recent momentum in this niche of the financial markets. And there are three primary ways that investors and traders can access the gold markets.

The first is physical gold, which is represented by gold coins, gold, bars, gold jewelry, etc… The second avenue is gold futures, which effectively represents a promise to buy gold in the future. Alternatively, investors and traders can also invest in gold-focused equities, such as gold mining companies and gold-focused ETFs. For example, the well-known SPDR Gold Trust (GLD).

The exact avenue by which one invests in gold will vary based on one’s outlook, investing approach and risk profile.

For example, if one were to buy gold as a safe haven—to protect against a breakdown in the financial system—then physical gold (coins, bars, jewelry) might make sense. That’s because a system-wide financial crisis could negatively impact the stock market (i.e. gold stocks) and/or the futures markets (i.e. gold futures).

A Brief Background on Gold’s Historical Relationship with the U.S. Dollar

One key dynamic to be aware of in this sector is that gold prices traditionally exhibit an inverse correlation with the U.S. dollar.

In that regard, gold prices often move higher when the dollar is moving lower because investors/traders in the currency markets tend to buy gold (and other assets) when the greenback is weakening. The reverse is true when the dollar is strengthening.

Another dynamic in this market is that gold is priced in U.S. dollars. That means when the U.S. dollar is losing value, more dollars are required to buy the same amount of gold. Alternatively, when the U.S. dollar is appreciating in value, fewer dollars are required to buy the same amount of gold.

For the aforementioned reasons, investors and traders deploying short-term capital in the gold market may first want to consider their outlook on the U.S. dollar. If one expects the dollar to depreciate in the foreseeable future, then an attractive opportunity may exist to buy gold.

On the other hand, if an investor or trader were expecting the dollar to strengthen during the foreseeable future, then a long gold trade may not be optimal. For investors with a longer-term perspective, however, the dollar dynamic may be moot—especially for “gold bugs” that firmly believe in the metal’s future potential.

Investing in Gold Amidst the Threat of a Recession

At this time, one of the big considerations in the gold market is the potential for a recession.

Historically, the stock market has underperformed during previous recessions. Moreover, these periods have also encompassed sharp corrections in the stock market, which can trigger so-called “flights to safety.”

Gold is traditionally one of the beneficiaries of such flights to safety, as are government bonds.

As mentioned previously, physical gold is one possible candidate for investors and traders that are looking to protect their capital from shocks to the financial system. However, one also has to keep in mind that there’s a security element to this choice, as physical gold needs to be stored in a secure manner.

The added storage cost/risk associated with physical gold may not be preferred for some market participants.

Futures markets represent another avenue for investing in gold. A futures contract essentially represents a promise to purchase a specific amount of gold for a specific price at a predetermined date in the future.

If an investor or trader holds a futures contract through expiration, then he/she must take delivery of the physical gold. However, the vast majority of futures contracts are closed prior to expiration.

The one challenge for gold futures is that notional values in traditional futures markets are high, which means significant capital is required to efficiently trade the commodities futures markets. That said, new products have entered the marketplace which offer small investors and traders a more capital-efficient method to access commodities futures.

Due to the capital constraints and complexity of the futures markets, some investors and traders instead choose to access gold exposure through the equity markets. Assuming this approach fits one’s outlook, trading approach and risk profile, this can also be effective.

However, before entering a gold-focused position in the equities market, investors and traders should be aware of the nuances of trading these securities. Gold-focused equities include the companies that mine for gold, as well as gold-focused ETFs.

Some of the best-known gold mining stocks are highlighted below (sorted by year-to-date return):

- Harmony Gold (HMY), +33%

- Gold Fields (GFI), +25%

- Kinross Gold (KGC), +24%

- Alamos Gold (AGI), +24%

- Franco-Nevada Corp (FNV), 0%

- Barrick Gold (GOLD), -8%

- Agnico Eagle Mines (AEM), -9%

- Royal Gold (RGLD), -9%

- Freeport-McMoRan (FCX), -11%

- Newmont Corp (NEM), -20%

The gold miners are somewhat unique because they can sometimes exhibit split personalities.

That’s because companies that mine gold are partly exposed to the underlying price of gold, and partly exposed to the general direction of the stock market. The former because they mine and sell gold—thus relying on prevailing prices—and the latter because they are publicly traded stocks.

Looking at an example, one can see that shares of Newmont Corp (NEM)—the largest capitalized gold mining company in the U.S.—have exhibited significant volatility during previous economic recessions. Amidst the 2008-2009 Great Recession, shares in Nemont corrected by about 50% (January 2008 to November 2008).

Along those same lines, shares of Barrick Gold (GOLD) also declined by more than 50% during that same period.

In contrast, gold prices only corrected by about 25% during this same period, while the overall stock market corrected by more than 50%. These figures help illustrate how gold mining stocks traded more in line with the stock market during that financial crisis, as opposed to trading like proxies for gold.

Importantly, ETFs like the SPDR Gold Trust (GLD) traded more closely in line with the gold market during the Great Recession. From peak to trough in 2008, GLD sank by about 25%, which was right in line with the pullback in the broader gold market.

These examples help illustrate how gold ETFs like SPDR Gold Trust (GLD) and the iShares Gold Trust (IAU) represent a different investment proposition than the gold miners. Both of these ETFs are up roughly 9% so far in 2023, which is closely in line with the 10% positive return in gold prices.

A brief examination of historical correlation data also supports this course of action. According to research conducted by tastylive, the average 3-month correlation between GLD and /GC (e.g. gold futures) is about 0.87, which is extremely high. For comparison the historical correlation between gold and silver—which tend to trade in lockstep—is roughly 0.89.

Taking all of the above into account, investors and traders expecting a recession may want to bypass the gold mining stocks, and instead focus on physical gold, gold futures or gold-focused ETFs such as GLD, IAU or the SPDR Gold MiniShares Trust (GLDM). Watch this video to learn more about such a GLD trade.

To follow everything moving the markets, including the commodities markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.