Reality Check: A Recession is Still Expected in 2024

The Atlanta Fed GDPNow tracker projects that the U.S. economy will grow at a rate of 5% in 2023, but a recession is still expected to develop at some point in H1 2024

- The Atlanta Fed GDPNow tracker projects that the U.S. economy will grow at a robust rate of 5% in 2023.

- Interest rates markets currently project that the Fed will cut rates starting in summer of 2024.

- The Fed typically cuts rates about 11 months after the completion of a tightening cycle, which would equate to June/July of 2024.

Back in 1939, Winston Churchill described Russia as “a riddle wrapped in a mystery inside an enigma.” These days, that quote could just as easily be used to describe the U.S. economy.

Interest rates in the United States have crested toward multi-decade highs, but despite that significant headwind, the U.S. economy continues to grow.

And somewhat unbelievably, the Atlanta Fed GDPNow tracker now projects that Q3 GDP growth could clock in at nearly 5%. Excluding the post-pandemic recovery, that would be one of the highest quarterly growth rates in the United States over the last decade.

Since 2013, the only other quarter that saw 5% GDP growth was Q2 of 2014, when the economy grew by 5.2% (again, excluding the post-pandemic expansion period).

What’s most interesting about the current situation is that several long-time recession indicators are also flashing red. As many investors and traders are well aware, the U.S. yield curve has been inverted since July of 2022.

In the last 40+ years, virtually every major U.S. economic recession has been foreshadowed by a similar inversion of the yield curve. However, the yield curve isn’t the only recession indicator that’s flashing red at this time.

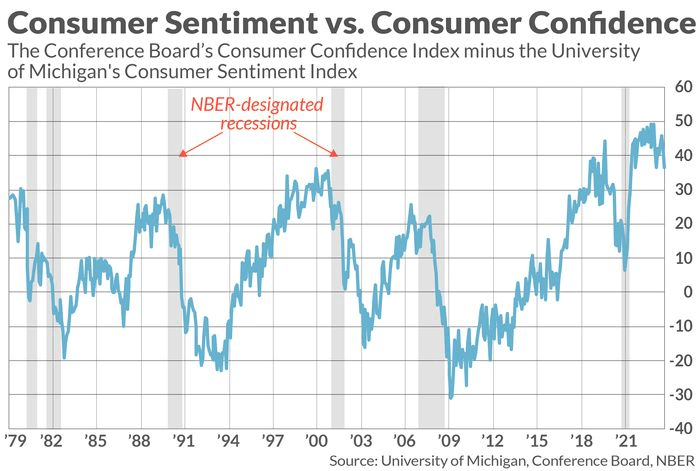

Another highly accurate recession barometer is calculated by subtracting the University of Michigan’s Index of Consumer Sentiment (UMICS) from the Conference Board’s Consumer Confidence Index (CCI).

Historically, the U.S. economy tends to enter a recession when the difference between these two indices widens, and then rapidly contracts. Going back to 1979, the U.S. economy has entered a recession nearly 100% of the time when that pattern emerges.

Notably, these two indices widened to roughly 50 points in December, and then shrunk to about 37 in recent weeks. That represents a narrowing of about 13 points.

If the difference between these two indices shrinks a little more—down to roughly 10—that would be on par with the pattern observed immediately prior to the five recessions observed between 1979 and 2008.

The reason this gauge has been so accurate historically is that people generally start to worry about their own personal finances first, which is reflected by a decline in sentiment. But if the economy continues to weaken, those concerns tend to cascade, and spill over into consumer confidence.

That’s why the underlying economy represents such a riddle at this time, because it almost seems to possess a split personality—much like Dr. Jekyll and Mr. Hyde. On the one hand, the economy is expected to grow at a healthy clip in Q3, but on the other, there are reliable indicators that suggest a recession could take hold in the near future.

It’s possible that the economy’s duplicitous behavior stems from the so-called “lag effect.”

According to this economic theory, the impact of higher rates doesn’t start to weigh on the economy until many months after interest rates hit a critical level. For example, in a January 2023 speech at the Council on Foreign Relations, Federal Reserve Governor Christopher Waller estimated that in the modern era, the lagging impact of higher interest rates tends to be “nine to 12 months.”

That begs the following questions. Did rates get critically high in March 2023, when they rose above 4.50%? Or not until May 2023, when they surged past 5.00%?

Depending on the assumption one uses for “critically high rates,” the lag effect suggests that a recession could develop at some point in the first half of 2024.

First Rate Cut Now Expected in Summer of 2024

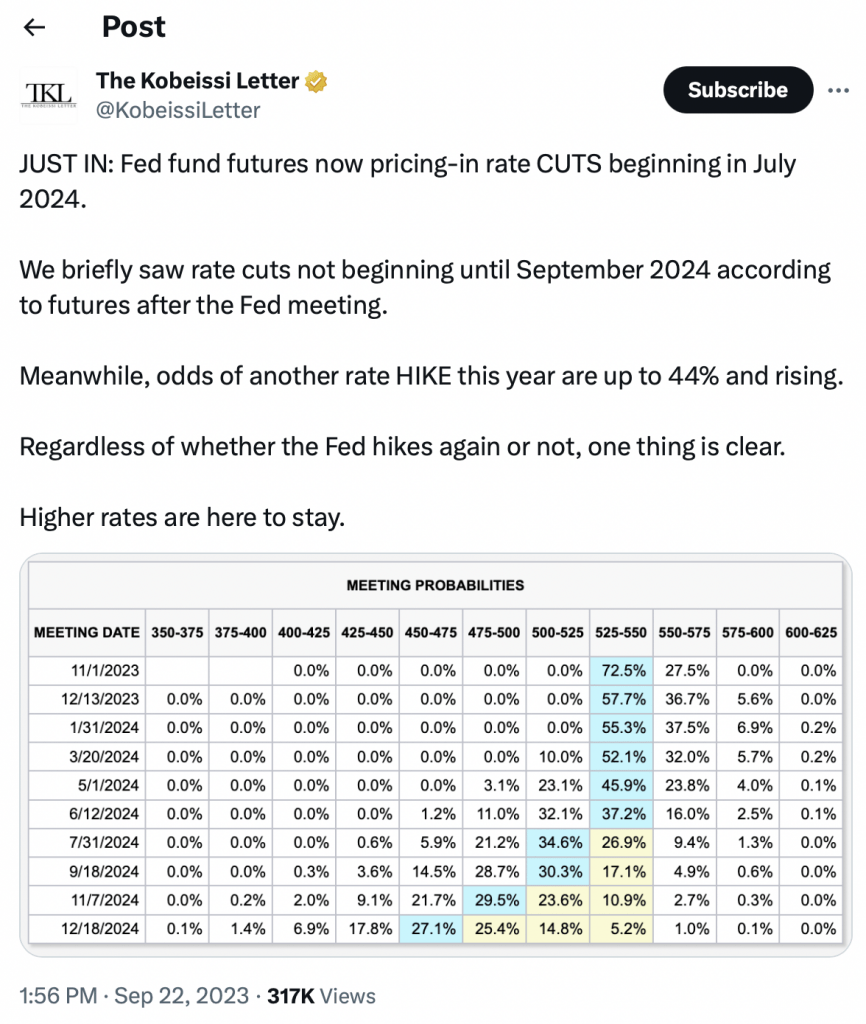

Importantly, there’s additional data that suggests the economy could weaken at some point during H1 2023. Right now, the interest rates market is projecting that the Federal Reserve will cut benchmark interest rates in July of 2024.

Traditionally, the Fed cuts rates in order to accommodate a slowing economy, because lower rates typically catalyze increased borrowing, which in turn contributes to stronger economic growth. That means in order to project a rate cut by next July, one would have to assume that the economy would weaken at some point prior to that.

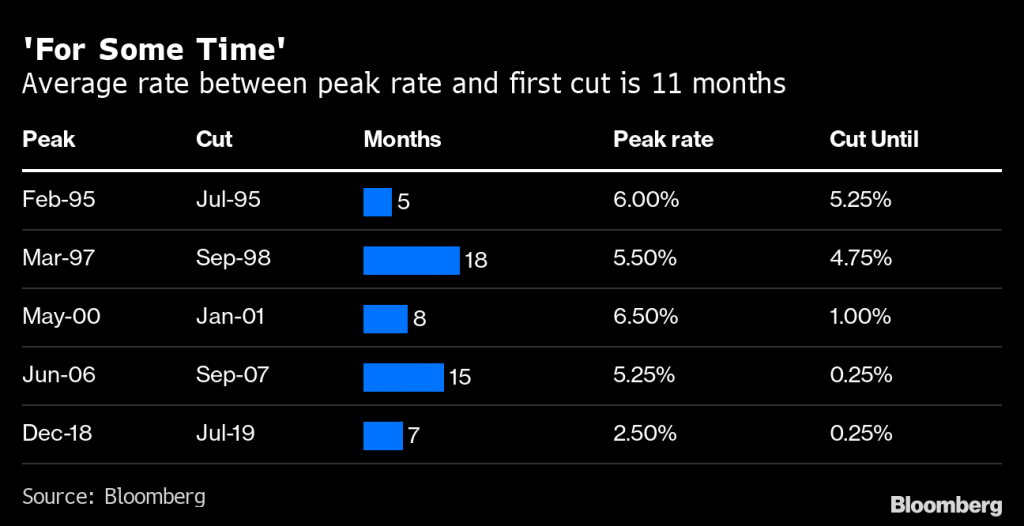

Interestingly, there’s other evidence that a rate cut could materialize by June or July of next year. According to historical data compiled by Bloomberg, the Fed typically cuts rates about 11 months (on average) after the final rate hike in a tightening cycle, as illustrated below.

Because the Fed last raised rates at the end of July, the aforementioned data suggests the first rate cut could arrive by June of 2024, which matches closely with the current July 2024 forecast implied by the interest rates market.

Taken all together, it appears a slowdown in the U.S. economy could develop at some point in Q2 of 2024, which would in turn necessitate a rate cut by the Federal Reserve in early summer.

That said, it’s difficult to assign a degree of accuracy to those projections. Moreover, something unexpected might occur, which could unexpectedly weaken or strengthen the economy. That’s why investors and traders need to remain vigilant going forward.

Looking back at history, economic recessions/depressions in the U.S. are almost always accompanied by corrections in the stock market. To wit, there have been 13 major bear markets in the market since 1946, and 10 of those 13 were accompanied by recessions/depressions, which may help explain why the stock market has pulled back in recent weeks.

To learn more about how the stock market has performed during previous recessions, readers can check out this previous Luckbox article. To follow everything moving the markets this year, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.