It’s Your Move

Trading platforms offer built-in tools that point toward expected stock prices

The market is defined from moment to moment by every single decision made by each trader—combined with all of the decisions made by all of the other traders—and instantly processed

and displayed.

With each tick up, down or sideways, the winners and losers prepare for their next trade. For most traders, that preparation centers on forecasting future movement.

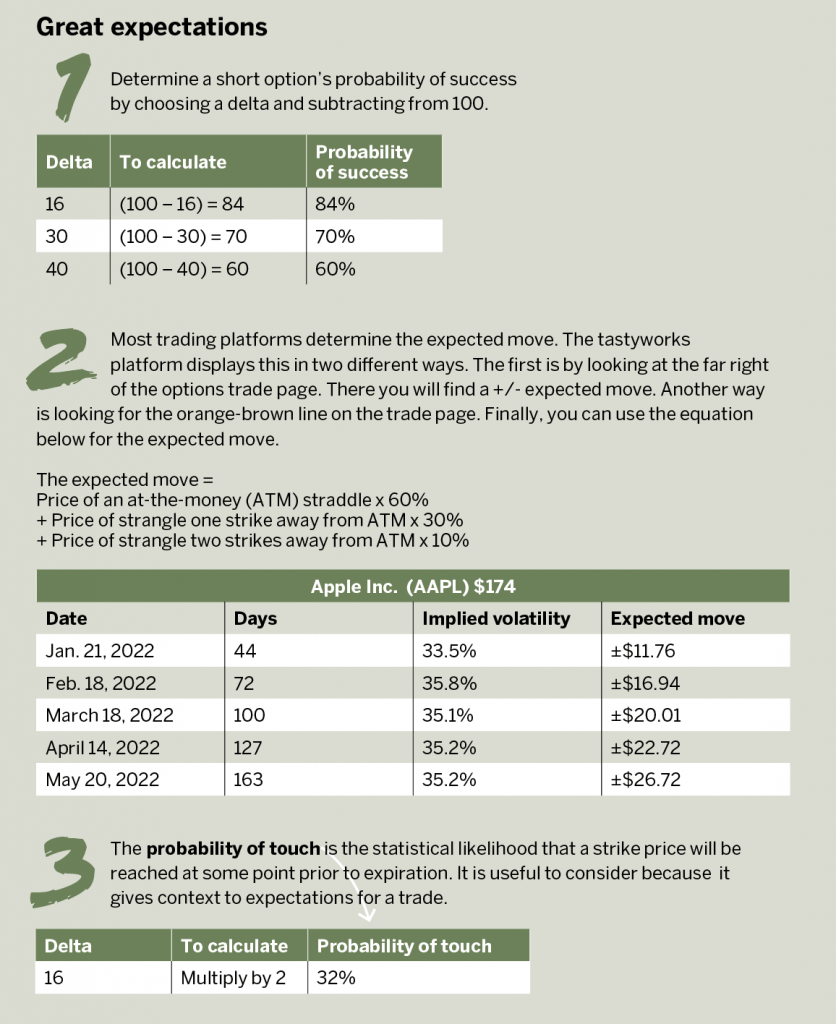

While some traders rely on instinct to predict the movement of the market, others improve their odds of success by using tools built into their trading platform.

Those tools can do the math and point to the expected movement of a market over a given period of time. Then the tools take another step and determine the probability of a future move and the probability of touch.

The probability of touch is the likelihood that a stock will trade up or down to a strike price at some point between now and expiration. But it may not stay at that level.

Using options, traders can estimate the movement of a market over a given time period. They can take that another step further and determine the probability of a future move, including when it may occur. They

can also determine the probability

of touch.

Mike Hart, a former floor trader at the Chicago Stock Exchange and proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79