Bitcoin Mining is Spewing Carbon

By Ed McKinley

Producing bitcoins uses as much electricity as the nation of Argentina, but cardano is offering an alternative

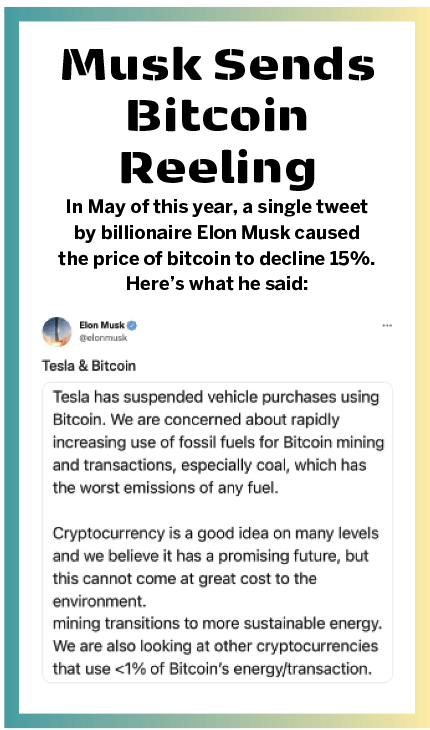

An energy-efficient cryptocurrency called cardano could help dislodge bitcoin, a notorious electricity junkie, from its position as the world’s premier crypto. The shift in the market would be a meaningful step in the effort to curb the worst effects of climate change.

“You can save 99.95% of the total [cryptocurrency] energy consumption with cardano, and that’s probably still a pessimistic estimate,” saidAlex de Vries, a data scientist and economist who runs Digiconomist, a Netherlands-based crusade against what he views as problems with bitcoin.

Or, look at it this way: Cardano is making it possible for...

Crypto Currently

-

New Challengers to YouTube’s Dominance

By Mark Helfman

|The original video-sharing platform can’t match the advantages of streaming on the blockchain -

The Epic Saga of FTX and Sam Bankman-Fried

|How It Started, How It’s Going… FTX was the world’s second-largest cryptocurrency exchange. On Nov. 11, FTX – valued at $32 billion – filed for bankruptcy. It had an $8… -

The Great Crypto Debate

|A Ponzi Scheme or the Future of Money? Proponents extoll the virtues of digital currency, while critics deem it worthless. Nearly everybody advocates regulating it. What’s the primary reason you… -

Crypto: What is it good for?

By Yesi D

|Critics disparage digital currency and believers praise it. Right now, the bears may seem clairvoyant, but investors who focus on the price of bitcoin may be missing three opportunities. By… -

The Simple Argument Against Crypto

|The first crypto project was called Bitcoin. It went badly because its technology and economics were poorly designed. Crypto was a project that wanted to remake money. Except many of… -

The Power of the Blockchain

By Mike Martin

|Technology safeguards cryptocurrency by creating an immutable ledger and banishing less-than-reliable humans from the equation To understand the value of cryptocurrencies—or lack thereof—investors can begin by cultivating a working knowledge… -

Crypto Crime Spree

By Weld Royal

|Cryptocurrency crime reaches an all-time high, affecting savvy and novice investors alike Crypto charlatans are using novel schemes to separate investors from billions of dollars. Last year alone, illicit addresses… -

The Blockchain: A New Paradigm for Data

By Mark Helfman

|A step closer to protecting individual privacy In April 2021, Russian hackers gained access to Colonial Pipeline’s computer network and shut it down. They demanded $4.4 million in bitcoin to… -

Crypto Doomsday

By Mark Helfman

|The year 2022 will mark the demise of cryptocurrency as we know it When forecasters get a prediction right, critics often chalk it up to little more than coincidence. But let’s… -

Inflation Has a New Hedge

By Mark Helfman

|The best hedge against inflation? Bitcoin. Because no matter what happens, the world will never have more than 21 million bitcoins. Plus, no one has shown that the price of… -

Cooking Up an NFT

By Mike Reddy

|Non-fungible tokens, or NFTs, have garnered a lot of attention in recent months. In the first half of 2021 alone more than $2.5 billion in NFT sales volume has exchanged… -

Minting Digital Ink

|NFTs are enabling artists to sell their physical creations online, providing more avenues for collectors, buyers and sellers The past year saw a rise in the sale of art in… -

The Future of the Future of Money

By Ed McKinley

|No one can see or touch cryptocurrency, but that’s not stopping it from entering the mainstream. It surpassed a market capitalization of $2.5 trillion this spring after beginning the year… -

Those Elusive 500% Annual Returns

By Mike Reddy

|Luckbox’s April 2020 issue, Darknet Diaries, took aim at the criminal underground operating within the anonymous, encrypted underbelly of the internet’s deep web. There, drug dealers use e-commerce sites to… -

Nakamoto’s New Era

By Luckbox

|Terms like “mining” and “proof of work” are essential for cryptocurrency literacy. In his latest book, Anthony Scaramucci simplifies the complex and explains why his firm now wholly embraces bitcoin… -

Crypto’s Next Frontier: Decentralized Finance

By Mark Helfman

|While many think of cryptocurrency as a way to make money or move it around, entrepreneurs and developers have started using the technology to solve problems with financial and commercial… -

Luckbox Leans in with Charles Hoskinson

By Jeff Joseph

|On bitcoin’s entropy, cardano’s opportunity, the next generation of digital currencies and libertarian ideals Charles Hoskinson, amathematician and tech entrepreneur,served as founding chairman of the Bitcoin Foundation’s education committee and… -

Crypto Committed

By Jeff Joseph

|Financier Anthony Scaramucci was well known among Wall Streeters and hedge fund insiders before he burst upon the national stage as White House communications director in July 2017. A scant…