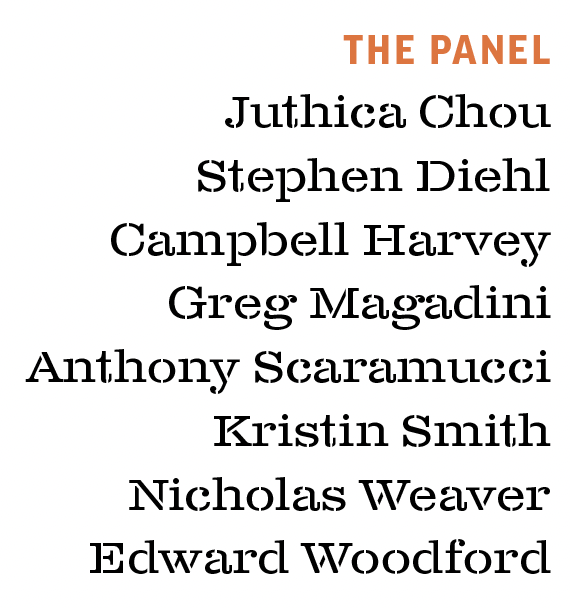

The Great Crypto Debate

A Ponzi Scheme or the Future of Money? Proponents extoll the virtues of digital currency, while critics deem it worthless. Nearly everybody advocates regulating it.

What’s the primary reason you would advocate for or against investing in cryptocurrencies?

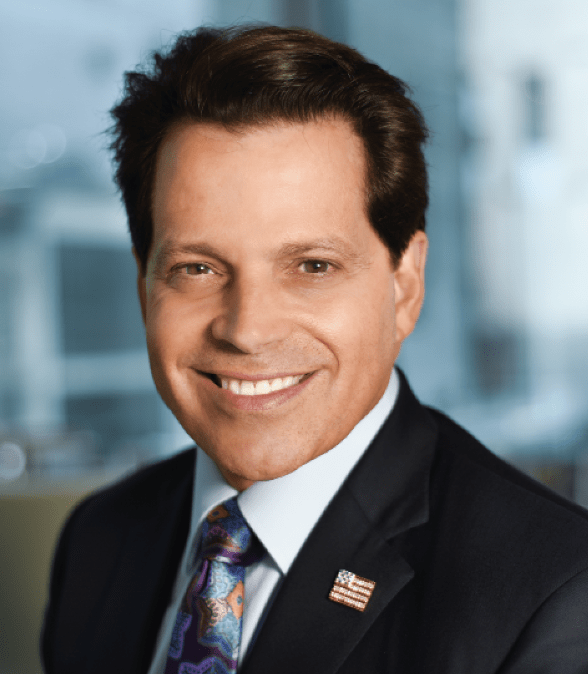

Anthony Scaramucci: Every investor should have some allocation to cryptocurrencies in their portfolio, even if it’s just 1% or 5% of your market exposure. It’s important to make a distinction between Bitcoin and everything else because the investment thesis is completely different. Bitcoin is the first technologically advanced non-sovereign currency or asset. Bitcoin’s tokenomics are clearly defined: It is censorship resistant, and the blockchain is secured through proof of work—which is the most secure consensus mechanism, although it uses lots of energy. For other cryptocurrencies, I believe we are in the early stages of a transition to a more decentralized financial system where trust is built into smart contracts that allow the financial system to operate without as many toll-taking intermediaries. We have a long way to go in terms of security of those decentralized systems, but I believe we will get there.

Nicholas Weaver: Cryptocurrencies start with zero sum: Every dollar “earned” is at the expense of someone else, and that’s before you consider the various costs in the system which turn it into a huge money loser. As such, the only “investment” it resembles is a giant Ponzi scheme and, in the end, the system will cost many billions of dollars of “investor” money.

Stephen Diehl: There’s no such thing as an investment in cryptocurrency. Because with cryptocurrency, it’s an asset that has no income. There’s no underlying fundamentals, there’s no underlying cash flow, there’s no income. So investing in cryptocurrency is the same thing as going to Las Vegas and playing roulette. So one is not investing crypto, one is gambling on crypto.

Recently, there have been several companies [Celsius, Voyager, Three Arrows] that had kind of a Lehman Brothers moment where they were offering bank-like services to the public, and it turns out they ran out of money, and there was a run on the bank. That decreases the entire faith in the entire ecosystem, which caused a run on a lot of other products, and people moved their money from crypto assets into safer assets.

Greg Magadini: From a pure investment perspective, cryptocurrencies are a paradigm-shifting world event. No one truly knows what these things are worth yet. This means it’s an “even” playing field for investors. No one has 50 years experience with this asset class, and often retail investors are the first ones in. Traditionally, retail investors are the last ones in as they are excluded from VC (venture capital) investments, pre-IPO funding rounds. Another interesting facet of cryptocurrency investing is the opportunity to self-custody funds and travel the world with your wealth attached to you. This might not seem important in the Western world when things are working well, but it becomes infinitely important outside of that context.

Edward Woodford: Crypto and the foundation of digital assets is a technology that can be applied to absolutely anything. It can be a means of transfer, it can be a store of value, it can be art, such as NFTs. The cryptocurrencies that are the largest assets today, like bitcoin, are seen more as a tradable asset. These are volatile assets, but the argument is simply, do you want better diversification? All the data points to the fact that you can have a better Sharpe ratio if you invest in digital assets as part of your

portfolio. [The Sharpe ratio measures risk-adjusted return.]

Campbell Harvey: I am a researcher. I do not advocate for any particular type of investment other than a diversified portfolio. But, it is a mistake to invest in a single crypto like bitcoin. That’s akin to investing in the equity market and choosing a single company. It should also be recognized that people misperceive that the tail risk for cryptos is much greater than equity markets. We show that the S&P 500 has many more 3,4,5 standard deviation tail events than bitcoin or ether. Yet, it is a mistake to believe that adding cryptos to your portfolio leads to large diversification gains. In the past, bitcoin and ether had near-zero correlation with the S&P 500. The correlation is dramatically higher today. Crypto investment is dominated by speculators, and cryptos are “risk on” investments—in good times they do well and in bad times people dump their crypto along with other risky assets.

This is a new space. There is considerable risk. However, we know from basic finance, there is a positive relation between risk and expected return. We are 1% into this disruption, and historically, there are advantages to getting in early—rather than waiting for the industry to mature.

Juthica Chou: I’d argue one of crypto’s main—and arguably overlooked—attractions is the fact it’s been utilized in so many different ways. This is often picked up by critics who argue crypto lacks a single constant and cohesive narrative and, therefore, no inherent utility. However, I’d counter by saying this is largely a result of the asset class’ permissionless nature and speaks to its persistent appeal for investors all around the world. Take bitcoin as an example. Investors in developed economies usually see bitcoin as an alternative means to gain exposure to the tech space, but we’ve seen how in other parts of the world, particularly in countries that lack a stable or accessible financial system, bitcoin is used as a means to purchase real-world goods and services. The trend for the multiplication of use cases will likely continue to accelerate, particularly with the substantial influx of both retail, and now institutional, investors who joined in the most recent cycle. Buying bitcoin or another crypto asset gives investors the opportunity to gain direct exposure to what is effectively a Cambrian explosion in utility.

What would change your opinion?

Chou: A key pillar of the value case for crypto is its permissionless nature, which enables it to be utilized in so many different ways. It follows that a core part of crypto’s appeal would be undermined if it lost its permissionless nature so that vast swathes of the global population found themselves excluded by gatekeepers. This speaks to the heart of the crypto movement, which was developed as a viable alternative to the legacy—and permissioned—banking system, which has excluded billions of people from accessing life-changing financial services. All to say, there would be very little point to the crypto movement if it ever became permissioned.

WEAVER: The cryptocurrency boosters have had over a decade to show some real-word utility, any utility, beyond paying for million-dollar ransoms and drug deals.

Magadini: These are tactical times to be flat or short cryptocurrencies from a trading perspective. Ultimately, these are speculative risk assets. Therefore, there’s a ton of two-way volatility to their prices. From a long-term investment perspective, jurisdictional regulation could complicate holdings and investments. Should my country or state make it impossible to invest in cryptos, this may sway my thesis or force me to move away.

Scaramucci: What would change my mind about investing in bitcoin would be if the network were ever hacked or corrupted, which has never happened, and becomes less likely by the day as the network expands.

What lesson should investors learn from the recent meltdown in the cryptocurrency complex?

Diehl: Crypto is repeating the financial disasters of the last 200 years. The Celsius meltdown was a very classical event. It was a bank run—an unregulated bank that was offering extremely high yield deposits to customers that were beyond belief. As it turns out, they were probably running something that was at first approximation like a Ponzi scheme. That’s not new.

Magadini: There are a few lessons to be had here. First, there’s been a lot of passive yield and “convergence” trades recently and positioning got very crowded. The problem with a crowded trade is that once a player liquidates, the spread goes against other holders, then another tranche of traders is forced to liquidate, making spreads worse again … so on and so forth. Actually, astute traders might hunt for obvious and crowded trades to bet against. The other lesson is that OTC lending desks are opaque. Their activity is systematic, and it’s hard to gauge their risk. Lastly, third party custodians are unreliable. Remember: ‘Not your keys, not your coins’—this mantra has proven to be true over and over again throughout the years.

Scaramucci: The lessons investors need to heed with respect to the recent drop in crypto prices are: Size your positions correctly and think long term. Crypto is a new asset class and thus, inherently volatile. If you’re not willing to ride those waves of volatility, your asset allocation should reflect that and crypto should be a small part of your portfolio. If you zoom out, crypto prices are on a steep upward trajectory that resembles the early life of many of today’s leading tech stocks. If you’re investing in the space, don’t try to trade against the pros, invest for the long term and focus on high-quality assets. Also, learn best practices around trading, custody and service providers you use. Certain lending platforms were offering unrealistic returns backed by excessive staking with customer assets. If you have the wherewithal, learn about self-custody with hard wallets. If you want to store your assets at a centralized entity, do your homework on that platform and work with best-in-class providers with transparent processes and balance sheets.

Harvey: This space is volatile. It is the sixth time since 2013 we have seen a drawdown like this. Further, cryptos are risk-on assets like equities. When the equity market falls, so do cryptos on average. That explains lots of the current movement.

Woodford: It’s volatile, it’s a risky asset. It should be a portion of your portfolio, not the entirety of the portfolio. I think people talk about 2% to 6% of your portfolio being in crypto—mine is higher just because I’ve been in the crypto space for five years.

Chou: First, this hasn’t been unique to crypto. The “meltdown” is part of a broader market downturn—the byproduct of a radical tightening in monetary policy in response to inflation running at levels not seen for 40 years—that has pretty much led to a sell-off in all asset classes, apart from the U.S. dollar.

All that being said, this meltdown—like the one in 2018—has highlighted that many crypto companies still do not have adequate treasury and/or risk management protocols in place, leading many investors to lose access to their funds. This downturn has demonstrated that investors should thoroughly research the companies and protocols they’re looking to entrust their capital to.

Gary Gensler, chairperson of the U.S. Securities and Exchange Commission, says the Howey Test from the 1940s applies to cryptocurrency. Should cryptocurrencies have to abide by the same regulations as securities, or should regulators devise new, bespoke rules?

Weaver: By and large, the cryptocurrency space is recapitulating half a millennium of various financial failures while cloaking itself in a fog of technobabble. The regulations, such as the Howey Test, the regulations from the free bank area (on stablecoins), and other older rules are very much: “If it looks like a duck, and quacks like a duck, and swims like a duck…”

Diehl: Crypto assets are securities for stocks. They meet the legal description of securities—take some money, give it to a bunch of people to do something with it, and make a return based on the efforts of the people that run it. Whether you do it on a computer, or you do it on paper, it doesn’t matter. Crypto assets are securities just like we’ve had for 100 years. We’ve had security since the stock markets in London in the 1700s. They meet the legal description, which under the Howey Test, has been in place for the last 75 years. The Securities Act of ‘33 is an enormously successful piece of regulation that has safeguarded U.S. capital markets for the last 100 years. I don’t see any reason why doing things on a computer should be exempt from the Securities Act, which should be technology agnostic, as Chairman Gensler says.

Scaramucci: I want to let the regulatory process play out in Washington, but we hope that Washington can develop a framework that protects investors without stifling innovation.

Woodford: Should the Howey Test be applied to cryptocurrencies to test effect? Securities? For sure, but it needs to be updated. It’s a framework of discussion of whether it’s a security, but there are definitely tokens that are securities, and there’s a bunch of tokens that are not securities.

Magadini: This is a personal philosophy and an eternal question—freedom or safety? I will choose freedom all the time. I think people are smart enough to make their own investment decisions. Should we restrict innovation to ensure these nascent markets are free of fraud? I would say, no. I’m not pro-fraud. I’m pro-innovation and progress. At the extreme, we could theoretically make investing extremely safe by making all forms of investments illegal, except holding cash at home under your mattress. Risk pays! Let people take risks. Let investors and founders learn from their mistakes. We should prosecute theft, Ponzi schemes, and lying. But that isn’t the same as prosecuting individuals with a legitimate business whose tokens fall under a “technical” definition of securities.